Crypto market capitalization hits $4 trillion as US crypto bills move forward

- The cryptocurrency market capitalization reached $4 trillion on Friday, fueling wider optimism.

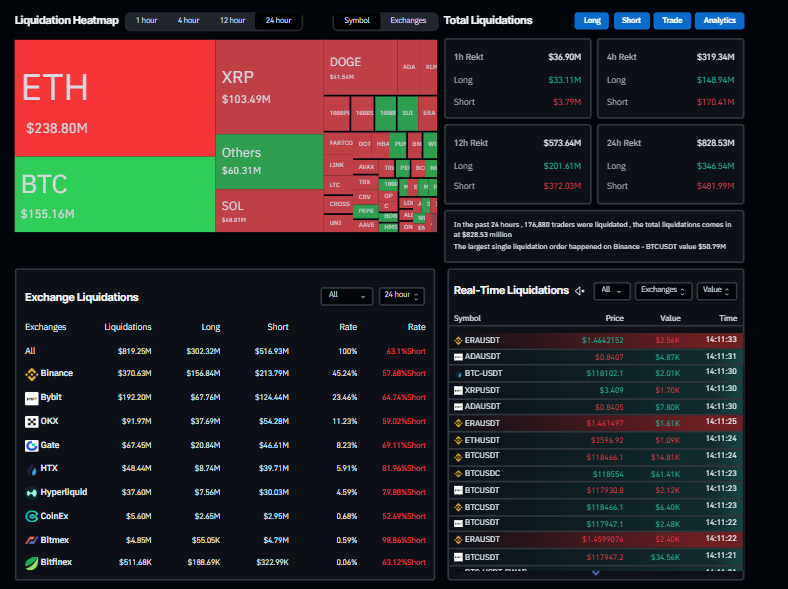

- More than $800 million in leveraged positions were liquidated across crypto markets in the past 24 hours, with 63% of these being short positions.

- US lawmakers passed the crypto-related GENIUS, CLARITY and Anti-CBDC bills, boosting investor confidence and fueling the market surge.

The global cryptocurrency market reached a new milestone on Friday, surpassing a $4 trillion market capitalization. The surge comes on the heels of major legislative progress in the US after the House of Representatives passed the crypto-related GENIUS, CLARITY, and Anti-CBDC bills on Thursday, fueling optimism and reinforcing investor confidence across digital asset markets.

Crypto market capitalization reaches $4 trillion

The global cryptocurrency market reached a record high of $4.02 trillion on Friday, according to data from Coingecko. Major cryptocurrencies such as Bitcoin hit a new all-time high of $123,218 on Monday, while Ethereum (ETH) rallied above $3,600, and Ripple (XRP) reached a record high of $3.66 on Friday.

This broad price rise in the main cryptocurrencies has triggered a wave of liquidations in the crypto markets. According to the CoinGlass Liquidation Map chart, a total of 176,880 traders were liquidated in the last 24 hours, resulting in a total liquidation value of over $800 million, of which 63% were short positions.

Why is the market rallying?

Several factors, including rising institutional and corporate demand, regulatory clarity, and broader adoption, drive the recent surge in the cryptocurrency market.

