Ethereum Price Forecast: ETH bounces off $2,150 as Bitmine stretches holdings above 4.28 million ETH

Ethereum price today: $2,360

- Bitmine Immersion lifted its stash to 4.28 million ETH last week after scooping 41,788 ETH.

- Bitmine Chairman Thomas Lee noted that the recent price plunge is "attractive," considering Ethereum's "strengthening fundamentals."

- ETH risks a further decline to $1,730 if it breaks below $2,150.

Ethereum (ETH) treasury firm Bitmine Immersion Technologies (BMNR) scooped 41,788 ETH last week in another round of weekly ETH acquisition.

The purchase has lifted the company's stash to 4.28 million ETH, worth about $10.1 billion at the time of publication.

From that figure, Bitmine has staked 2.89 million ETH across three staking providers, reflecting an increase of 888,192 ETH over the past week. The company said it would be making $374 million annually from staking by the time it fully stakes all of its ETH stack.

The Nevada-based firm also holds 193 Bitcoin (BTC), a $200 million investment in Beast Industries, a $20 million stake in Worldcoin treasury Eightco Holdings and total cash of $586 million.

ETH's fundamentals make pullback attractive

In a statement on Monday, Bitmine Chairman Thomas Lee noted that the company will continue stacking up ETH due to its improved fundamentals despite the recent decline in crypto prices. Lee highlighted that Ethereum transaction count and active addresses have risen to record highs over the past month, while prices fell from around $3,000 to $2,300 — a contrast with previous price crashes.

"Bitmine has been steadily buying Ethereum, as we view this pullback as attractive, given the strengthening fundamentals," said Lee. "In our view, the price of ETH is not reflective of the high utility of ETH and its role as the future of finance."

Additionally, the Bitmine chairman stated that the soaring prices of precious metals have also shifted attention and risk appetite from crypto.

Bitmine's share price is down 5% at the time of publication, stretching its loss over the past month to 23%. The company holds a paper loss of over $6 billion on its ETH stash.

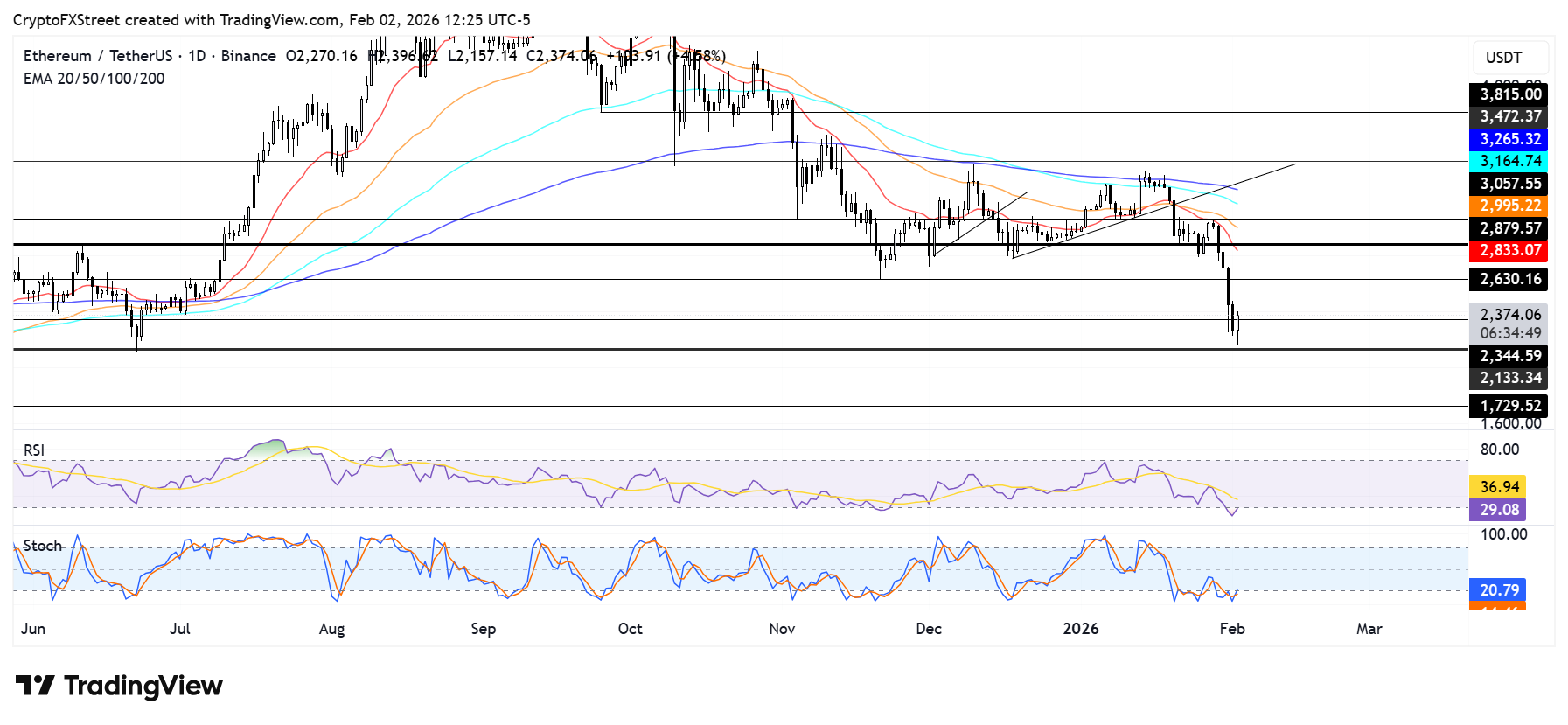

Ethereum Price Forecast: ETH eyes recovery but risks a further decline to $1,730

Ethereum experienced $280 million in liquidations over the past 24 hours, comprising $169 million and $111 million in long and short liquidations, respectively, over the past 24 hours.

ETH found support near the $2,150 level — which held as a critical base throughout 2024 — on Monday after plunging nearly 20% last week.

The top altcoin is attempting to hold a bounce above $2,350. A firm recovery could see it test $2,630 and stretch toward $2,880.

On the downside, ETH risks a decline to $1,730 if it breaches the $2,150 support level.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are in oversold territory, indicating an intense bearish momentum. Sustained oversold conditions in both indicators have often preceded a recovery.