Crypto Today: BTC price stumbles below $94K, SUI surges as Trump hints at Hollywood tariffs

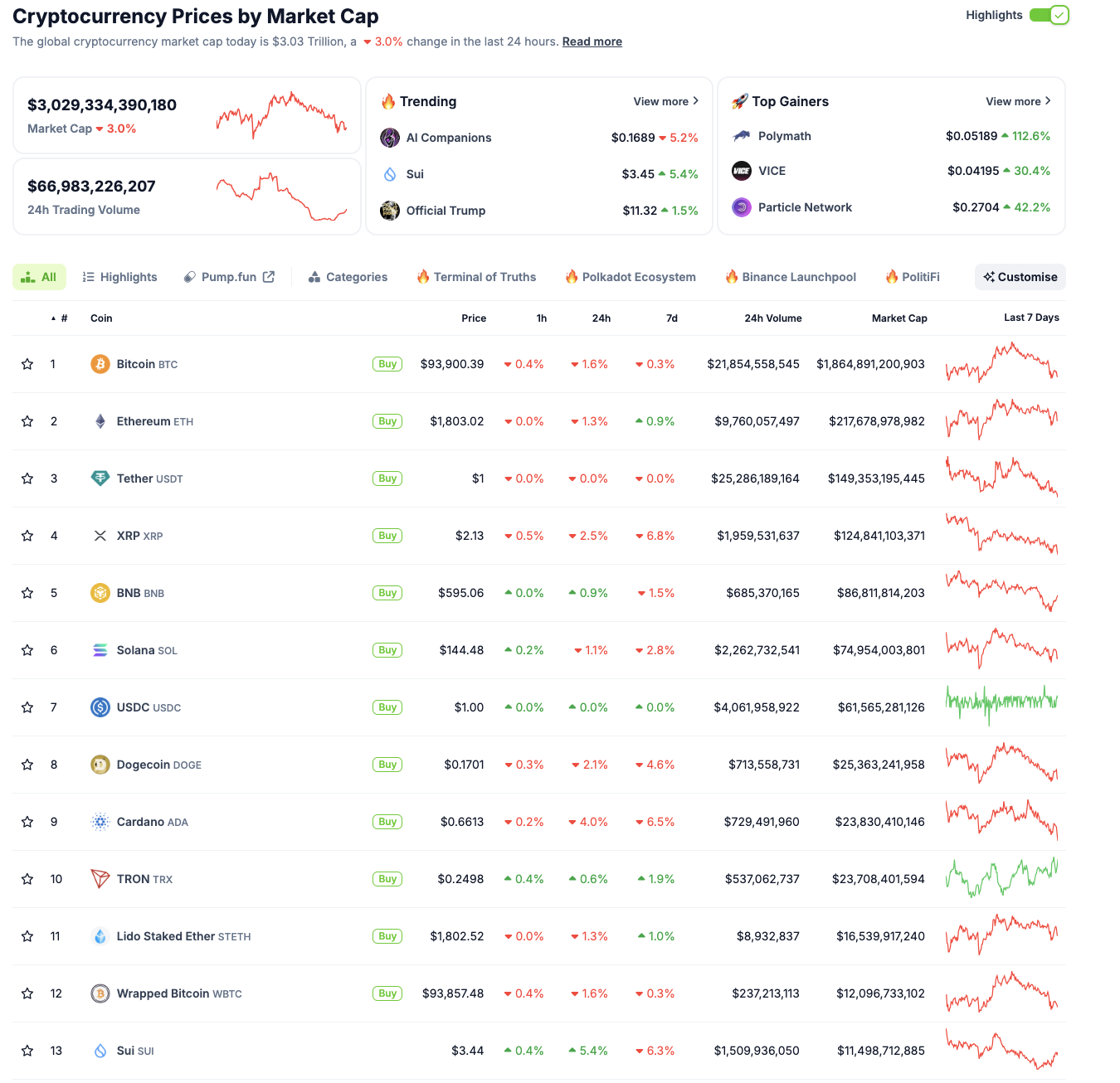

- Cryptocurrency market capitalization settles at $3.06 trillion, down 3% with over $100 billion in outflows in the last 24 hours.

