Zilliqa Price Forecast: ZIL rallies over 20% ahead of Cancun EVM upgrade

- Zilliqa price extends gains by more than 20% on Tuesday after surging nearly 34% the previous day.

- The upcoming Cancun EVM upgrade, scheduled for Thursday, has boosted investor sentiment.

- On-chain and derivatives data support bullish sentiment, as trading volume and open interest are rising.

Zilliqa (ZIL) price is extending its gains, rallying over 20% to $0.006 on Tuesday after soaring nearly 34% the previous day. The upcoming Cancun upgrade this week is boosting investor sentiment, despite broader weakness in the crypto market. ZIL continues to attract strong buying interest, supported by rising trading activity and improving derivatives metrics.

Zilliqa’s Cancun EVM version support boosts sentiment

Zilliqa’s upcoming Cancun Ethereum Virtual Machine (EVM) version support, which will activate on the mainnet through a hard fork, is scheduled for this week on Thursday. This update aims to deliver faster communication and finer-grained control, as posted by Zilliqa’s X.

In addition, Zilliqa’s community updates blog on Monday announced that Liechtenstein Trust Integrity Network (LTIN) will join the Zilliqa network as the first government-backed institutional validator, reinforcing Zilliqa’s regulatory-readiness direction.

These developments and announcements have boosted bullish sentiment among investors, as ZIL has rallied more than 60% so far this week despite broader weakness in the crypto market.

ZIL’s on-chain and derivatives data show bullish bias

Santiment data indicates that the Zilliqa ecosystem’s trading volume (the aggregate trading volume generated by all exchange applications on the chain) reached $278.07 million on Tuesday, the highest volume since December 2024. This volume rise indicates a surge in trader interest and liquidity in Zilliqa, boosting its bullish outlook.

[09-1770094693438-1770094693440.06.35, 03 Feb, 2026].png)

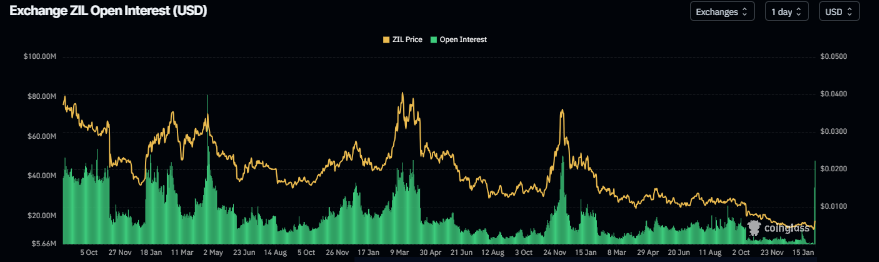

CoinGlass data shows that futures OI in Zilliqa at exchanges reached $47.76 million on Tuesday, up from $5.72 million on Monday, the highest levels since December 9, 2024. An increasing OI represents new or additional money entering the market and new buying, which could fuel the current ZIL price rally.

Zilliqa Price Forecast: ZIL bulls in control of the momentum

Zilliqa price started the week on a positive note, rallying more than 34% on Monday and closing above the 50-day Exponential Moving Average (EMA) at $0.005. As of writing on Tuesday, ZIL is extending its gains by more than 20%, trading above the 100-day EMA at $0.006.

If ZIL continues its upward trend, it could extend the rally toward the 200-day EMA at $0.007.

The Relative Strength Index (RSI) on the daily chart reads 67, above the neutral level of 50, indicating bullish momentum gaining traction. The Moving Average Convergence Divergence (MACD) showed a bullish crossover on Tuesday, further supporting the bullish view.

If ZIL faces a correction, it could extend the decline toward the 50-day EMA at $0.005.