Ripple Price Forecast: XRP holds key support, but weak retail demand could lag recovery

- XRP trades near $2.10 as bulls aim for a breakout above the 50-day EMA.

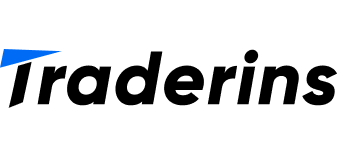

- XRP spot ETFs extend inflow streak for 15 consecutive days, signaling steady institutional demand.

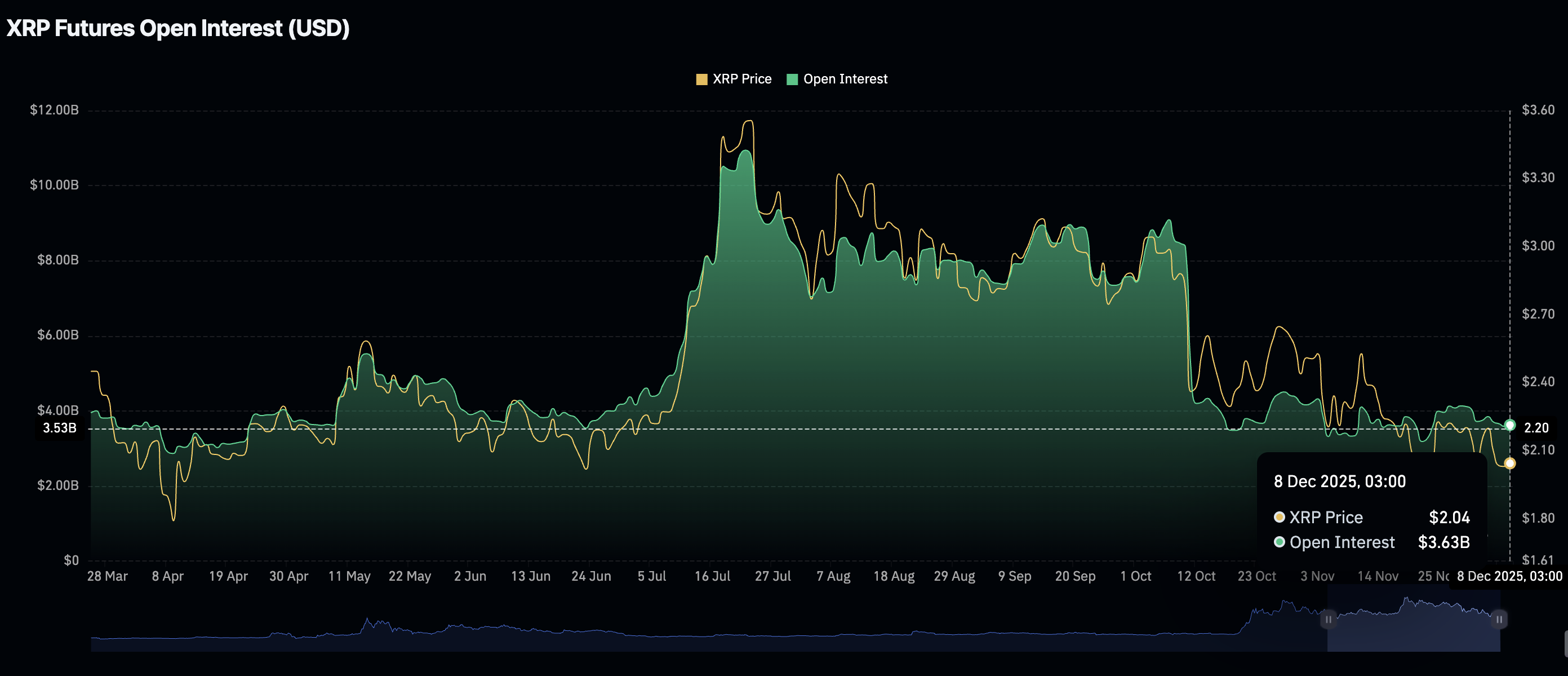

- Retail demand remains weak, with futures Open Interest averaging $3.63 billion.

Ripple (XRP) is trading at around $2,10 at the time of writing on Monday, after bouncing off its short-term support at $2.00. The cross-border remittance token has continued to receive steady support from institutional investors through spot Exchange Traded Funds (ETFs) listed in the United States (US), although this has failed to materialize into a substantial price increase for the token.

Traders should remain cautious considering XRP showcases a weak derivatives market.

XRP ETFs extend inflow streak

Demand for XRP spot ETFs has remained steady since their debut on November 13. SoSoValue data shows that US-listed XRP ETFs posted approximately $10 million in inflows on Friday. This extended the inflow streak to 15 days, bringing the cumulative inflow volume to $897 million and net assets to $861 million.

Steady ETF inflows increase buying pressure, bolstering the case for XRP and supporting a bullish outlook.

Four XRP ETFs operate in the US, including Canary Capital’s XRPC, Grayscale’s GXRP, Bitwise’s XRP and Franklin Templeton’s XRPZ.

Meanwhile, retail demand has remained significantly suppressed for almost two months. CoinGlass data shows that XRP futures Open Interest (OI) stands at $3.63 billion on Thursday, up slightly from $3.59 billion on Sunday.

Despite the minor increase in OI, which represents the notional value of outstanding futures contracts, the derivatives market is lagging those levels seen before the October 10 deleveraging event (OI of $8.36 billion) and its record high of July 22 ($10.94 billion).

This massive decline underscores the low retail interest. Investors are staying on the sidelines, not convinced that XRP can sustain an uptrend in the short term.

Technical outlook: XRP consolidating gains

XRP is trading at $2.09, with the price sitting below the falling 50-day Exponential Moving Average (EMA) at $2.27. The 100-day EMA at $2.43 and 200-day EMA at $2.47 also slope lower, maintaining a bearish bias and capping rebounds.

The Relative Strength Index's recent uptick on the daily chart suggests fading downside pressure, but the indicator remains at 45 (neutral-bearish). The descending trend line from XRP's record high of $3.66 also limits gains, with resistance at $2.60. The Parabolic SAR has flipped below price, placing a trailing support near $1.90, though bears retain control while the pair trades under the moving averages.

A close above the 50-EMA at $2.27 could open the path toward the descending trendline barrier at $2.60. The rising trend line (green) from $1.62 underpins the medium-term bias, offering support on dips. Holding the $1.90–$1.83 support band would allow a base to form a recovery, while a break below it would sustain the broader downtrend toward April's low of $1.61.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.

(The technical analysis of this story was written with the help of an AI tool)