Ethereum trades in red despite DWS Group ETH ETCs listing on Deutsche Borse

- Asset manager DWS Group lists Ethereum ETC on German stock exchange Deutsche Borse.

- The declining share of liquid staking protocol Lido could help Ethereum to escape "security" classification, according to JP Morgan analysts.

- Ethereum restaking carries risks similar to those that caused the 2008 financial crisis, says Steven Walbroehl through Blockworks.

Ethereum’s (ETH) price continued consolidating for a third consecutive day on Friday after the hefty losses seen at the beginning of the week. Traders continue exercising caution despite news of German asset manager DWS Group launching an Ethereum exchange-traded commodity (ETC) and JP Morgan analysts providing positive updates on Ethereum's potential security status.

Read more: Ethereum continues consolidating as Q1 results show massive growth for the largest altcoin

Daily digest market movers: ETH ETCs, security designation, restaking risks

Ethereum's ETF decision is still one of the major topics surrounding the largest altcoin. While recent moves by key market players provide a positive for its price growth, restaking risks are gradually becoming a major concern. Here's Friday's ETH market movers:

- Asset manager DWS Group, which handles a portfolio of around $900 billion, launched Bitcoin and Ethereum ETCs on the German stock exchange Deutsche Borse on Thursday. The ETCs, launched in partnership with digital investment manager Galaxy Digital Holdings, aim to track the price performance of Bitcoin and Ethereum. According to a press release by DWS, the ETCs are backed by their respective individual assets custodied by Zodia Custody and Coinbase, "which store the cryptocurrencies in segregated offline ('cold storage') custody accounts.”

- The launching of DWS's Ethereum-based commodity product comes at a time when questions surround its "commodity" status in the US. After Fortune's report that the Securities and Exchange Commission (SEC) is cracking down on the Ethereum Foundation in a bid to classify Ethereum as a security, many have expressed doubts that the SEC will approve applications for a spot Ethereum ETF. In an X discussion on Wednesday between Bloomberg analyst James Seyffart and Cory Klippsten, CEO of Bitcoin financial service firm Swan.com, the former reiterated that the SEC would find it difficult to classify Ethereum as a security after approving a commodity-based Ethereum futures ETF.

- Moreover, in a report released Wednesday, JP Morgan analysts led by Nikolaos Panigirtzoglou shed light on the issue by stating that the recent reduction in the staked ETH share of staking protocol Lido raises "the chance that Ethereum will avoid being as a security in the future." According to the analysts, the "Hinman documents" released in June 2023 clarified the SEC's view of network decentralization's role in deciding if a digital token is a security. They further stated that SEC officials have previously acknowledged that "tokens on a sufficiently decentralized network are no longer securities because there's no 'controlling group' in the Howey sense."

Also read: Ethereum shows slow movements following criticism of issuance curve article by developer

- Following the report, Ripple announced in a press release on Thursday that it would launch a USD stablecoin on its XRP Ledger and Ethereum. Considering the growing market cap of stablecoins, "there's clear demand for trust, stability, and utility," said Ripple.

- Despite these positives, Steven Walbroehl, CTO of cybersecurity firm Halborn, has raised concerns about the current restaking boom on Ethereum in an article released on Blockworks. "Restaking protocols claim they've achieved new levels of efficiency by piggybacking on staking-based security models (...) but those efficiencies also entail risks — risks we don't entirely understand," said Walbroehl. He cited how these risks align with the problems that caused the Great Financial Crisis of 2008 and the 2022 exploit of Ankr restaking protocol on the BNB network. This comes off the back of similar restaking risk concerns raised by Coinbase analysts David Duong and David Han.

