Bitcoin Price Forecast: BTC on the verge of a breakdown amid possible US strike on Iran

- Bitcoin price finds support around the 50-day EMA at $103,100; a decisive close below this level could trigger a sharp correction.

- Reports that US officials are preparing for a strike on Iran in the coming days could further weigh on sentiment.

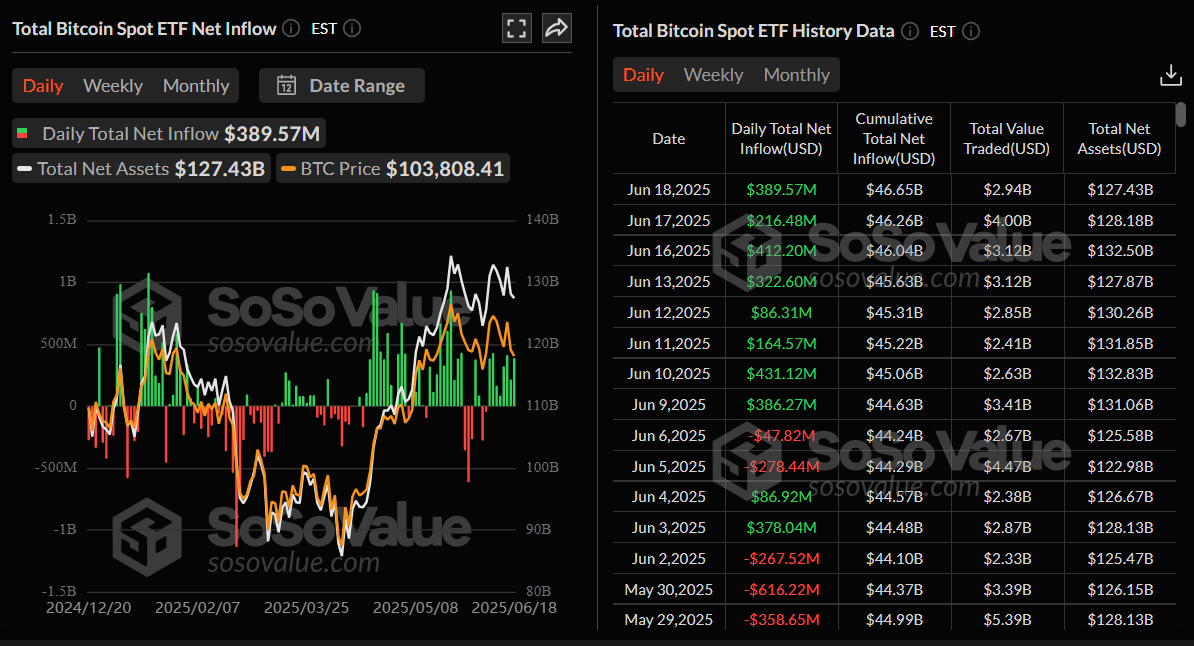

- US spot Bitcoin ETFs recorded $389.57 million in inflows on Wednesday, marking the eighth consecutive day of positive flows.

Bitcoin (BTC) price edges slightly higher, trading near $104,700 at the time of writing on Thursday, after stabilizing above a key level, the 50-day Exponential Moving Average (EMA) at $103,100. A breach below this level could trigger a sharp fall in BTC. The risk aversion could weigh in, as reports say US officials are preparing for a strike on Iran in the coming days. Despite this risk-off sentiment in global markets, institutional demand remained robust, with a positive inflow in US spot Bitcoin Exchange Traded Funds (ETFs) for the last eight consecutive days.

