Tron Price Forecast: TRX handles over $21 billion in weekly USDT transfers, surpassing Ethereum

- Tron price hovers around $0.287 on Tuesday after gaining nearly 4% the previous week.

- TRX network surpasses 13 billion transactions and handles over $21 billion in USDT transfers weekly, outpacing Ethereum.

- Integrations of projects like TRUMP and Plume’s Skylink reflect rising adoption and innovation on the TRON blockchain.

Tron (TRX) is hovering around $0.287 at the time of writing on Tuesday after rising nearly 4% the previous week. The TRX network has processed over 13 billion transactions and handles more than $21 billion in USDT transfers each week, surpassing Ethereum (ETH). The surge in activity is fueled by the integration of projects like Official Trump (TRUMP) and Plume’s Skylink, signaling increasing utility and momentum for the TRX ecosystem.

Tron's network activity surpasses ETH

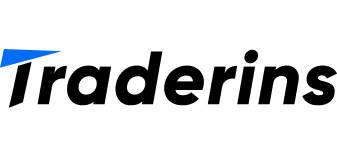

CryptoQuant data shows that Tron has surpassed 13 billion in total transactions, and the trend is not slowing down. Examining the USDT transfer volume on a weekly basis, TRX handles over $21 billion, while Ethereum processes around $8 billion.

This rise in network activity indicates TRX’s network growth, increased user activity, and its growing relevance in the global cryptocurrency economy as a viable alternative.

Tron to launch SkyLink and Official Trump across its network

Tron announced a collaboration with Plume to launch SkyLink across its network on Monday. This strategic integration of an omnichain RWA (Real World Asset) yield distribution protocol across the TRON network will allow users to access yields from tokenized US Treasuries, private credit, and other institutional-grade financial products directly through Plume.

On the same day, Tron also announced the launch of the Official Trump, a US President Donald Trump-backed meme coin, which is powered by LayerZero.

These collaborations and developments reflect rising adoption and innovation on the TRON blockchain.

Tron Price Forecast: TRX bulls aim for the $0.296 mark

Tron price rebounded after retesting its daily support level around $0.259 on June 22 and rallied by nearly 9% in the next 13 days. At the time of writing on Tuesday, it hovers at around $0.287.

If TRX continues its upward trend, it could extend the rally toward the next daily resistance at $0.296.

The Relative Strength Index (RSI) reads 61, above its neutral level of 50, indicating bullish momentum. The Moving Average Convergence Divergence (MACD) on the daily chart also displayed a bullish crossover last week, providing a buy signal and indicating an upward trend.

TRX/USDT daily chart

However, if TRX faces a pullback, it could extend the decline to find support around its 50-day Exponential Moving Average (EMA) at $0.274.