Trade Gold CFDs — Regulated and On-Demand

Access competitive spreads, real-time gold prices, and flexible long/short trading with Mitrade。

What Is Gold CFD Trading?

Gold CFD (Contract-for-Difference) trading is the act of speculating on the price of gold without owning the physical metal. Here, you agree to exchange the difference in gold’s price between the time you open and close a contract. This means you can profit (or incur losses) from rising or falling gold prices

How to Trade Gold in Australia?

- 01.Open a gold trading Australia account with a broker such as Mitrade.

- 02.Fund the account with AUD.

- 03.Choose a gold market (Spot, Futures, CFDs, Mining Stocks, and ETFs).

- 04.Monitor & close the trade.

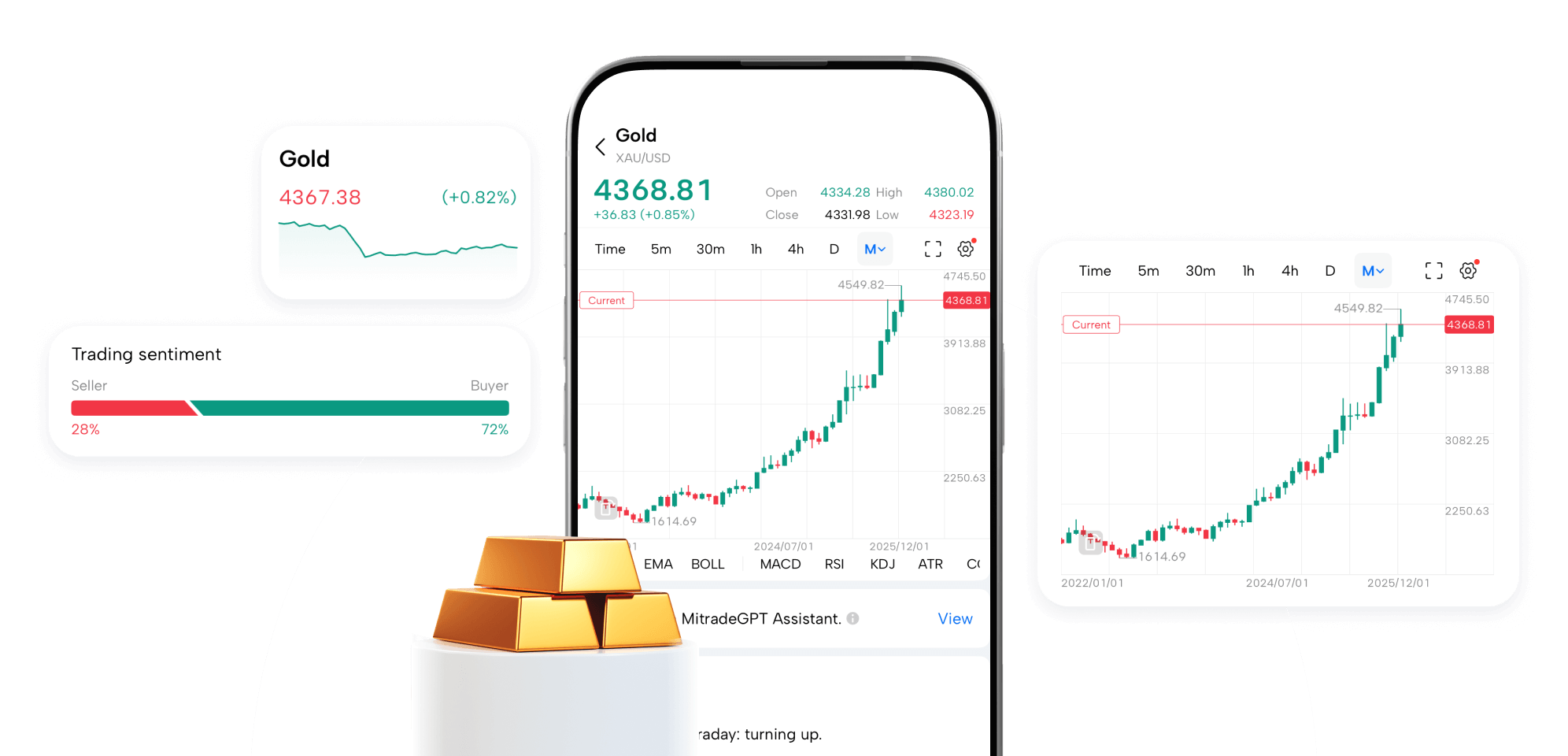

Gold CFD Live Price

Why Trade Gold with Mitrade?

