Midnight Price Forecast: NIGHT warms up as Hoskinson reveals March mainnet release

- Midnight is up 2% on Thursday, surging above $0.0500, but the 50-period EMA on the 4-hour chart risks capping the gains.

- Charles Hoskinson announced the mainnet release of Midnight in late March as a partner chain to Cardano.

- The technical outlook indicates a gradual bullish shift in trend, with a higher low formation hinting at a bottom.

Midnight (NIGHT) edges higher by 2% at press time on Thursday, driven by its founder, Charles Hoskinson, announcing the mainnet release by late March at the Consensus 2026 event. The technical outlook for Midnight highlights a potential bottom formation that could ignite the next bullish trend.

Midnight mainnet release announcement boosts demand

Charles Hoskinson, founder of Cardano, announced the mainnet launch of Midnight, a privacy-focused chain that uses zero-knowledge proofs, by the last week of March. Midnight will serve as a partner chain to Cardano, aiming to provide privacy and regulatory support for decentralized applications.

According to Hoskinson, he has partnered with leading companies, “Google is one of them. Telegram is another,” he said.

During his keynote speech, Hoskinson also announced plans to onboard the institutional-focused LayerZero on the Cardano blockchain to meet rising demand to shift traditional demand on-chain.

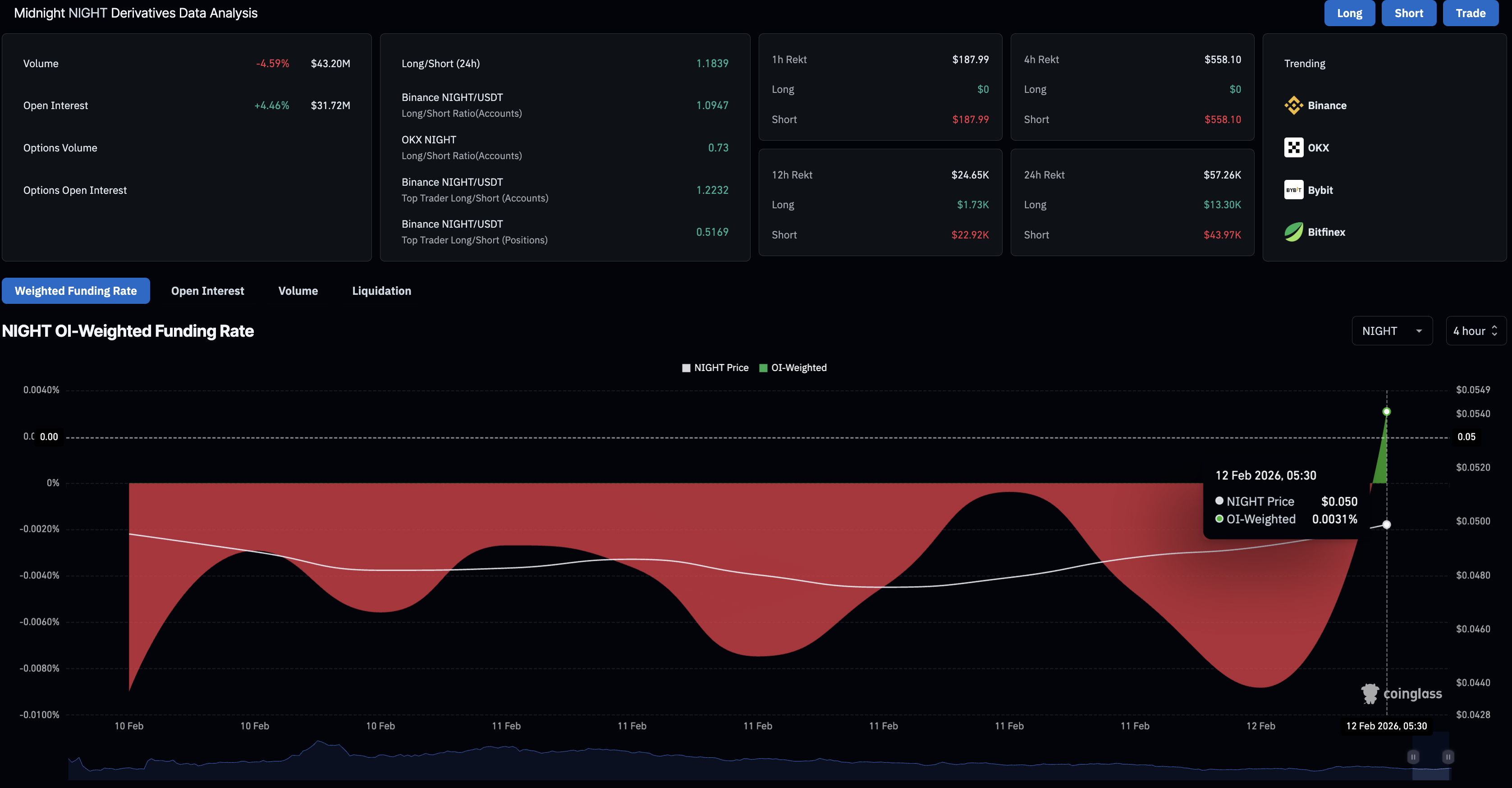

CoinGlass data shows that the NIGHT futures Open Interest (OI) increased by over 4% in the last 24 hours, reaching $31.72 million, indicating increased investor demand following the mainnet release date.

Midnight to face multiple resistances

Midnight trades above the $0.0500 psychological level at the time of writing on Thursday, reflecting a minor recovery on the 4-hour chart. The NIGHT token's price action shows a higher low on the same chart after a series of lower lows, suggesting a potential trend reversal.

However, short-term resistance remains at the 50-period Exponential Moving Average (EMA) at $0.0502, which could cap the gains. If Midnight clears this moving average, it could target the overhead supply zone between $0.0551 and $0.0558, near the 200-period EMA at $0.0568.

The technical indicators on the 4-hour chart suggest renewed buying pressure, backing the possibility of a trend reversal. The Relative Strength Index (RSI) at 51 crosses above the midline following a short consolidation, suggesting increased buying pressure. Additionally, the Moving Average Convergence Divergence (MACD) crosses above its signal line while both remain below the zero line, suggesting renewed bullish momentum.

On the downside, a potential pullback below Wednesday’s low at $0.0472 would nullify the chances of a sustained recovery. In such an instance, deeper support zones are present at the January 31 and February 5 lows, at $0.0446 and $0.0413, respectively.