Swiss bank UBS Group mulls Bitcoin and Ethereum offering for select private clients

- UBS Group AG plans to offer crypto investment services to select private clients.

- The offering will allow clients of its private bank in Switzerland to buy and sell Bitcoin and Ethereum.

- UBS’s push for crypto adoption is part of a digital asset strategy and reflects clients’ needs and market trends.

UBS Group AG, one of the world’s largest asset managers, is planning to offer cryptocurrency investment services to a select group of its Swiss-based private bank clients, according to Bloomberg. The investment bank is in the process of selecting partners to spearhead its digital asset strategy, which largely leans on regulatory developments, client needs, market control, and risk management.

UBS plans to offer Bitcoin and Ethereum trading

Sources familiar with the matter, who asked to remain anonymous, revealed that discussions have been ongoing for several months, though UBS has yet to finalize its approach to the digital asset space, according to Bloomberg’s report.

USB is expected to roll out the initial phase of digital service adoption to a select group of investors through its private bank in Switzerland. Subsequent offerings of Bitcoin (BTC) and Ethereum (ETH) trading will be rolled out in the United States (US) and the Asia Pacific.

Offering crypto services would mark a paradigm shift in UBS's stance, which has long remained cautious about digital assets. The interest comes amid a similar pivot by US banking institutions such as JPMorgan Chase & Co. and Morgan Stanley, which are actively embracing digital asset offerings following President Donald Trump’s push for crypto regulation.

The asset manager’s spokesperson stated, “As part of UBS’s digital asset strategy, we actively monitor developments and explore initiatives that reflect client needs, regulatory developments, market trends and robust risk controls. We recognize the importance of distributed ledger technology like blockchain, which underpins digital assets.”

UBS was until now focused on its digital-asset efforts on building blockchain-based infrastructure for tokenized funds and payments. Globally, many lenders have tempered their ambitions to expand and grow their offerings to include digital asset trading, mainly due to the rules outlined in the Basel III framework.

However, the Basel Committee said in November that it would review certain elements related to banks and crypto holdings, potentially setting the stage for new initiatives for lenders and asset managers.

Institutional crypto adoption accelerates

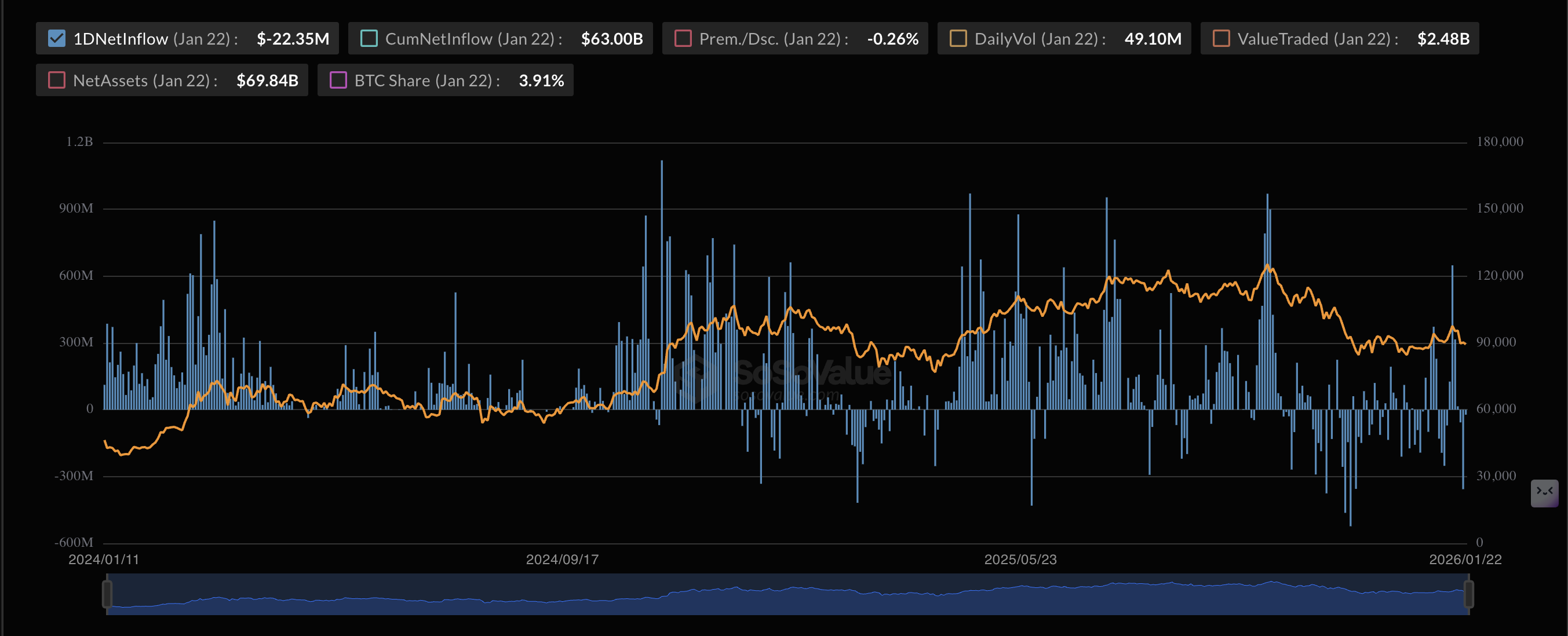

The developments at UBS highlight the growing initiatives by financial institutions globally to expand their crypto holdings services. BlackRock’s IBIT Exchange Traded Fund (ETF) has grown to nearly $70 billion in net assets since its approval in 2024.

Morgan Stanley is partnering with cryptocurrency provider ZeroHash to let E*Trade clients trade popular tokens like Bitcoin, Ether and Solana starting in the first half of this year. JPMorgan is exploring crypto trading for institutional clients, Bloomberg reported in December.

UBS allowed access to crypto-linked ETFs to high-net-worth clients in Hong Kong in 2023, joining other progressive institutions such as HSBC Holdings Plc. Although this move marked an initial shift toward crypto-related products, direct trading of digital assets like BTC and ETH remained a significant commitment.

As regulatory clarity improves and client demand intensifies, traditional asset managers are finding it difficult to remain adamant about crypto adoption. Key institutional support will remain the core foundation of this growth. Nevertheless, some lenders may delay their initiatives if regulatory headwinds persist or volatility escalates.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.