Tight Spreads & Low Trading Costs

Mitrade is known for its no-commission, tight-spread pricing. This cost efficiency means more of your capital goes to potential gains when trading gold.

Access Spot Gold Prices

The broker's spot gold is built from the best available quotes. This allows you to take short-term positions with continuous pricing.

ASIC-Regulated & Trusted Broker

Mitrade is authorised and regulated by the Australian Securities and Investments Commission. We adhere to strict financial standards that protect traders and investors on our site.

Advanced Trading Tools

Discover and make use of modern charting and analysis tools suited for technical traders. This includes popular indicators (e.g. MACD, Bollinger Bands) and trade alerts.

Flexible Trading Or Investing

Choose between leveraged gold CFDs for active trading or non-leveraged exposure through share or ETF products.

Negative Balance Protection

If a leveraged gold trade moves against you violently, your account will not go below zero.

How Does Gold CFD Trading Work?

Gold CFD trading provides Australian traders with the flexibility to speculate on gold’s price direction, utilising leverage and margin to optimise capital efficiency. Here’s how it works:

Go Long or Short

If you believe gold prices will rise, you open a long (buy) position. If you expect them to fall, you open a short (sell) position. This flexibility enables you to capitalise on both rising and falling markets.

Trading on Margin (Leverage)

CFDs are leveraged instruments. This means you only deposit a fraction of the total trade value to open a position. While leverage increases potential gains, it also magnifies losses. Disciplined risk management is therefore advised.

Costs and Spreads

The primary trading cost is the spread (the difference between the buy and sell price). If you hold a position overnight, some brokers may also charge a funding (swap) fee.

Cash Settlement Only

With CFD trading, you’re not buying or storing physical gold. Instead, profit or loss is realised in cash based on the difference between your opening and closing prices.

