Ethereum Price Forecast: ETH reclaims $4,500 as Bit Digital expands treasury to 150,244 ETH

Ethereum price today: $4,520

- Bit Digital has expanded its Ethereum treasury to 150,244 ETH after closing a $150 million offering.

- US spot Ethereum ETFs have recorded seven consecutive days of net inflows, totaling $1.9 billion.

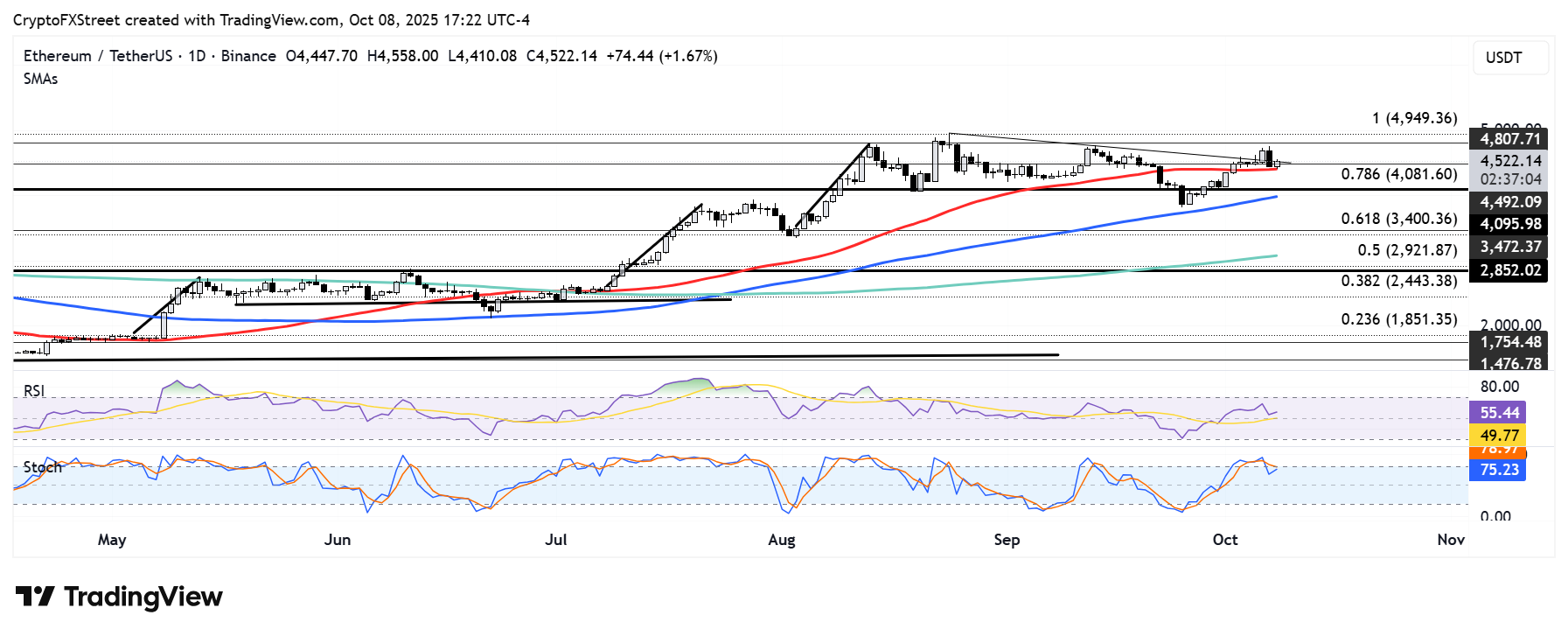

- ETH bounced off the 50-day SMA but faces a descending trendline hurdle.

Ethereum (ETH) reclaimed $4,500 on Wednesday following Bit Digital's (BTBT) announcement that it has boosted its treasury to 150,244 ETH.

Bit Digital splashes $150 million offering on ETH acquisition

Ethereum treasury company Bit Digital said it bought 31,057 ETH, after raising $150 million from a convertible note offering, according to a statement on Wednesday.

The latest purchase has increased the firm's holdings to 150,244 ETH, valued at about $670 million, making it the sixth-largest Ethereum treasury, according to data from the StrategicETHReserve website.

"This purchase demonstrates our commitment to building shareholder value by financing ETH accumulation on terms that are accretive to NAV per share," said Bit Digital CEO Sam Tabar.

Bit Digital funded the ETH acquisition through proceeds from its convertible note offering, priced at $4.16, an 8.2% premium to the firm's market-cap-to-net asset value (mNAV) at the time of pricing.

"The structure of our convertible notes allowed us to raise capital at a premium to mNAV, and we have deployed those proceeds directly into ETH," added Tabar. "We view ETH as foundational to digital financial infrastructure and believe current levels provide a compelling long-term entry point."

Bit Digital isn't the only Ethereum treasury expanding its stash. On Monday, BitMine Immersion (BMNR) announced that it had grown its holdings to 2.83 million ETH, making it the largest public holder of the top altcoin.

Meanwhile, US spot ETH exchange-traded funds (ETFs) continue to attract interest, recording $420.8 million in net Inflows on Tuesday, per SoSoValue data. The products have recorded seven consecutive days of net inflows, totaling $1.9 billion.

Ethereum Price Forecast: ETH bounces off 50-day SMA but faces trendline hurdle

Ethereum experienced $88.3 million in futures liquidations over the past 24 hours, comprising $48.6 million and $39.6 million in long and short liquidations.

After finding support near the 50-day Simple Moving Average (SMA), the top altcoin is retesting the key descending trendline resistance, which extends from August 24.

ETH/USDT daily chart

ETH could attempt to retest the $4,800 resistance if it breaks the descending trendline hurdle. However, a rejection at the trendline could see it breach the 50-day SMA and decline toward $4,100. Further down is the 100-day SMA support, which bulls defended during key price declines on June 22 and September 25.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are above their neutral levels and have halted their recent downtrend, indicating bullish dominance.