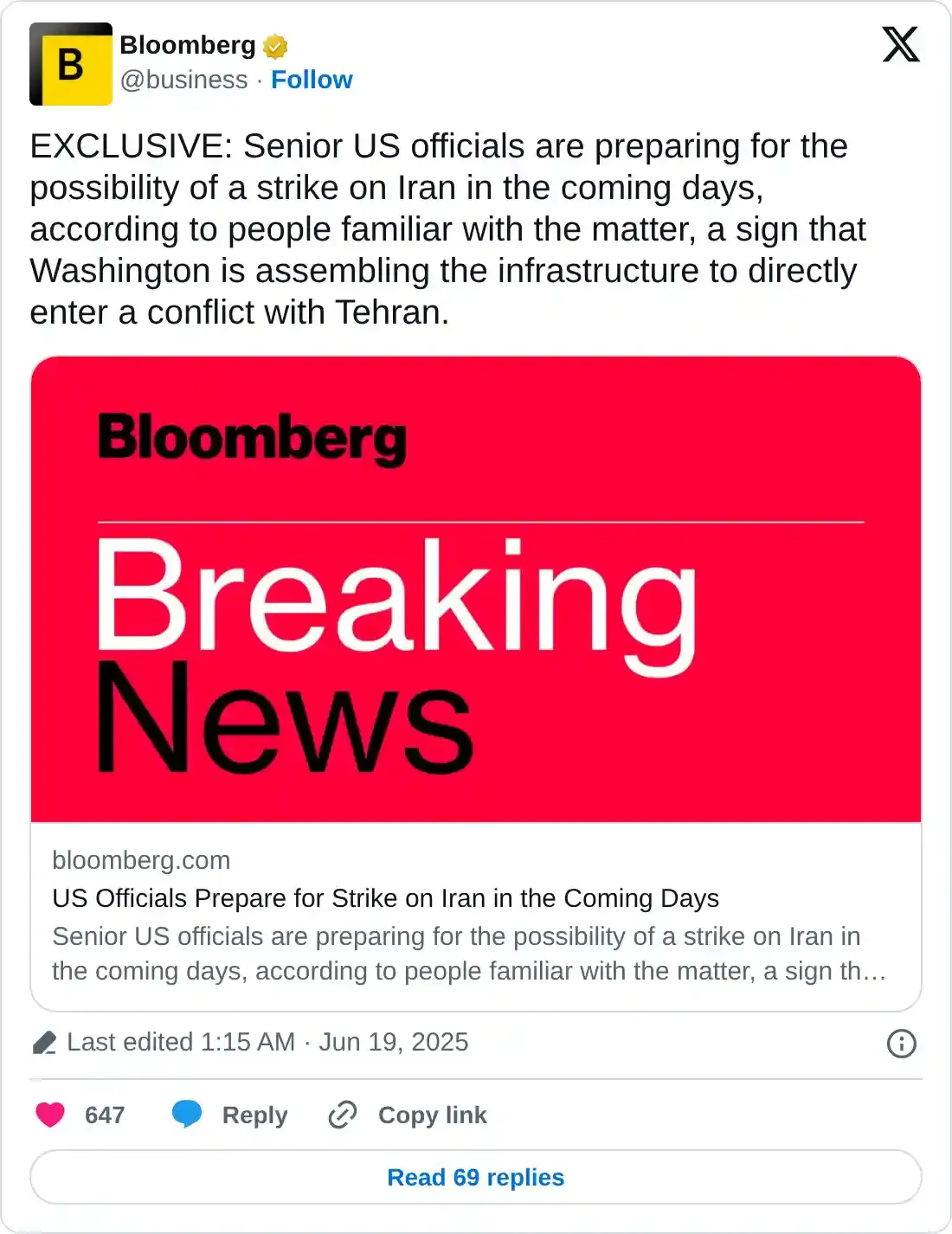

US prepares strike on Iran, says Bloomberg

The ongoing seven-day war between Iran and Israel took a major turn early on Thursday, as the news came in that the US officials are preparing for a strike on Iran in the coming days, according to Bloomberg.

