Ethereum Price Forecast: ETH briefly breaches $2,700 amid launch of The DAO Security Fund

Ethereum price today: $2,730

- Ethereum is getting over a $200 million security boost from the launch of The DAO Security Fund.

- The DAO was a crowdfunded venture capital fund that suffered a 2016 hack, ultimately leading to the Ethereum fork.

- ETH briefly broke the $2,700 support level, eyeing $2,625.

Ethereum is getting a security boost from the comeback of The DAO, nearly a decade after the infamous hack.

According to developer Griff Green, who helped create the platform, "edge case" funds that were set up to refund "special cases" victims of the hack are being redeployed to improve Ethereum's security.

"Some of the security things in crypto and in Ethereum really need support [...] we're not improving security for the lay person to feel comfortable putting their life savings into crypto assets," said Green in an interview with Laura Shin on Thursday.

The DAO Security Fund is being set up to address this challenge, leveraging idle, unclaimed funds — now worth over $200 million, up from $6 million in 2016 — to support security initiatives on Ethereum, including wallet user experience, incident response, L2 and bridge security and core protocol security.

How The DAO Security Fund will function

The funding rounds will be guided by the Ethereum Foundation's (EF) "Trillion Dollar Security" initiative, distributing funds through open mechanisms such as "quadratic funding, retroactive funding, RFP rank-choice voting and more," wrote Green in a Thursday blog post. The EF's Grants Management team will handle eligibility requirements supported by the Giveth team, another crypto donations platform founded by Green.

The initiative will use proceeds from staking 70,500 ETH from an Extrabalance contract, which has potential claimants and 4,600 ETH (from DAO and ETH tokens), with no clear claimants.

The DAO Security Fund will be led by curators, including Green, Ethereum co-founder Vitalik Buterin, MetaMask's Taylor Monahan, Dappnode's Pol Lanski, and others.

The DAO hack of 2016

The DAO launched in 2016 as the first onchain crowdfunded venture capital fund on Ethereum, pooling about $150 million worth of ETH from several investors. However, the platform's smart contract was hacked a few weeks later, forcing developers to decide whether to roll back Ethereum's transaction history.

The community voted in favour, leading to a hard fork that split the chain into the main Ethereum chain today and Ethereum Classic — the OG chain — which a few developers stuck with.

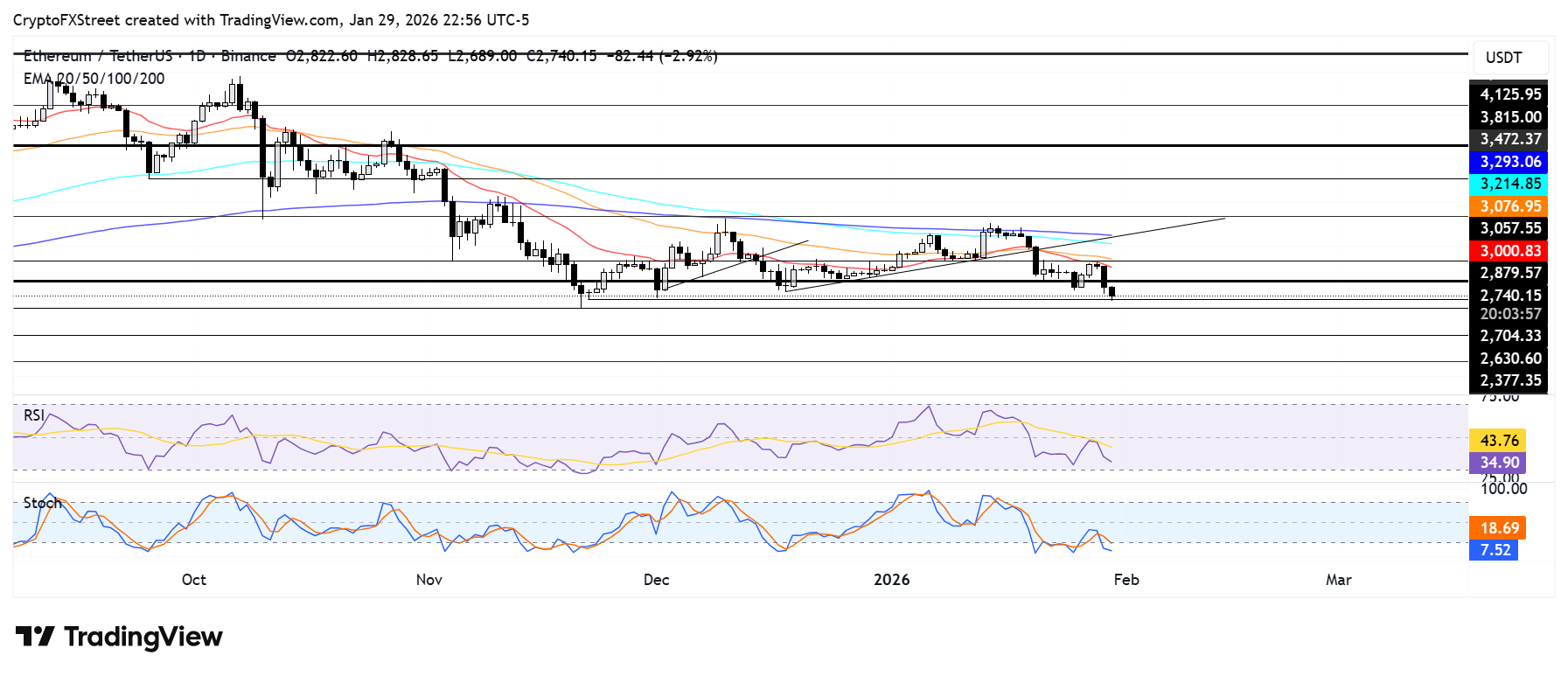

Ethereum Price Forecast: ETH briefly breaches $2,700 support

Ethereum saw $416.8 million in liquidations over the past 24 hours, spearheaded by $391 million in long liquidations, according to Coinglass data.

ETH briefly broke the support level near $2,700, following a rejection at the $3,060 resistance, which is strengthened by the 20-day Exponential Moving Average (EMA). A failure to hold $2,700 could push ETH toward $2,625, which served as a support during a major price decline last November. Further down is the $2,380 support level.

On the downside, the Relative Strength Index (RSI) is trending downward below its neutral level while the Stochastic Oscillator (Stoch) is in oversold territory, indicating a dominant bearish momentum. Oversold conditions in the Stoch could lead to a short-term reversal.