Ethereum Price Forecast: ETH defies market correction as SharpLink becomes top corporate ETH holder

Ethereum price today: $3,040

- SharpLink flipped the Ethereum Foundation to become the top corporate holder of ETH with a stash of over 280,000 ETH.

- Ethereum ETFs have garnered $1.3 billion in net inflows over the past seven trading days.

- ETH reattempts a breakout above a key ascending trendline resistance.

Ethereum (ETH) racked up a 2% gain on Tuesday, defying the correction seen in Bitcoin and other top cryptocurrencies after SharpLink Gaming revealed it expanded its treasury holdings to over 280,000 ETH in the past week.

SharpLink dethrones Ethereum Foundation to top ETH treasury leaderboard

Nasdaq-listed SharpLink Gaming (SBET) flipped the Ethereum Foundation to become the largest corporate holder of ETH after acquiring 74,656 ETH for $213 million last week, according to a press release. Combined with staking earnings of 94 ETH during the period, the acquisition has lifted the company's holdings to 280,706 ETH.

SharpLink stated that it made the purchase after raising $413 million from the sale of 24.5 million shares of its common stock through its At-The-Market (ATM) facility last week. The company added that it still has a balance of $257 million from proceeds that have not yet been allocated to ETH purchases.

Notably, 10,000 ETH from the recent acquisition was from an over-the-counter (OTC) deal with the Ethereum Foundation.

The Minnesota-based firm launched its ETH treasury strategy in May, following a $425 million private placement spearheaded by Consensys, whose CEO, Joseph Lubin, went on to become Chairman of the company's board.

Several low-cap, publicly traded companies have warmed up to the top altcoin, with former Bitcoin miners Bit Digital (BTBT) and BitMine (BMNR) pivoting to an Ethereum treasury.

The increased attention around ETH comes at a time when US spot ETH exchange-traded funds (ETFs) have been attracting strong inflows. The products recorded $259.04 million in net inflows on Monday, stretching their positive streak to seven consecutive trading days, worth over $1.31 billion, per SoSoValue data.

Ethereum Price Forecast: ETH attempts breakout above rising trendline resistance

Ethereum saw $136.5 million in futures liquidations in the past 24 hours, comprising $82.63 million and $53.87 million in liquidated long and short positions, according to Coinglass data.

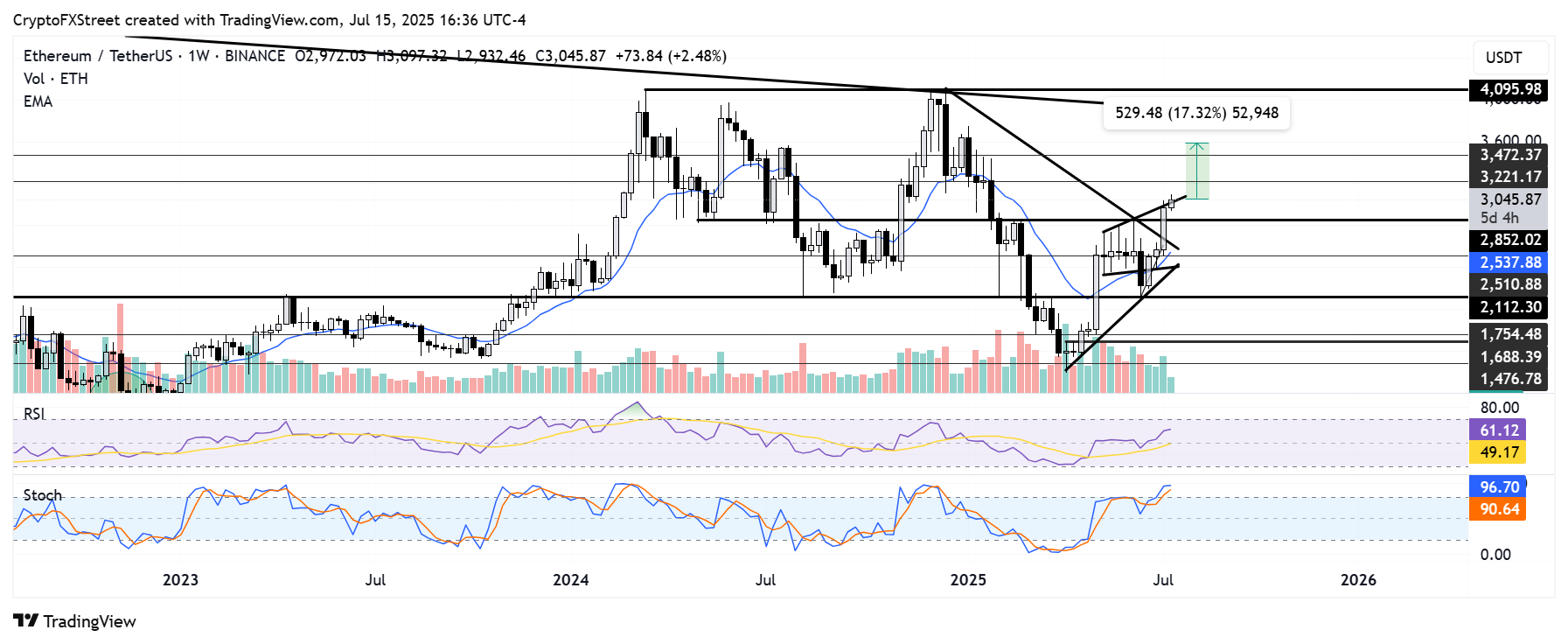

ETH hasn't seen much change in its price since reclaiming the $3,000 psychological level last Thursday. The top altcoin is reattempting a breakout above a key ascending trendline resistance near $3,100 on the weekly chart.

ETH/USDT weekly chart

ETH could surge by 17% toward $3,600 if it sustains a strong move above the resistance. However, it has to overcome key hurdles at $3,220 and $3,470 for such a move to materialize.

On the downside, ETH could find support near $2,850 if bears prevail over bulls at $3,000. Further down, the $2,500 key level could provide a price bounce if ETH loses $2,850.

The Relative Strength Index (RSI) is above its neutral level, while the Stochastic Oscillator (Stoch) has crossed above its overbought region. This indicates a dominant bullish momentum with potential for a short-term pullback due to overbought conditions in the Stoch.

A weekly candlestick close below $2,500 will invalidate the bullish thesis.