Crypto Today: Bitcoin, Ethereum, XRP recover rate-triggered losses amid tariff impact concerns

- Bitcoin ticks up to erase overnight losses seen after the Fed's hawkish stance, amid growing inflation concerns.

- Ethereum steadies the uptrend buoyed by corporate treasury strategies.

- XRP bulls hint at regaining control as the RSI stabilizes within bullish territory.

Cryptocurrency prices exhibit stability on Thursday, as traders buy the dip that followed the United States (US) Federal Reserve (Fed) interest rate decision the previous day. Bitcoin (BTC) leads the recovery, trading at around $118,544 at the time of writing.

Interest in altcoins, including Ethereum (ETH) and Ripple (XRP), is steady, with prices rising slightly from key support levels. After defending support at $3,744 on Wednesday, the Ethereum price has ticked up to $3,861 while XRP is up over 2.5%, exchanging hands at around $3.16.

Market overview: Bitcoin recovery could stall amid tariff impact concerns

Bitcoin has recouped most of the losses accrued following the Fed decision to leave interest rates unchanged in the range of 4.25% to 4.50%. Although market participants widely expected the move, Fed Chair Jerome Powell's hawkish remarks took centre stage.

Despite Fed Governors Christopher Waller and Michelle Bowman were in favour of cutting the rates, Powell said in his remarks that there was no defined monetary policy direction, casting doubt on the possibility of a rate cut in September. He added that the central bank is assuming a wait-and-see approach to gauge the impact of US President Donald Trump's higher tariffs.

"Higher tariffs have begun to show through more clearly to prices of some goods, but their overall effects on economic activity and inflation remain to be seen," Powell said.

Countries that have not inked a deal with the US by Friday will face reciprocal tariffs. Powell argued that the goal of the central bank is to keep " inflation expectations well anchored" in the long term and prevent inflation from becoming a sticky problem.

The cryptocurrency market remains relatively stable, with major coins falling slightly and recouping overnight losses. As investors digest the impact of Powell's hawkish stance on monetary policy, attention is quickly shifting to the upcoming increase in tariffs.

Chart of the day: Bitcoin holds key support

Bitcoin price is trading above several key support levels, including the buyer congestion at $115,792, which was tested on Wednesday, the 100-period Exponential Moving Average (EMA) at $117,316, and the 50-period EMA at $118,072, reclaimed on the 4-hour chart.

The Moving Average Convergence Divergence (MACD) indicator has confirmed a buy signal in the 4-hour time frame, with the blue line crossing and settling above the red signal line. If investors heed the signal and increase exposure, bullish momentum will steady and accelerate the recovery toward the $120,000 resistance level.

BTC/USDT 4-hour chart

Altcoins update: Ethereum, XRP bulls tighten grip

Ethereum is increasing its intraday gains, up over 1% on Thursday and trading at $3,861. Since the beginning of July, ETH has surged by over 61% backed by institutional and retail demand.

Despite tariff impact concerns, publicly listed companies continue to launch Ethereum-based corporate treasuries, with some like BTCS recently increasing exposure to $270 million earlier this week.

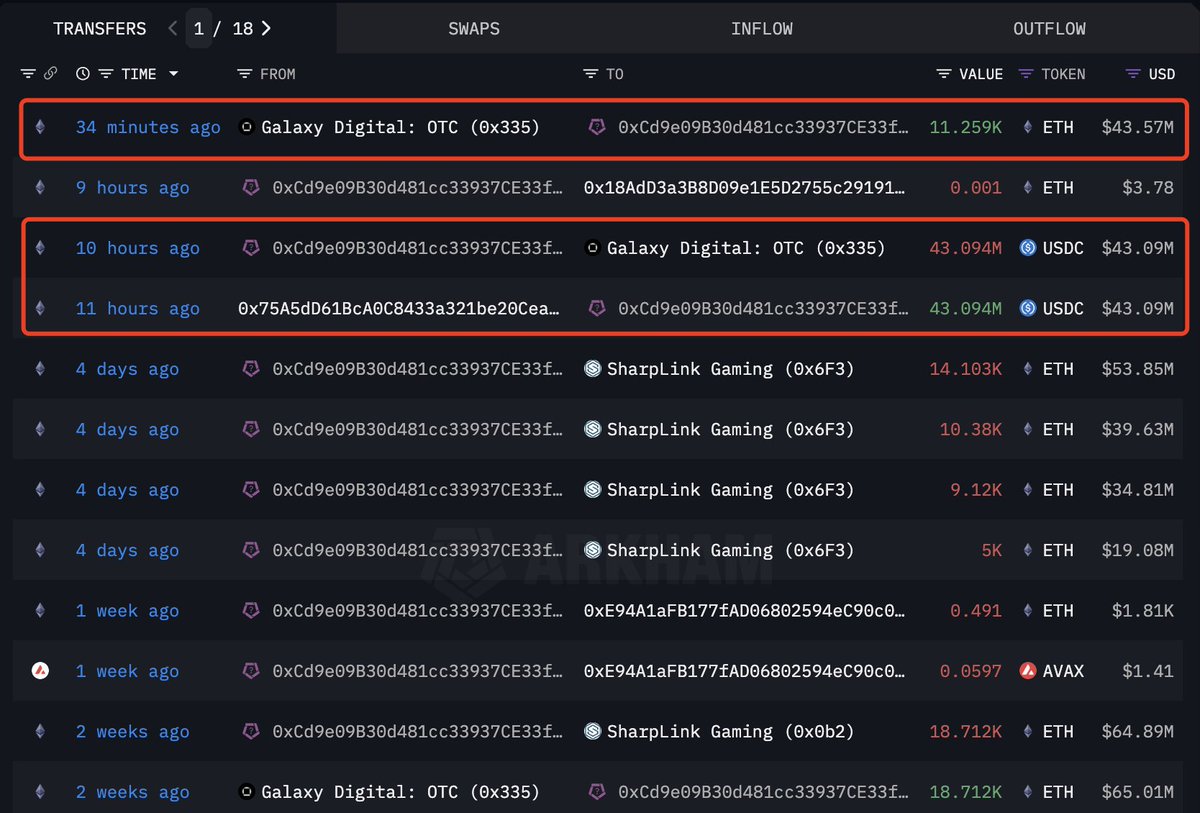

According to Lookonchain, SharpLink continued its buying spree, expanding its holdings by 11,259 ETH. SharpLink currently holds 449,276 ETH valued at approximately $1.73 billion.

SharpLink buys more ETH | Source: Lookonchain

As demand for Ethereum grows, the probability of breaching the $4,000 resistance significantly increases. However, traders should be wary of a sell signal confirmed by the MACD indicator on the daily chart, which could trigger a short-term reversal if investors reduce exposure.

ETH/USDT daily chart

As for XRP, bulls are fighting to regain control of the trend after the price dropped, testing support around the $3.00 level on Wednesday. The Relative Strength Index (RSI), which is stabilizing near 60, indicates bullish momentum is building.

XRP/USDT daily chart

Still, a delay could occur at the short-term $3.32 resistance, which was tested on Monday. Key areas of interest for traders include the record high of $3.66, reached on July 18 and the potential price discovery phase toward the $4.00 milestone.

The MACD indicator triggered a sell signal on Friday and maintains the descent — a situation that could see short positions become attractive, thus boosting risk-off sentiment. In the event the decline resumes, the demand at $3.00 and the 50-day EMA at $2.77 could absorb the selling pressure.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.