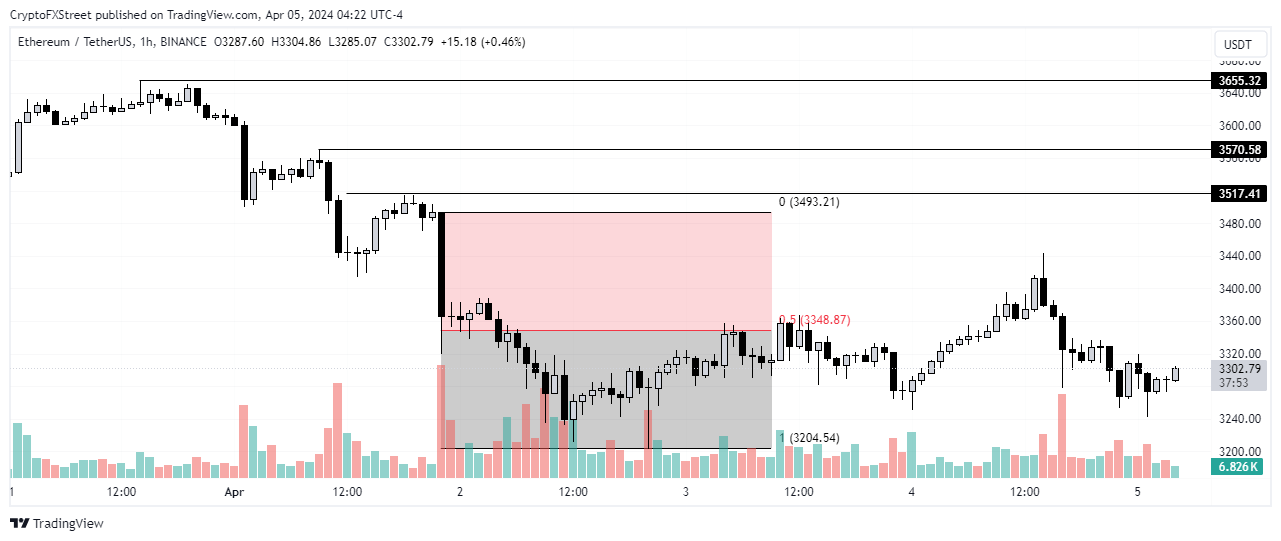

Technical Analysis: Can the fourth Bitcoin halving trigger an Ethereum rally

Ethereum's price has mostly stayed the same in the past three days as. traders are still indecisive about whether to go bullish or bearish. However, things could change soon, as Bitcoin's fourth halving event is only a few days away and Ethereum’s price movement tends to be highly correlated with those of Bitcoin.

ETH/USDT 1-hour chart

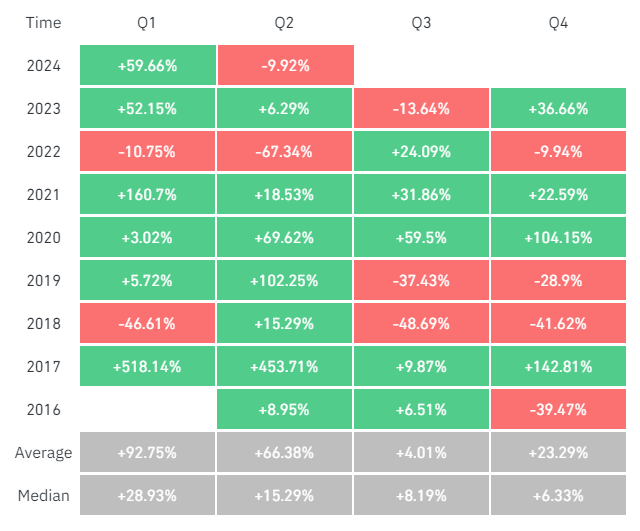

ETH's quarterly returns showed it recorded 69.62%, 59.5%, and 104.15% gains in Q2, Q3, and Q4 2020, respectively, after the third Bitcoin halving, according to data from Coinglass.

ETH quarterly returns

Read more: SEC calls for comments on Spot Ethereum ETF applications, according to recent filings

While traders are bracing for a potential rally, Coinbase and Glassnode analysts have noted that the impact of the upcoming Bitcoin halving event may already be priced in considering the recent bull run led by the approval and launch of the spot Bitcoin ETFs in the US.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.