ZEC sees 5% gain as Grayscale files to convert its Zcash Trust to an ETF

- Grayscale has filed a registration statement with the US SEC to convert its Zcash Trust to an ETF.

- The Zcash Trust currently manages about $196 million in assets.

- Grayscale has launched multiple altcoin ETFs over the past month, including products for Solana, XRP and Dogecoin.

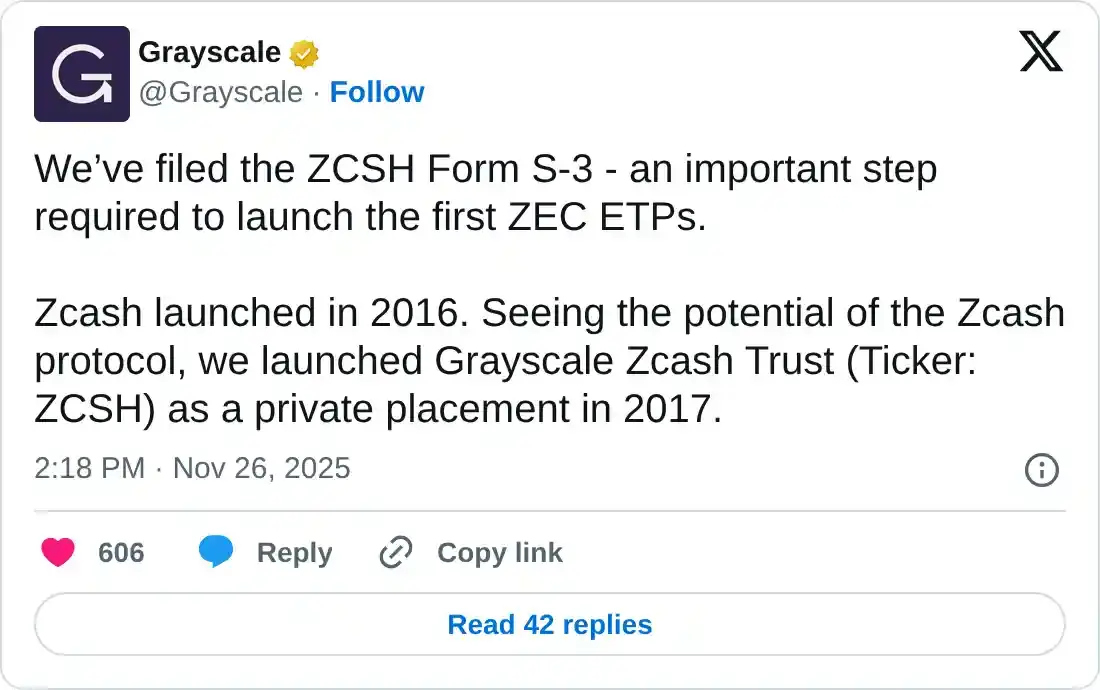

Grayscale filed a registration statement with the US Securities & Exchange Commission (SEC), seeking to convert its Zcash (ZEC) Trust into an exchange-traded fund (ETF).

Grayscale set to introduce spot Zcash ETF, awaits SEC approval

Digital asset manager Grayscale is planning to launch the first-ever privacy token-focused spot ETF following a Wednesday filing with the SEC to convert its Zcash Trust to an ETF.

The firm has filed a Form S-3 registration statement, taking a key regulatory step toward launching what could be the first Zcash-focused investment fund in the US. If approved, the fund would offer regulated exposure to Zcash, a privacy-centric cryptocurrency built to enable secure transactions with optional disclosure features on its blockchain.

Grayscale noted in its filing that the Trust aims to list its shares on NYSE Arca under the ticker ZCSH. The firm also highlighted that, for now, it cannot support in-kind share creation or redemption with authorized participants.

Grayscale highlighted that the limitation stems from lingering market uncertainty, even after the SEC granted approvals for in-kind processes for certain spot digital asset ETFs. The company explained that broker-dealers and other participants have yet to clarify how they will update their procedures to align with the new regulatory framework, leaving the timeline for adopting in-kind mechanisms unresolved.

Issuers are increasingly offering investors exposure to altcoin ETFs. Grayscale recently accelerated its shift toward altcoin products, rolling several of its long-standing single-asset trusts into ETFs, including XRP, Dogecoin and Solana.

The Grayscale Zcash Trust, launched in 2021, manages about $196 million in assets. The move to convert the product into an ETF comes amid a recent surge in demand for privacy tokens.

ZEC has surged over 500% in the past two months. The token is up 5% on Monday, mitigating its weekly decline to 17%.