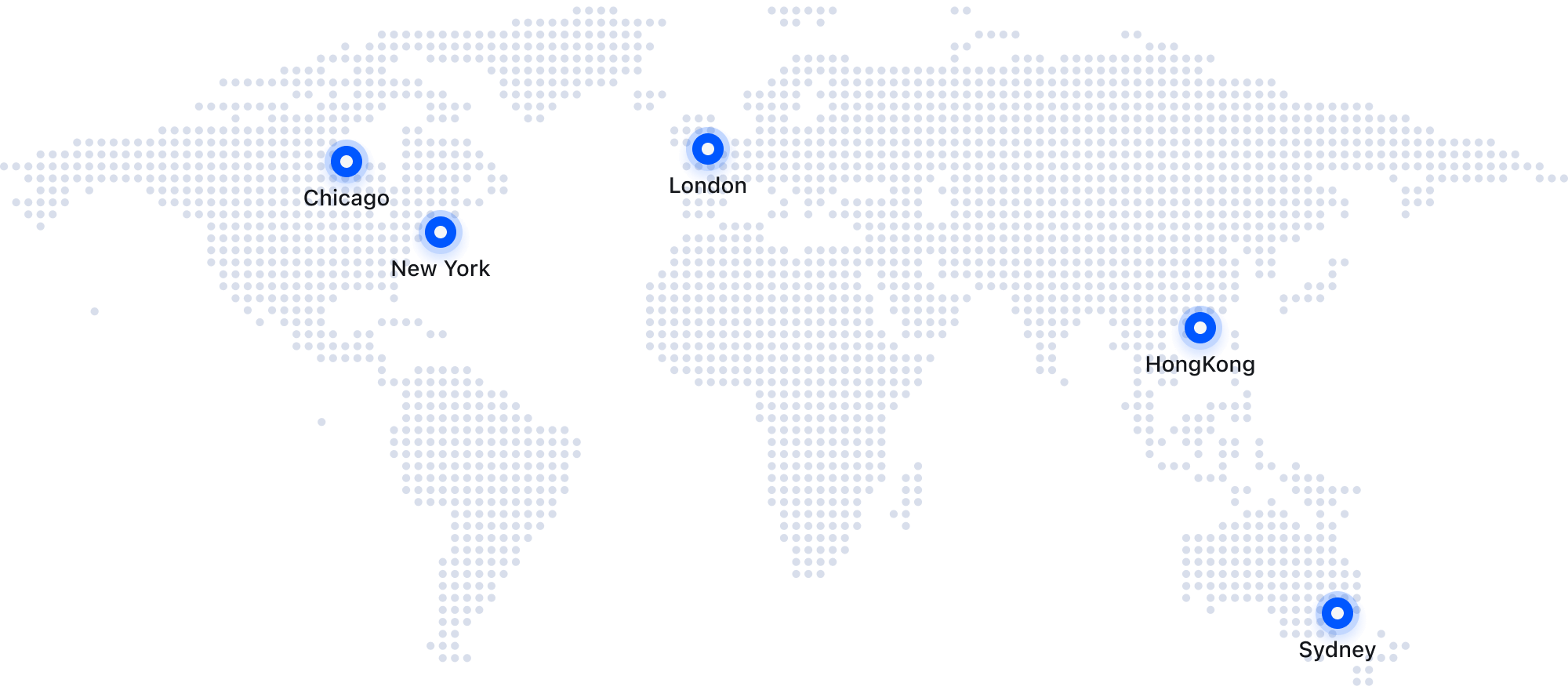

Liquidity and 24/5 Market Access

Gold is one of the world’s most actively traded assets. Most platforms, including those in Australia, provide near 24-hour trading access during weekdays, covering major global sessions.

Ways To Trade Gold And Gold Market Trading Hours

Gold Spot

Trading spot gold means dealing with live market prices (e.g. XAU/USD). Spot gold trades roughly 24/5.

Gold Futures

These are standardised contracts for future delivery of gold at set dates. Futures also run almost continuously 24/5, with only brief daily breaks.

Gold CFDs

This category overlaps spot and futures CFDs. Gold trading in CFDs lets you use leverage and go both ways.

Gold Mining Stocks

Instead of metals, you can trade shares of gold mining companies (e.g. ASX: NCM and RIO).

Gold ETFs

ETFs track the gold price and trade on stock exchanges.

Gold CFD Trading: Benefits And Risks

Trading gold CFD offers both opportunities and challenges for traders.

Leverage And Market Opportunities

- Gain larger exposure to gold with a relatively small initial margin.

- Trade both rising and falling gold prices by going long or short. This lets you seek opportunities in different market conditions.

- Leverage amplifies losses and gains. Small price moves can have a large impact on your account.

- Sudden price swings may trigger rapid stop‑outs. This closes your positions sooner than expected.

Cost Efficiency And Holding Costs

- No storage, insurance, or vault costs, unlike physical gold bars or coins.

- Trading costs are often lower than buying and selling physical gold.

- Overnight funding (swap) fees apply when positions are held beyond the daily rollover time.

- Holding positions for the long term can result in funding costs accumulating.

Flexibility And Volatility

- Easy to open and close positions during trading hours. This provides flexibility for short‑term strategies.

- No need to manage physical delivery, transport, or safekeeping of gold.

- Gold can be highly volatile, and sharp moves may lead to large losses.

- Major news or market events can cause slippage, where orders are filled at a different price than requested.

Liquidity And Execution Conditions

- Gold is one of the most liquid global markets, which generally supports fast order execution.

- Tight spreads in normal conditions can help reduce overall trading costs.

- Spreads can widen during periods of low liquidity or around key announcements, increasing trading costs.

