Ethereum breaches key support, receives ‘digital oil’ tag from world's largest bank

Ethereum is termed the "digital oil" of the digital future by the world's largest bank, ICBC.

SEC is yet to provide feedback on ETH ETF S-1s despite expectations of agency's comments earlier on Friday.

Ethereum's recent sell-off may be temporary, considering bullish events on the horizon.

Ethereum (ETH) is down over 6% on Tuesday as the general crypto market is trending downward. Despite the bearish sentiment, the Industrial & Commercial Bank of China has commended Ethereum's growth, describing it as "digital oil."

Daily digest market movers: SEC stays mute, ICBC commends ETH

In a recent report, the world's largest bank, the Industrial & Commercial Bank of China (ICBC), hailed the growth of Ethereum and Bitcoin. While comparing Bitcoin to Gold due to its scarcity, the bank also termed Ethereum "digital oil," noting its role in "providing a strong platform" for supporting a host of Web3 innovations.

"Ethereum has been continuously upgrading its technology in terms of security, scalability and sustainability, providing technical power for the digital future," the report states.

Meanwhile, the Securities & Exchange Commission (SEC) has yet to respond to prospective spot ETH ETF issuers on Tuesday, more than one week after they filed their S-1 registration statements on May 31. Issuers had expected the agency to comment on their filings on June 7. However, they have yet to get any feedback and now expect the SEC to provide comments this week, a source told The Block. According to Nate Geraci, issuers will file another round of amendments after they receive the SEC's comment.

The SEC approved spot ETH ETF 19b-4 filings of issuers on May 23. Before spot ETH ETFs can begin trading though, the agency must approve the issuers' S-1 registration statements. SEC Chair Gary Gensler told Reuters last week that the timing of the S-1 approval depends on how fast issuers respond to the agency's comments.

While the wait continues, issuers have stated that they plan to market the ETFs as a “producing tech stock” or the “ultimate app store.”

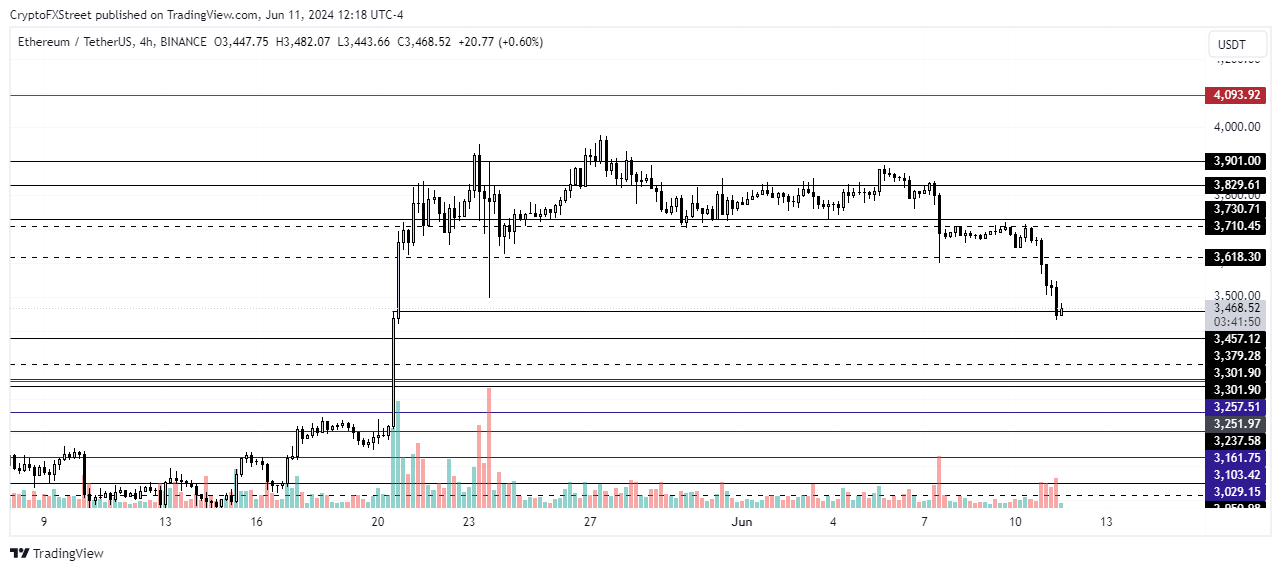

ETH technical analysis: Ethereum's recent setback may be temporary

Ethereum is trading around $3,490, down over 6% on Tuesday. The market appears to be in risk-off mode ahead of the Consumer Price Index (CPI) report and Federal Open Market Committee decision on June 12, according to QCP Capital.

The market decline has accelerated ETH liquidations, with long liquidations accounting for $48.39 million of a total of $52.58 liquidations in the past 24 hours.

ETH open interest (OI) has declined by about $680 million between Friday and Tuesday. Specifically, ETH options OI also reduced by $1.21 billion in the same time range. Coupled with declining options volume, this confirms the bearish sentiment in the market.

ETH/USDT 4-hour chart

ETH has breached the $3,618 support and is looking to extend the downward move below the $3,457 price level. With spot ETH ETFs on the horizon, the current sell-off may prove to be a temporary setback and a good accumulation zone. A further plunge below the $3,300 support will strengthen the bearish trend.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

! Cảnh báo rủi ro: Xin lưu ý rằng bất cứ hình thức đầu tư nào đều liên quan đến rủi ro, bao gồm rủi ro mất một phần hoặc toàn bộ vốn đầu tư.

Trước khi đưa ra quyết định giao dịch, bạn cần trang bị đầy đủ kiến thức cơ bản, nắm đầy đủ thông tin về xu hướng thị trường, biết rõ về rủi ro và chi phí tiềm ẩn, thận trọng cân nhắc đối tượng đầu tư, mức độ kinh nghiệm, khẩu vị rủi ro và xin tư vấn chuyên môn nếu cần.

Ngoài ra, nội dung của bài viết này chỉ là ý kiến cá nhân của tác giả, không nhất thiết có ý nghĩa tư vấn đầu tư. Nội dung của bài viết này chỉ mang tính tham khảo và độc giả không nên sử dụng bài viết này như bất kỳ cơ sở đầu tư nào.

Nhà đầu tư không nên sử dụng thông tin này để thay thế phán quyết độc lập hoặc chỉ đưa ra quyết định dựa trên thông tin này. Nó không cấu thành bất kỳ hoạt động giao dịch nào và cũng không đảm bảo bất kỳ lợi nhuận nào trong giao dịch.

Nếu bạn có thắc mắc gì về số liệu, thông tin, phần nội dung liên quan đến Mitrade trong bài, vui lòng liên hệ chúng tôi qua email: . Nhóm Mitrade sẽ kiểm duyệt lại nội dung một cách kỹ lưỡng để tiếp tục nâng cao chất lượng của bài viết.