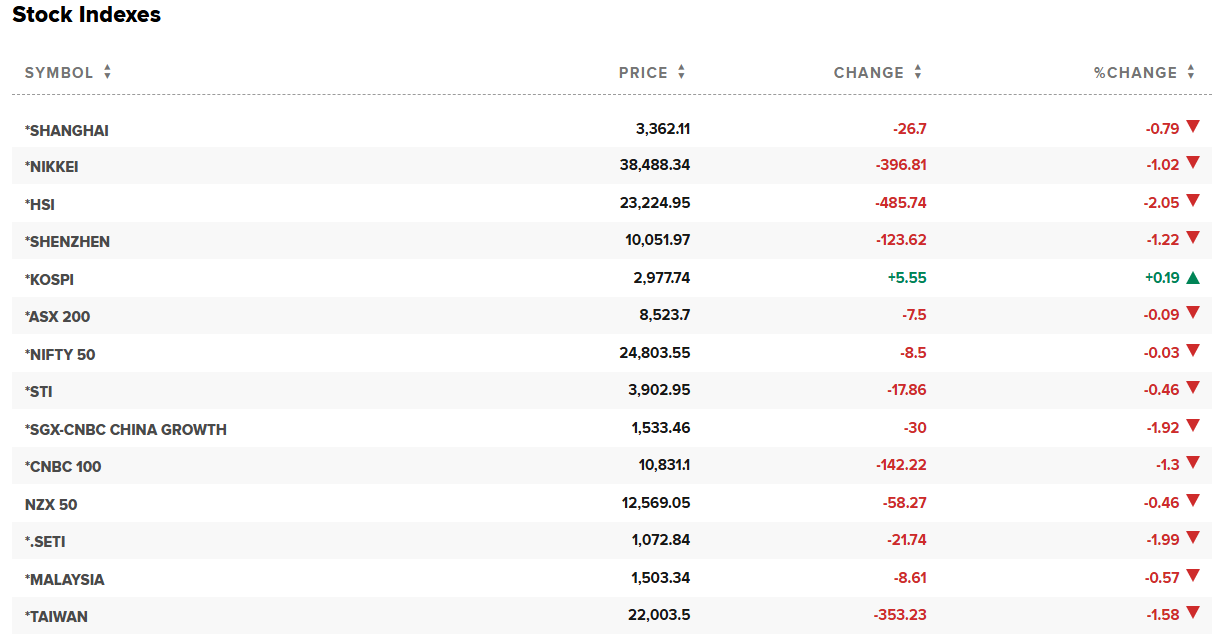

The chart below shows that the Asian markets reacted negatively to this news. However, the largest cryptocurrency by market capitalization had a mild effect, as BTC holds around $104,700 during the early European session.

Asian markets chart.

However, BTC traders should still remain cautious, as volatility could increase if the US attacks Iran in the upcoming days, which could further weigh on sentiment, potentially causing a sharp decline in the BTC price.

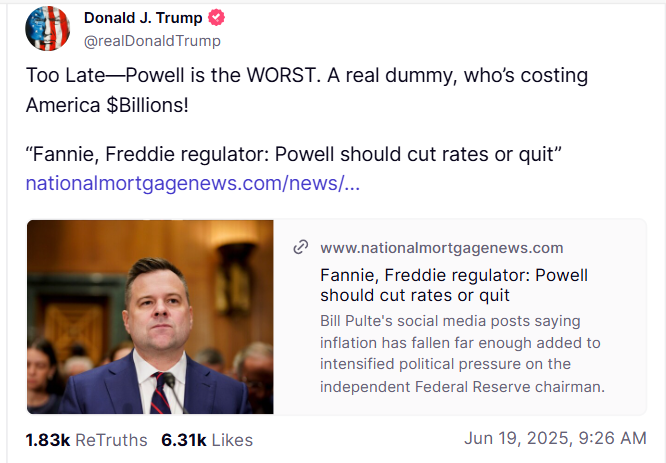

US Fed holds interest rates amid tariffs and Israel-Iran conflict

The US Federal Reserve (Fed) kept the interest rate unchanged at the 4.25%–4.50% range at its June meeting on Wednesday, as widely expected. The Federal Open Market Committee (FOMC) still sees around 50 basis points of interest rate cuts through the end of 2025.

Fed Chair Jerome Powell warned that ongoing policy uncertainty will keep the Fed in a rate-hold stance, and any rate cuts will be contingent on labor and inflation data.

The markets remained neutral, as an unchanged interest rate was highly expected.

On Thursday, US President Donald Trump posted on his Truth Social account, “Too Late—Powell is the WORST. A real dummy, who’s costing America $Billions!”

