Cosmos Price Forecast: ATOM regains strength on whale demand

- Cosmos records an over 10% rise on Thursday, testing a local resistance trendline after a reversal last week.

- The derivatives market sees renewed demand for ATOM among large wallet investors.

- The technical outlook remains optimistic despite strong resistance, as bullish momentum continues to build.

Cosmos (ATOM) rises above the $3.00 round figure at the time of writing on Thursday, preparing for a potential breakout from a local resistance trendline. The sudden surge in ATOM is on the back of increased derivatives market demand from large wallet investors, popularly known as whales, which is driving up futures Open Interest (OI). The technical outlook is giving early signals of a bullish shift, as the Relative Strength Index (RSI) indicates increased buying pressure, aligning with a potential breakout.

Whales add positions in ATOM futures, boosting overall demand

Cosmos is racking up retail interest this week following the partnership between Everstake and Turkey’s Paribu Custody to provide institutional-grade staking for ATOM and other digital assets.

As the market settles after a rough start to the week, the partnership becomes a sentimental catalyst for Cosmos, driving whale demand in derivatives markets. CryptoQuant data shows that large whale orders are increasing the average order size in ATOM futures, suggesting risk-on sentiment as traders anticipate a recovery.

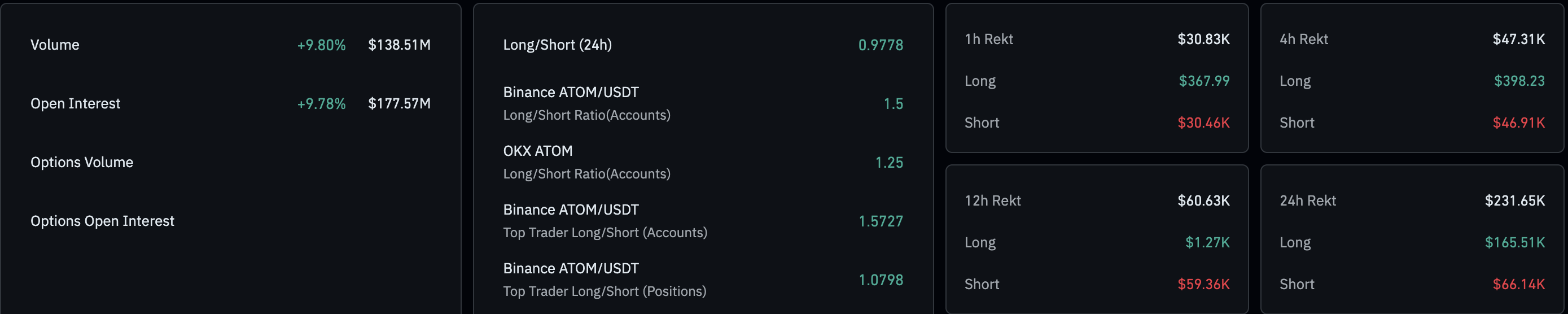

In line with rising order sizes, the ATOM futures Open Interest (OI) has increased by 9.78% over the last 24 hours, reaching $177.57 million.

Cosmos builds bullish momentum amid breakout possibility

Cosmos is forming a potential bullish Marubozu candle, with an 11% surge by press time on Thursday, after a hammer candlestick the previous day, overshadowing the last seven candles on the daily chart. The intraday surge exceeds a local resistance trendline formed by connecting the peaks of October 13 and November 11, near $3.00.

If ATOM holds the daily close above the $3.00 round figure, it would confirm a breakout and mark a short-term bullish trend reversal. However, the proximity of overhead resistance, including the 50-day Exponential Moving Average (EMA) at $3.21 and the supply zone near $3.50, would act as a headwind.

Although ATOM is opposed to multiple resistances, the short-term increase in buying pressure signals a shift in trend momentum. The RSI at 52 on the daily chart surpasses the midline for the first time since the mid-September pullback. At the same time, the Moving Average Convergence Divergence (MACD) flips upwards from near the signal line, avoiding a bearish crossover. An extension in the MACD uptrend aligns with an increase in the green histogram bar, suggesting strong bullish momentum.

However, if Cosmos reverses from the $3.00 mark, it could retest the November 4 low at $2.34.