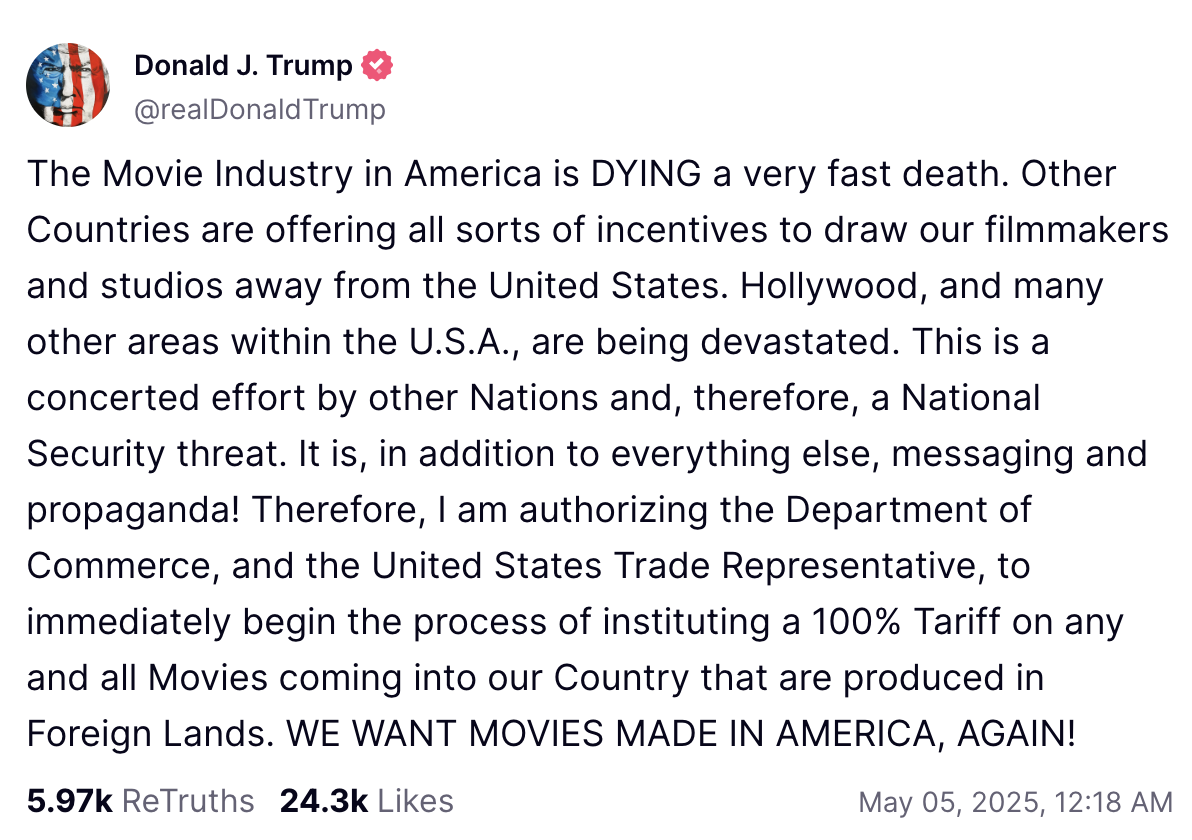

- On Monday, US President Donald Trump announced 100% tariffs on foreign-made movies.

- Bitcoin and top altcoins like XRP, ETH and SOL fall to weekly lows on Monday, as investors react to Trump’s latest protectionist rhetoric.

Cryptocurrency market capitalization settled at $3.1 trillion on Monday, dipping 3% with outflows exceeding $100 billion in the last 24 hours. The market dip coincides with US President Donald Trump's latest calls for 100% tariffs on foreign-made movies, which sparked investors' skepticism across global markets.

Bitcoin market updates:

Bitcoin price plunged as low as $93,400 on Monday, down 5% from last week’s local top of $98,200, recorded on Friday.

Strategy purchased 1,895 BTC between April 28 and May 4, the company disclosed in a regulatory filing on Monday.

The acquisition increases Strategy’s total Bitcoin holdings to 555,450 BTC, representing 2.6% of the current total supply.

The $180 million purchase was financed through recent stock sales, with Strategy selling 353,825 shares of its Class A common stock (MSTR) and 575,392 shares of its Series A preferred stock (STRK), according to the Securities and Exchange Commission (SEC) filing.