Some signs of optimism

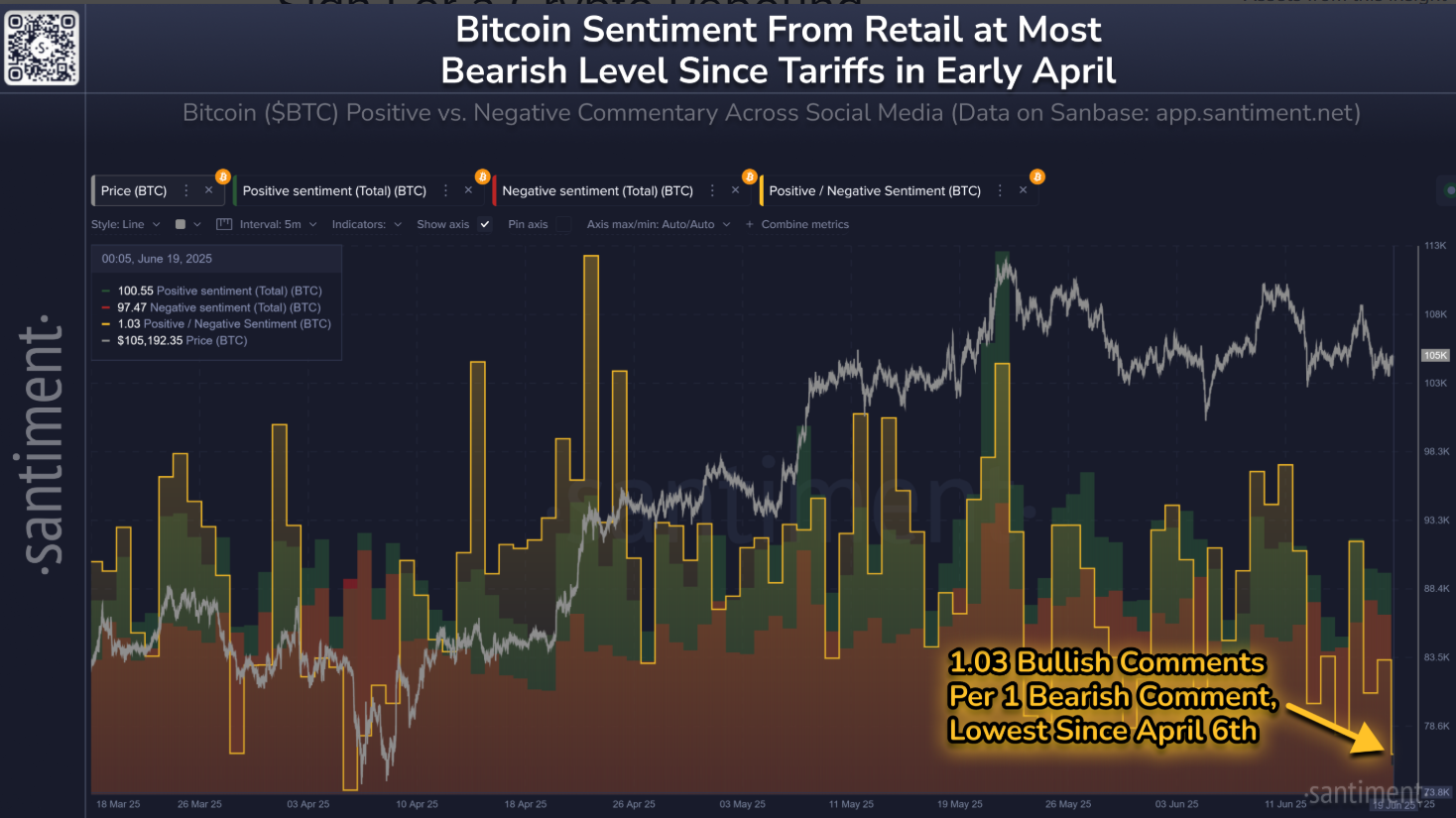

Despite the fear and uncertainty regarding geopolitical conflicts, BTC shows some signs of optimism. Santiment's Bitcoin positive vs. negative commentary across social media data shows that Bitcoin sentiment from retail traders reaches 1.03 bullish comments for every 1 bearish comment, a level not seen since the Fear, Uncertainty and Doubt (FUD) during the initial tariff reactions on April 6. Historically, the markets have moved in opposite directions to retail sentiment, indicating early bullish signs for BTC.

Retail sentiment chart. Source: Santiment

Looking at the institutional demand also remains strong. According to SoSoValue data, US spot Bitcoin Exchange Traded Funds (ETFs) recorded an inflow of $389.57 million on Wednesday, continuing its eight-day streak of gains since June 9. If these inflows continue, it could serve as a cushion for any price dips in BTC.

Total Bitcoin Sport ETF net inflow daily chart. Source: SoSoValue

Bitcoin Price Forecast: 50-day EMA holding BTC for now

Bitcoin price drew liquidity from its Fair Value Gap (FVG) around $108,064 on Monday and declined by 2.1% the following day. BTC has retested and found support multiple times around the 50-day Exponential Moving Average (EMA) at approximately $103,100, highlighting its strength as dynamic support. At the time of writing on Thursday, BTC trades at around $104,800.

If BTC continues its pullback and closes below the 50-day EMA at $103,100 on a daily basis, it could extend the decline to retest its key psychologically important level at $100,000.

The Relative Strength Index (RSI) momentum indicator on the daily chart reads 47, below its neutral level of 50, indicating that bearish momentum is gaining traction. The Moving Average Convergence Divergence (MACD) indicator displayed a bearish crossover last week. It also shows rising red histogram bars below its neutral level, indicating bearish momentum and giving credence to the downward trend.

BTC/USDT daily chart

On the contrary, if BTC closes above its FVG level at $108,064, it could extend the recovery toward retesting its May 22 all-time high of $111,980.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.