Ripple Price Forecast: XRP remains under pressure as licensing operations expand across Europe

- XRP lags behind other crypto majors, declining for the second consecutive day on Thursday.

- Ripple secures preliminary approval for an Electronic Money Institution license from the CSSF, Luxembourg's financial regulator.

- The EMI license will scale Ripple Payments' infrastructure across Europe, support institutional clients and unlock dormant capital.

Ripple (XRP) is trading lower above support at $2.08 at the time of writing on Thursday, as the broader cryptocurrency market mildly pulls back following a bullish start of the week.

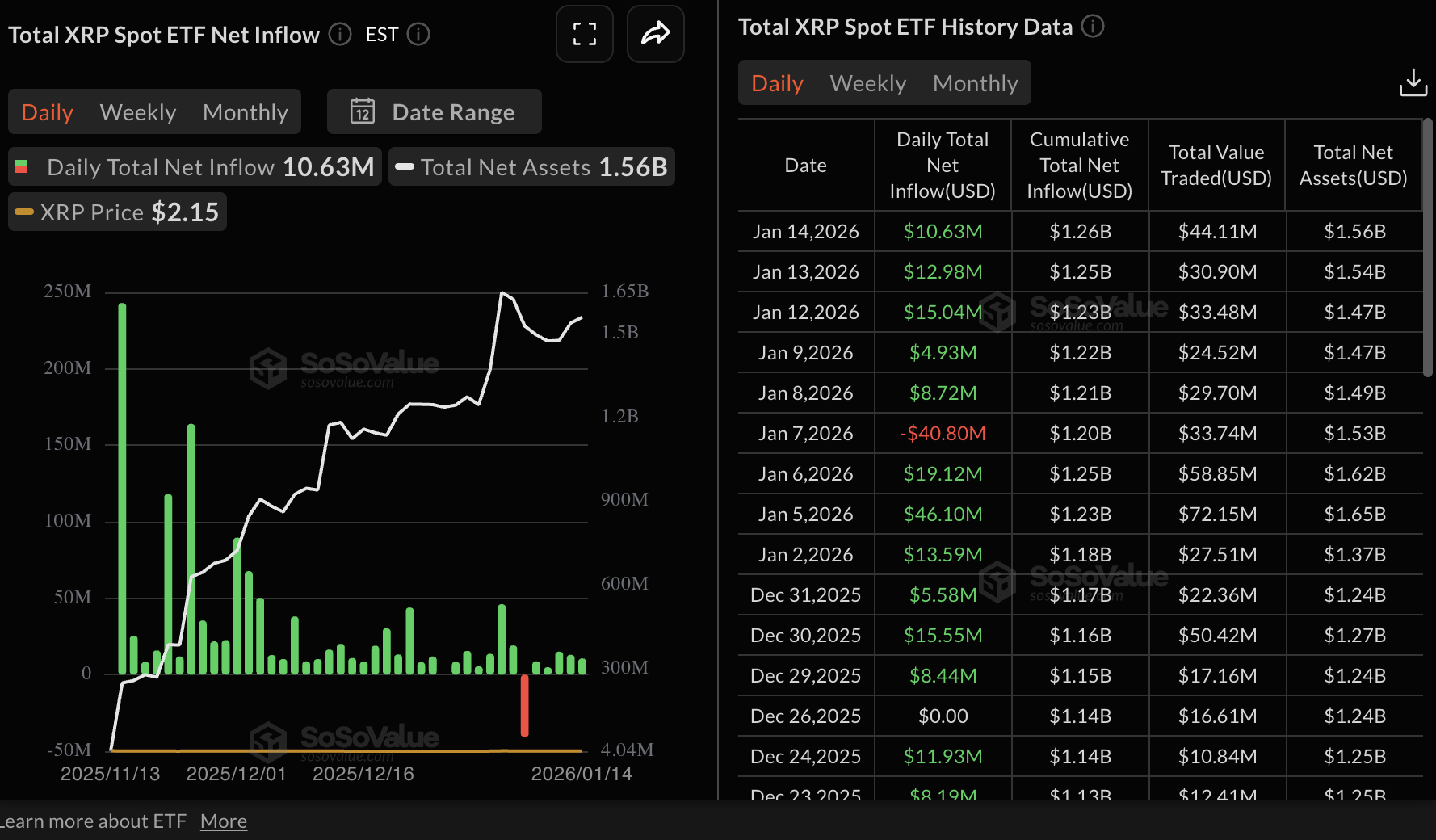

Despite a two-day correction in the price of XRP, market sentiment remains relatively positive, as reflected by steady inflows into spot Exchange Traded Funds (ETFs). As reported, US-listed XRP ETFs posted almost $11 million in inflows on Wednesday. The cumulative inflow stands at $1.26 billion, and the net assets at $1.56 billion, indicating steady investor confidence.

Ripple targets cross-border payments growth in Europe

Ripple announced on Wednesday that it has secured a preliminary approval for its Electronic Money Institution (EMI) license from Luxembourg's Commission de Surveillance du Secteur Financier (CSSF).

The EMI license marks a major step toward scaling cross-border transfers on the Ripple Payments infrastructure across Europe. Ripple believes that the approval will also boost support for institutional clients, ensuring seamless, real-time and 24/7 payments.

Monica Long, President at Ripple, commended the European Union's (EU) progressive approach to crypto regulation.

Long stated that “By extending Ripple’s licensing portfolio and evolving our payments solution, we are doing more than just moving money. We are managing the end-to-end flow of value to unlock trillions in dormant capital and moving legacy finance into a digital future.”

The CSSF approval follows the company's receipt of its EMI licence and Crypto Asset Registration from the United Kingdom’s (UK) Financial Conduct Authority (FCA) last week. In total, Ripple has received 75 regulatory licenses globally, enabling it to support institutions' and individuals' digital asset needs.

Technical outlook: Can XRP hold above key support?

XRP is trading above support provided by the 50-day Exponential Moving Average (EMA) at $2.08 at the time of writing on Thursday. The Relative Strength Index (RSI) has declined to 54 on the daily chart, indicating that bullish momentum is gradually fading.

An extended drop in the RSI below the midline would suggest the overall outlook has shifted from bullish to bearish, potentially accelerating losses below the pivotal $2.00 level. Beyond this area, XRP could target the January low of $1.82 and April’s low of $1.61.

Still, the Moving Average Convergence Divergence (MACD) indicator holds slightly above the red signal line, which may encourage investors to lean into risk, adding to buying pressure.

A decisive break above the 100-day EMA at $2.21 is needed to validate XRP’s short-term bullish turnaround. Traders will anticipate more resistance at the descending trendline and the 200-day EMA at $2.33.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.