Moo Deng price rallies over 130% in 24 hours as Solana memecoin sector hits $12B valuation

- Moo Deng price surged over 130% in the last 24 hours, becoming the most-searched Solana memecoin on Coingecko.

- With trading volume reaching $890 million, significantly exceeding its $124 million market cap, Moo Deng's price action signals overbought conditions.

- The RSI indicator nears 90.0, highlighting overbought conditions.

Solana-hosted memecoin Moo Deng price rallied 153% in the last 24 hours, driven institutional demand for SOL and increased retail interest following Bitcoin’s rally above $103,000 on Friday.

Moo Deng leads Solana memecoin rally as Bitcoin tops $103K

Moo Deng (MOODENG), a meme token built on Solana, surged over 153% in the past 24 hours, fueled by a spike in trading volume and social interest.

The token emerged as the most-searched Solana-based coin on CoinGecko as risk appetite returned to the crypto markets following Bitcoin’s breakout above $103,000 on Friday.

Moo Deng Price Action, May 9 2025 | Coingecko

Moo Deng’s 24-hour trading volume hit $890 million, significantly outpacing its market capitalization of $127 million, a technical red flag suggesting high speculative activity.

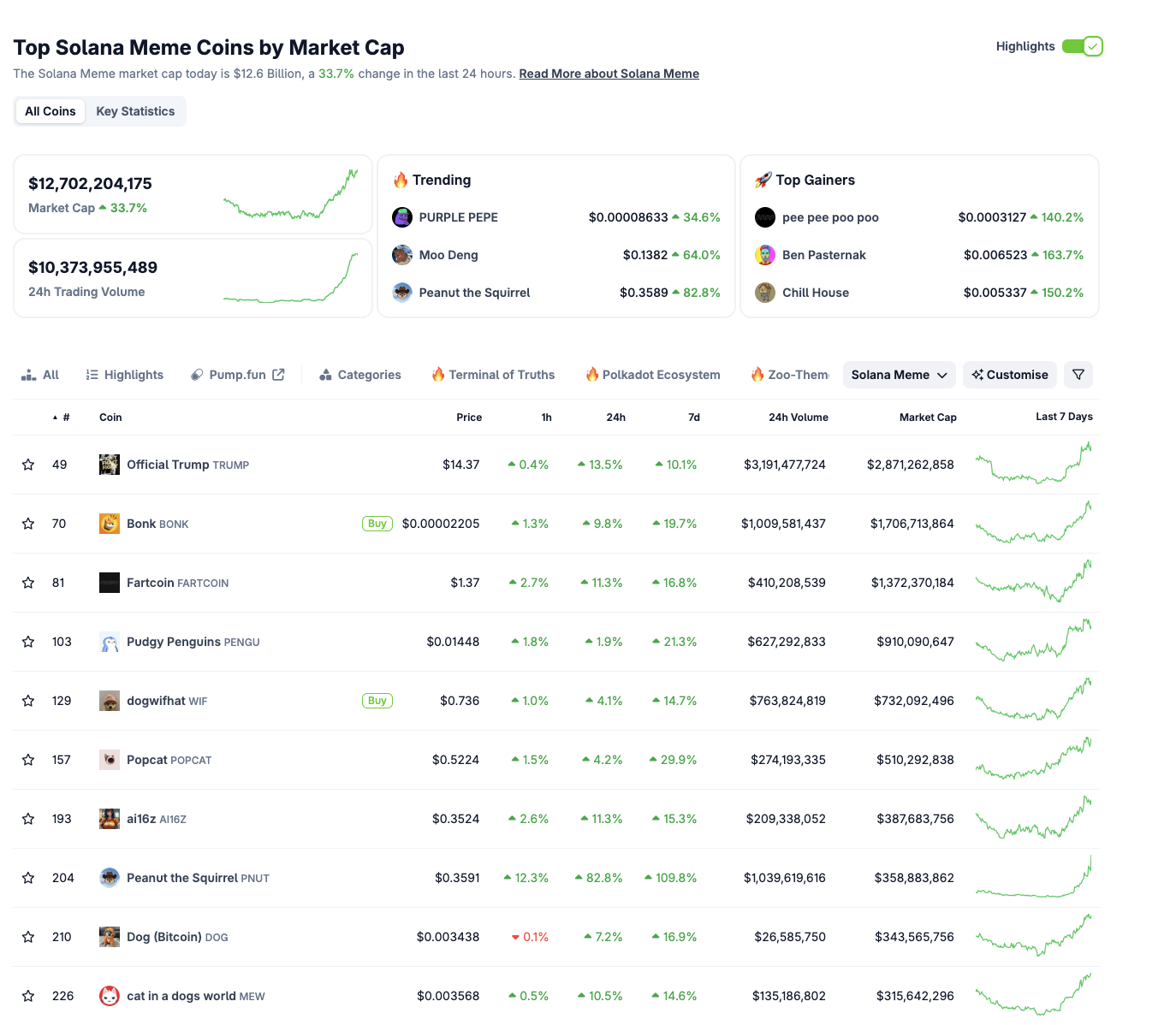

Top 10 Solana memecoins in profit as traders eyes short-term bets

All top 10 Solana-based memecoins recorded gains over the last 24 hours, underlining a decisive risk-on rotation among crypto traders.

With global financial markets buoyed by improving sentiment, driven by Trump-era trade optimism and rising Fed rate-cut expectations, investors appear to be reallocating capital toward low-liquidity, high-volatility assets.

Solana memecoin sector performance | Source: Coingecko

The total market cap of Solana-based memecoins rose 33.7% in the last 24 hours, reaching $12.6 billion on Friday. Trading volumes also ballooned to $10.37 billion, underlining the speculative momentum powering the rally.

Moo Deng was among the top gainers, joined by new entrants like “pee pee poo poo” +140.2% and Chill House 162.6%. Popular legacy tokens such as BONK (12.6%), Fartcoin (11.5%), and WIF with a 7.2% uptick also logged strong performances on Friday, benefiting from improved investor risk appetite.

Historically, when a crypto rally is driven by strong macro sentiment as seen this week with hope for Trump trade deals, investors often place large bets on high-risk memecoins to earn outsized short-term profit by capitalizing on market sentiment.

Moo Deng price forecast: Breakout eyes $0.20 as RSI flashes overheated signal

Moo Deng (MOODENG) price entered a vertical rally early Friday, posting intra-day gains of up to 150% when it rallied to a four-month peak of $0.15.

Trading at $0.14081, at press time, technical indicators, Moo Deng still maitains a clear distance above both the 50-day and 100-day Simple Moving Averages (SMAs) at $0.03684 and $0.04708, respectively. Bulls could cluster major support around these key levels if markets enter a consolidation phase.

The 150-day SMA at $0.11102 has also been decisively cleared, eliminating the last major dynamic resistance and opening the path to test the psychological $0.2 mark.

Moo Deng Price Forecast Today

However, on the downside, the RSI at 89 is deep in overbought territory, typically signaling an overheated rally and potential for short-term pullback.

However, overbought readings alone rarely trigger reversals in euphoric meme cycles, particularly when breakout structure and momentum align.

A minor retracement toward $0.11100 could serve as a healthy retest of support before continuation.

Only a break below the 100-day SMA would invalidate the bullish setup, exposing $0.04700 to the downside. For now, however, price action remains in favor of bulls as $0.20000 comes into view.