Bitcoin price blitz $730M sell-wall amid India’s missile attack on Pakistan

- Bitcoin price rebounded as high as $97,260 on Wednesday after initially retracing towards $94,000.

- Bitcoin’s latest volatile swings coincides with Asian geo-political tensions as the Indian military launches a missile attack on Pakistan.

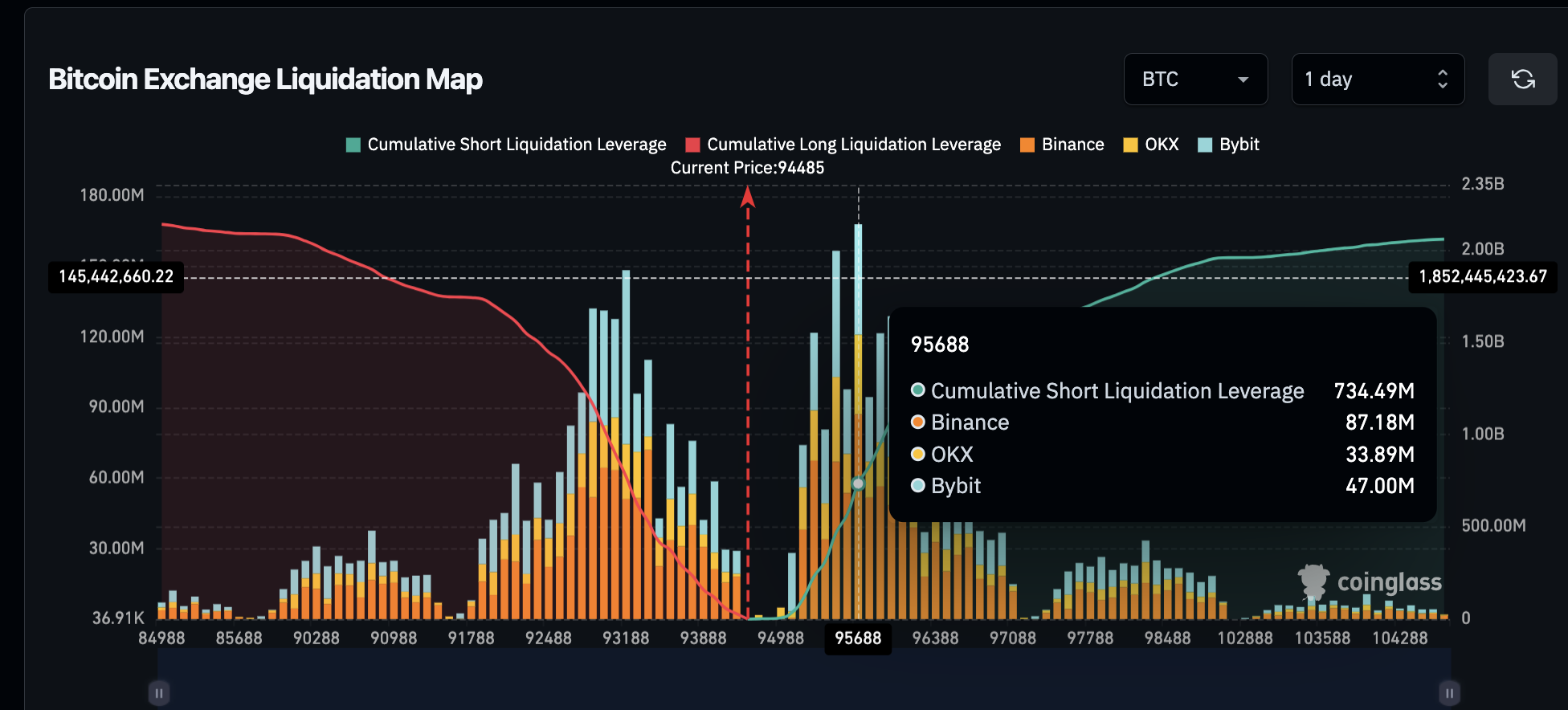

- Coinglass data shows BTC breached a cluster of $734 million BTC short positions around the $95,600 level.

Bitcoin price surged to $97,260 after initially retracing below $94,000 on Wednesday amid India’s missile attack on Pakistan, triggering market-wide volatility.

Bitcoin wobbles under pressure for India's military attack on Pakistan

Bitcoin price climbed to $97,260 on Tuesday before swiftly retracing below $94,000 as geopolitical tensions exploded in South Asia.

The initial BTC price dip had conceded India’s military assault on nine targets across Pakistan and the disputed Kashmir region.

Bitcoin price action after India’s attack on Pakistan, May 6, 2025 | BTCUSD | Coingecko

As the news spread across Asian markets, Bitcoin’s price reacted with immediate volatility. According to Coingecko data, BTC plunged toward $93,500, marking a sharp rejection from intraday highs. The move disrupted bullish momentum and triggered short-term selloffs during early trading hours in Asia.

Pakistan responded by announcing countermeasures, escalating fears of prolonged conflict. The sudden nature of India’s strike added weight to market uncertainty. Bitcoin's sharp dip coincided with regional instability, reinforcing its sensitivity to geopolitical flashpoints.

Traders reacted promptly, leading to sharp liquidations and exit from leveraged positions. Despite the drop, Bitcoin managed to hold above $93,500, signaling support near last week’s local lows.

BTC retests $97,100 as Trump moves to de-escalate India-Pakistan tensions

Bitcoin regained footing later Tuesday, retesting $97,100, as the White House confirmed recent talks with both India and Pakistan. The news had triggered major market impact due to India’s status as one of America’s largest trade partners, with official data showing $129 billion worth of goods traded between both countries in 2024. For context this figure exceeds the entire GDP of countries like Georgia and El-Salvador.

As tensions spiked, diplomatic efforts began forming behind the scenes.

"It's a shame, we just heard about it. I guess people knew something was going to happen based on a little bit of the past. They've been fighting for a long time. I just hope it ends very quickly." Trump said.

Trump’s public call for calm coincided with Pakistan’s announcement of a response to India’s attack. The market responded positively to Washington’s instant intervention.

The Indian Embassy also confirmed that National Security Adviser Ajit Doval had briefed Rubio on India’s actions per Reuter’s report.

At press time Bitcoin price reclaimed $97,100 as traders viewed Trump’s comments as de-escalatory, giving BTC bulls renewed confidence to reclaim higher levels.

$734M in BTC shorts liquidated as bulls reclaim $95,600

Amid the market volatility induced by the geo-political unrest between India and Pakistan, Coinglass data shows Bitcoin broke through $734 million in short positions clustered around the $95,600 level.

That key resistance level aligned with several recent pullbacks in the past week, marking a crucial psychological boost.

As BTC reclaimed that zone, bears were forced to exit positions. The resulting short liquidations pushed the price upward, creating a cascade that brought Bitcoin near its earlier peak of $97,260.

Bitcoin Liquidation Data, May 6 2025 | Source: Coinglass

Coinglass data also confirms that bullish leveraged positions now total $2.14 billion, higher than short-side leverage at $2.06 billion. This confirms bulls have regained dominance in the derivatives market.

With the $95,600 resistance cluster now broke, bulls could potentially push for another leg-up towards last week’s peak above $98,200

If Trump’s de-escalation efforts continue and global supply chains remain undisrupted by the India-Pakistan crisis, rising institutional demand could propel Bitcoin price towards the next major milestone target at $100,000.