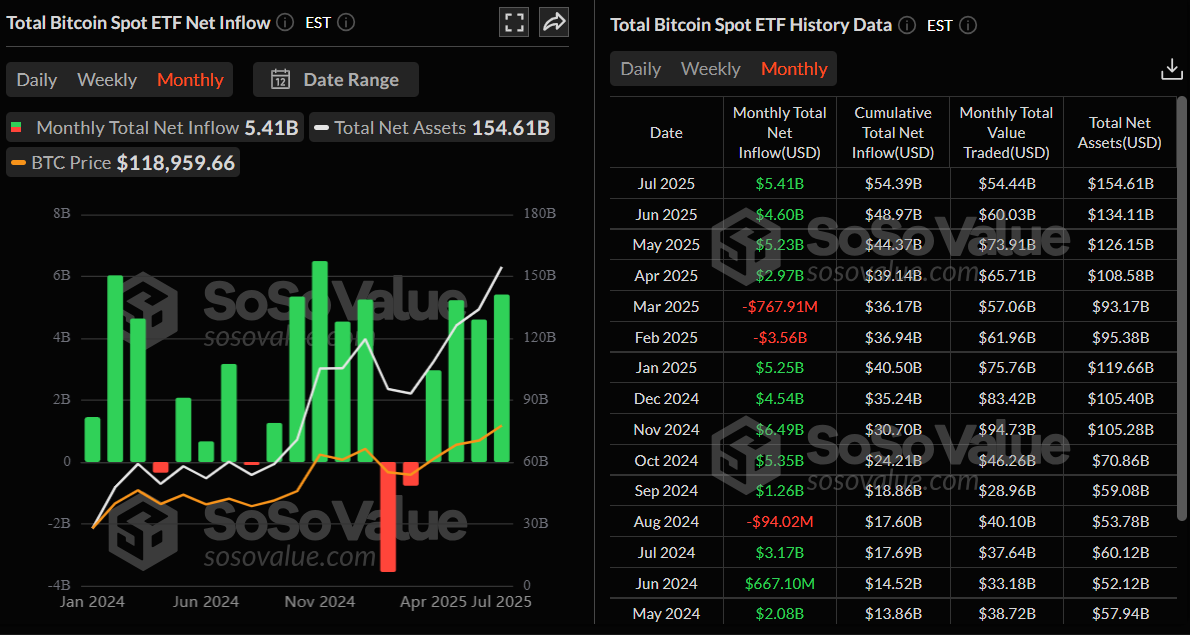

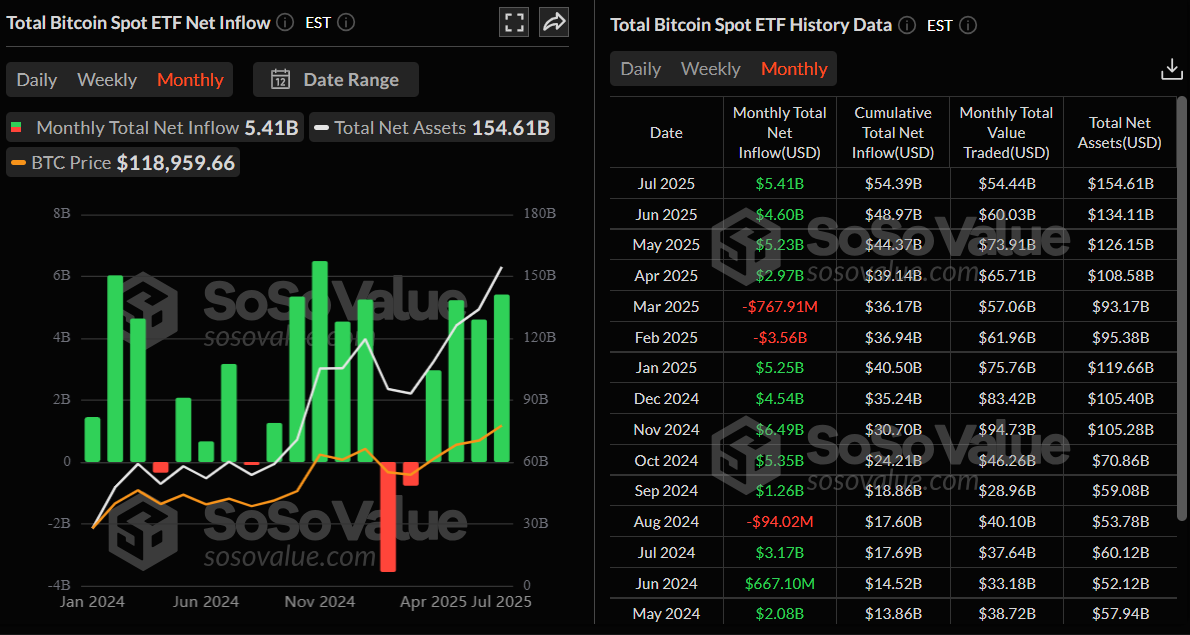

According to SoSoValue data, as of Thursday, Bitcoin Spot Exchange Traded Funds (ETFs) have recorded an inflow of $2.02 billion so far this week. The July total inflow is $5.41 billion, marking four straight months of inflows since April. Ethereum also saw a spike in inflows, recording $1.78 billion this week, its highest since the spot ETFs launch.

Total Bitcoin Spot ETF monthly net flow chart. Source: SoSoValue

Total Ethereum Spot ETF weekly net flow chart. Source: SoSoValue

The approval on Thursday of several crypto-related bills in the US further supported the rally. The US House of Representatives passed three pieces of crypto legislation, including the Guidance and Establishing Innovation for US Stablecoins (GENIUS) bill, the Digital Asset Market Clarity (CLARITY) bill, and the Anti-CBDC bill. All three crypto bills now move to President Trump's desk for final signing.

The three bills aim to establish a clear US federal regulatory framework for digital assets, with the aim of boosting investor confidence, increasing regulatory clarity, and promoting wider adoption.

Additionally, on Thursday, the Financial Times reported that Donald Trump is preparing to sign an executive order that would pave the way for 401(k) accounts to invest in cryptocurrencies.

If passed, the order would allow for the provision of digital assets, precious metals such as Gold, and private loans in retirement plans to serve as alternatives to the traditional portfolio of stocks and bonds.