Ethereum Price Forecast: ETH recovers $3,100 as BitMine, top whales expand buying pressure

Ethereum price today: $3,100

- BitMine acquired 138,452 ETH last week, pushing its holdings to 3.2% of ETH's circulating supply.

- Top whales are opening long ETH positions on Hyperliquid.

- ETH could tackle the resistance at $3,470 if it clears the selling pressure near $3,250.

Ethereum (ETH) is up 3% on Monday as BitMine disclosed holdings of 3.86 million ETH. The firm's weekly update follows several long bets on the top altcoin from key whales on Hyperliquid.

BitMine scoops additional ETH, expands cash balance

Ethereum treasury firm BitMine Immersion (BMNR) expanded its digital asset stash with another round of weekly ETH acquisition.

The company purchased 138,452 ETH last week, its largest since October. As a result, BitMine holds 3.86 million ETH as of December 7, maintaining its lead as the largest Ethereum treasury and second-largest crypto treasury behind Michael Saylor's Strategy (formerly MicroStrategy). The figure represents 3.2% of ETH's circulating supply, which is two-thirds of its original 'Alchemy of 5% of ETH' goal.

"Our stepped up buying activity reflects our confidence that ETH prices should strengthen in the months ahead, given multiple catalysts," said BitMine Chairman Thomas Lee in a Monday statement. He cited Ethereum's Fusaka upgrade last week, quantitative tightening by the Federal Reserve (Fed) and a potential interest rate cut on Wednesday as key stimuli to a price recovery.

The Nevada-based firm also disclosed that it grew its cash holdings to $1 billion, while maintaining a 193 Bitcoin (BTC) balance and a $36 million stake in Worldcoin (WLD) treasury Eightco Holdings (ORBS).

"The best years are ahead for crypto given the substantial upside to current adoption rates for crypto and given the coming transformation as Wall Street tokenizes everything onto the blockchain," added Lee.

While BitMine continued to accumulate, its peers SharpLink Gaming (SBET) and The Ether Machine (ETHM) held steady, with holdings of 859,395 ETH and 496,712 ETH, according to the StrategicETHReserve data.

Whales increase bullish bets on ETH

BitMine isn't alone in its bullish positioning on ETH. Several top whales are using leverage to long ETH on the decentralized exchange Hyperliquid.

The BitcoinOG (1011short) is holding $155.7 million worth of ETH longs after closing a $14 million position for $305,000 profit, according to data posted by smart money tracker Lookonchain. Anti-CZ whale and pension-usdt.eth also hold ETH longs worth about $194 million and $62.5 million, respectively.

In addition to these whales, Arkham Intelligence highlighted that whale 0xBADBB has used two accounts to open long positions in ETH worth about $189.55 million.

Ethereum Price Forecast: ETH eyes $3,470 but faces pressure near $3,250

Ethereum has seen $113.6 million in futures liquidations over the past 24 hours, with short liquidations leading at $64.6 million, per Coinglass data.

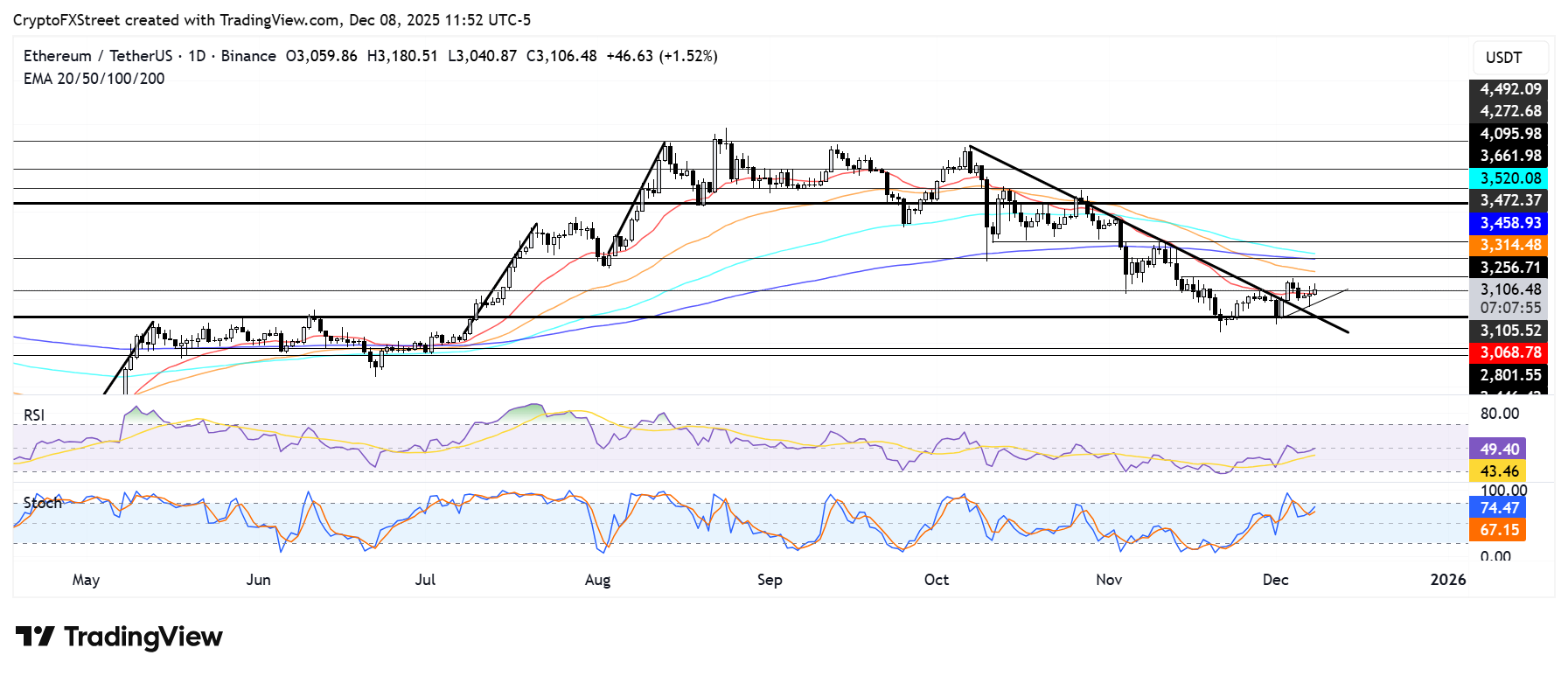

ETH is attempting to hold a rise above $3,100 and the 20-day Exponential Moving Average (EMA), but it continues to face selling pressure at the resistance near $3,250, a level that has proven a key hurdle since November.

A firm move above $3,250 could see ETH rise above the 50-day EMA to tackle the short-term resistance near $3,470, which coincides with the 200-day EMA.

On the downside, ETH could fall toward the $2,800 support level if it fails to hold above the $3,000 psychologically important level.

The Relative Strength Index (RSI) is testing its neutral level line, while the Stochastic Oscillator (Stoch) is approaching overbought territory, indicating a rising bullish momentum. A firm crossover in both indicators could accelerate the bullish momentum.