- In fast‑moving markets, execution delays or requotes may occur. This affectshe final entry or exit price.

Gold Trading vs Silver Trading

Gold and silver are both actively traded precious metals, but they exhibit distinct characteristics in terms of price drivers, volatility, and typical applications.

| Feature | Gold Trading | Silver Trading |

|---|---|---|

| Market Size | Very large global market | Smaller market, lower overall volume |

| Volatility | Moderate | Higher (2–3× gold’s daily swings) |

| Use Cases | Store of value, inflation hedge, safe-haven | Industrial usage (tech, solar), plus investment |

| Price Drivers | Central bank policy, inflation, USD value, crises | As gold, plus industrial demand and mining supply |

| Typical Spreads | Tighter (due to deeper liquidity) | Wider (smaller, less liquid market) |

| Trading Uses | Portfolio hedging, long-term diversification | Tactical trades on volatility, industrial trends |

Gold Trading Strategies

Gold trading strategies help traders approach the market with structure and discipline. Below are common strategies used in gold CFD trading.

Trend following

Trend-following strategies seek to ride sustained moves in gold prices rather than picking tops and bottoms.

- Use tools like simple and exponential moving averages (SMA/EMA) or trendlines to confirm whether gold is in an uptrend or downtrend.

- Enter long positions when price trades above key moving averages and makes higher highs; enter short positions when price trades below averages and makes lower lows.

- Hold positions while the trend structure (higher highs/higher lows or lower highs/lower lows) remains intact. Consider exiting when price breaks the trendline or moving average.

Breakout trading

Breakout trading targets strong moves when gold escapes tight ranges or key technical levels.

- Identify consolidation zones, chart patterns (such as triangles or rectangles), or major support and resistance levels.

- Place pending orders just above resistance for potential upside breakouts or just below support for downside breakouts, using stop-losses.

- Focus on trading confirmed breakouts accompanied by momentum indicators to avoid false breaks.

Range trading

Range trading works best when gold oscillates between well‑defined horizontal support and resistance levels.

- Mark clear zones where price repeatedly bounces (support) or stalls (resistance) on higher time frames first. Proceed to refine on intraday charts.

- Use oscillators such as RSI or Stochastic to spot overbought conditions near resistance and oversold conditions near support.

- Look to buy near support with tight stops below the range and sell near resistance with stops just above.

News and event‑driven trading

Gold is highly sensitive to macroeconomic data and geopolitical headlines, which can drive volatility.

- Monitor key events such as CPI inflation releases, Federal Reserve decisions (FOMC), U.S. jobs data (NFP), and major geopolitical developments.

- Expect sharp intraday moves around high‑impact announcements and plan entries and exits in advance.

- Apply strict risk management because slippage and gapping can occur during fast markets.

Interest rate / Fed cycle strategies

Interest rate expectations and the Federal Reserve's policy stance are major drivers of gold over medium and long horizons.

- Track Fed meeting statements, dot plots, forward guidance, and market‑implied rate expectations from bond futures and yields.

- Gold often strengthens when real yields and interest rate expectations fall or when the Fed turns more dovish, reducing the opportunity cost of holding a non‑yielding asset.

- Watch U.S. Treasury yields, inflation data, and the U.S. dollar index together to confirm macro trends supporting a bullish or bearish gold view.

Risk‑off strategy

Gold frequently benefits from "risk‑off" sentiment when investors reduce exposure to equities and other risk assets.

- Look for signals such as sharp equity market sell‑offs, widening credit spreads, elevated volatility indices (like the VIX), or heightened geopolitical tensions.

- Consider long gold positions when safe‑haven flows increase, often alongside weaker risk assets and sometimes a softer U.S.

- Combine risk‑off indicators with technical confirmation on gold's chart, such as breakouts or strong uptrends, to avoid relying on sentiment.

Trade Gold CFDs with Confidence on Mitrade

Take your gold trading to the next level with Mitrade. Access real-time gold prices, trade long or short with tight spreads, and use advanced tools on a trusted, ASIC-regulated platform.