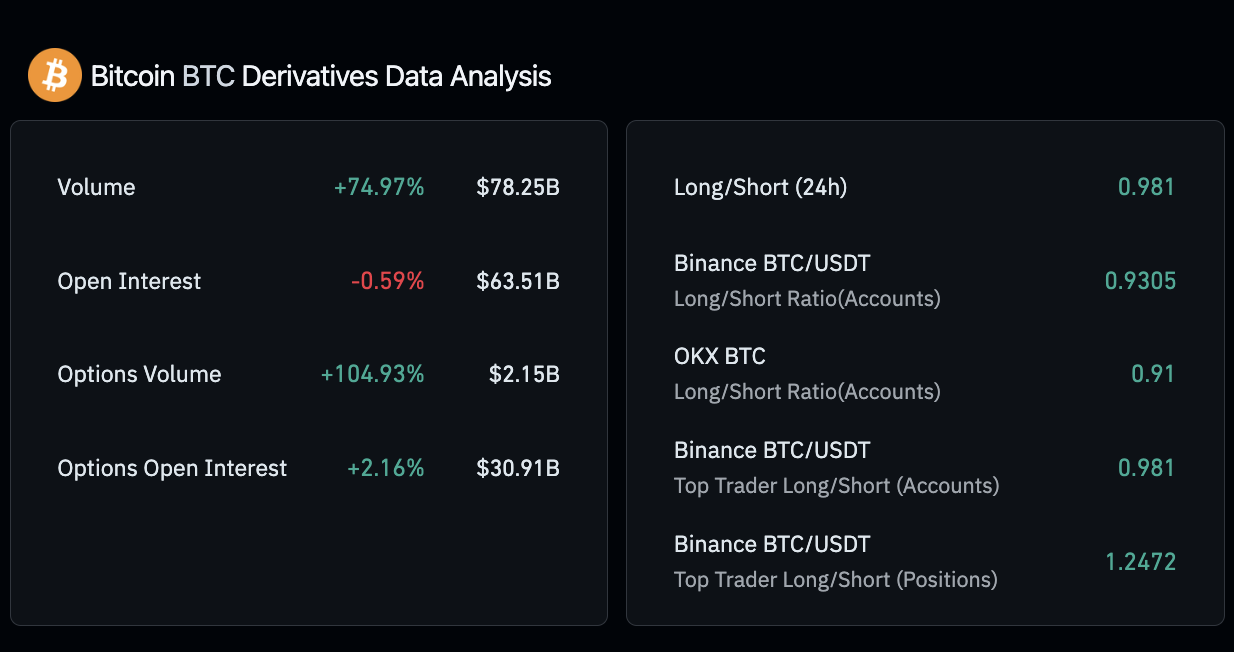

Chart of the Day: BTC derivatives volumes surge 74% as traders brace for volatile week ahead

After a subdued weekend trading, Bitcoin traders now appear to be gearing up for short-term activity on Monday.

According to Coinglass data, Bitcoin derivatives volume soared 74.97% to $78.25 billion in 24 hours amid the 3% price dip.

This signals rising speculative activity as traders position for heightened volatility.

Bitcoin derivative market analysis

Despite the surge in trade volume, total open interest dipped 0.59% to $63.51 billion, suggesting that traders are actively covering their short positions rather than closing them out.

Options markets saw even stronger activity, with volumes up 104.93% to $2.15 billion.

However, the Long/Short account ratios across Binance and OKX remain below 1.0, hinting at cautious sentiment.

Top trader positions lean bullish (1.24), pointing to increased institutional activity amid growing macro and regulatory uncertainty.

Altcoin market updates: SUI emerges lone gainer as Trump Hollywood tariffs spark short-term panic

The global cryptocurrency market cap slipped 3% to $3.03 trillion as risk appetite weakened following a fresh statement from Donald Trump imposing 100% tariffs on movies made outside America.

Top-ranked altcoins, including Ethereum (ETH), Solana (SOL) and Ripple (XRP), saw moderate pullbacks around 1%, and low-cap assets reflected sharper losses as traders rotated capital into more liquid pairs amid weak market volumes.

In contrast, SUI defied the market dip, rising 5.1% to $3.44 on strong network activity and investor accumulation. With $1.5 billion in trading volume, SUI outperformed, becoming the day’s top gainer among the top 10 ranked cryptocurrencies.

Cryptocurrency market performance | Source: Coingecko

Meanwhile, AI-themed tokens like AI Companions and PolitiFi tokens, including the Official Trump coin, also saw increased activity, albeit with mixed performance, as traders speculated on politically driven narratives.

The surge in meme-adjacent sectors like Pump.fun and VICE further reflects short-term sentiment-driven plays.

With Bitcoin derivatives volumes rising 74% and bearish sentiment re-emerging after Trump’s latest tariff comments, crypto market participants are bracing for a turbulent week ahead.

Crypto news updates:

OKX relaunches Web3 DEX aggregator with new security upgrades after Lazarus-linked shutdown

OKX has relaunched its decentralized exchange aggregator, OKX Web3, following a security pause caused by misuse linked to the North Korean hacking group Lazarus.

The platform had been temporarily taken offline after identifying suspicious activity tied to the group’s known wallet addresses.

The updated version includes a real-time abuse detection and blocking system, enhanced on-chain analysis features, and a live database for tracking suspicious wallets.

Security audits for the upgrade were conducted by CertiK, Hacken, and SlowMist, reinforcing OKX’s compliance and counter-fraud infrastructure.

Michael Saylor pays tribute to Warren Buffett amid retirement announcement

MicroStrategy Executive Chairman Michael Saylor described Berkshire Hathaway as the "Bitcoin of the 20th century" during the firm’s annual shareholder meeting on Saturday.

The remark coincided with Warren Buffett’s announcement that he would step down as CEO of Berkshire by the end of the year, ending a 60-year tenure.

Buffett confirmed that Vice Chairman Greg Abel will take over as CEO starting in 2026.

Despite retiring from the role, the 94-year-old billionaire stated he will retain his shares and remain involved in some company affairs, according to CNBC.

Under Buffett’s leadership, Berkshire Hathaway achieved a 20% compounded annual return from 1965 through 2024.