Hyperliquid Price Forecast: HYPE bulls aim for the $25 mark as open interest reaches a new all-time high

- Hyperliquid price trades around $21.20 on Wednesday after rebounding nearly 6% so far this week.

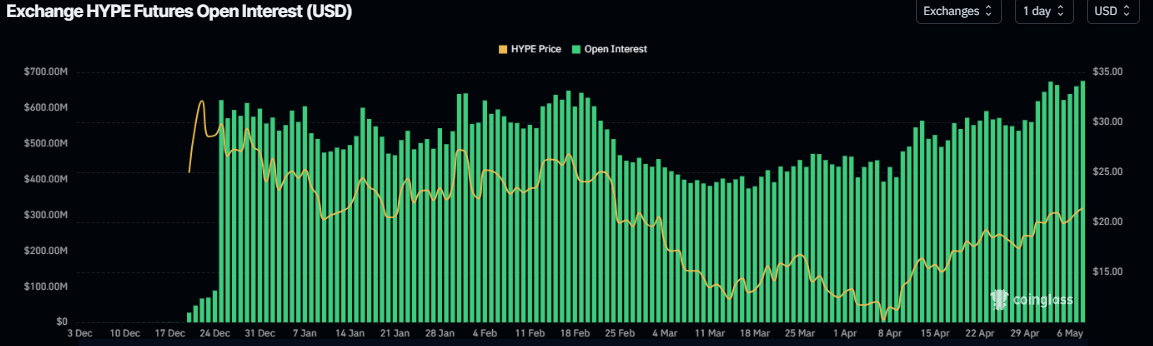

- CoinGlass data shows HYPE open interest reaches a new all-time high of $697 million, suggesting a bullish outlook.

- Ethena launches USDe stablecoin on Hyperliquid, bringing the Dollar-pegged asset to a fast DeFi and derivatives hub.

Hyperliquid (HYPE), the decentralized perpetual trading platform and Layer 1 blockchain, edges higher and trades around $21.20 at the time of writing on Wednesday after rebounding nearly 6% so far this week. CoinGlass data shows HYPE Open Interest (OI) reaches a new all-time high of $697 million, suggesting a bullish outlook. Moreover, Ethena Labs launched USDe stablecoin on Hyperliquid on Monday, bringing the Dollar-pegged asset to a fast Decentralized Finance (DeFi) and derivatives hub.

Hyperliquid Open Interest reaches new all-time high

Coinglass’ data shows that the futures’ OI in HYPE at exchanges rose from $622 million on Monday to $676.03 million on Wednesday, a new all-time high. An increasing OI represents new or additional money entering the market and new buying, which could fuel the current rally in the Hyperliquid’s price.

HYPE Open Interest chart. Source: Coinglass

Ethena Labs announced on Monday that it has launched USDe stablecoin on Hyperliquid’s exchange and HyperEVM blockchain. This will enable users to hold a Dollar-pegged asset in a high-speed DeFi ecosystem known for derivatives trading.

The integration of USDe into Hyperliquid’s ecosystem will benefit its native token HYPE as it increases ecosystem utility and adoption, boosts trading volume, attracts stablecoin liquidity, and signals growth through DeFi integrations and partnerships.

Hyperliquid’s technical outlook suggests 17% gains ahead

Hyperliquid’s price found a cushion around its daily support level at $19.24 on Tuesday and recovered slightly. This level roughly coincides with the 50% Fibonacci retracement (drawn from the February 14 high of $28.53 to the April 7 low of $9.28) at $18.90. At the time of writing on Wednesday, HYPE trades slightly above at around $21.23.

If HYPE continues its upward momentum, it could extend the rally by 17% from its current level to its psychological importance level of $25.

The Relative Strength Index (RSI) on the daily chart reads 66, above its neutral level of 50, indicating strong bullish momentum. The Moving Average Convergence Divergence (MACD) indicator also showed a bullish crossover, indicating a continuation of the upward trend.

HYPE/USDT daily chart

However, if HYPE fails to find support around the daily level of $19.24 and closes below it, it could extend the decline to retest its April 28 low of $16.90