Axie Infinity Price Forecast: AXS rally meets high futures interest, heavy trading volume

- Axie Infinity is up roughly 25% so far on Monday, hitting the 50-day EMA above $1.50.

- The first-ever bAXS airdrop was completed on Thursday, marking a shift in the game’s tokenomics.

- Retail demand strengthens for AXS as its futures Open Interest and trading volume surge.

Axie Infinity (AXS) starts the week on a bullish note with nearly 25% gains at press time on Monday, signaling renewed demand for the gaming token. The recovery follows the completion of the bonded AXS b(AXS) token airdrop completed on Thursday, which was likely overshadowed by the broader market correction. A surge in trading volume and AXS futures Open Interest on Monday indicates heightened retail demand, which could skew the short-term outlook to the bullish side.

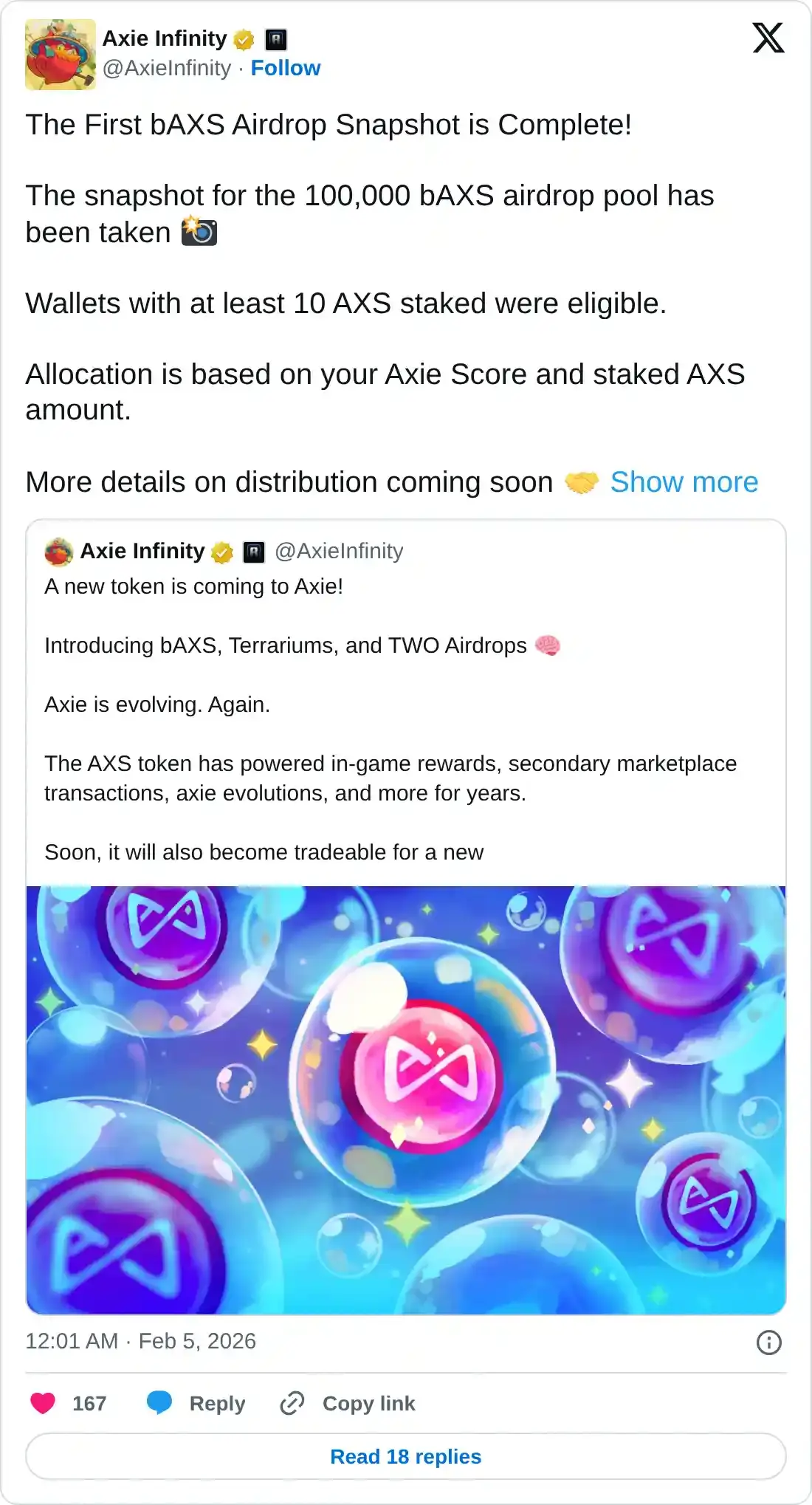

Axie Infinity’s bAXS plans to reduce sales of rewarded supply

The first-ever airdrop of the 100,000 bAXS tokens was completed on Thursday, based on the Axie score and more than 10 staked AXS tokens. Rationale for bAXS is to limit the immediate sale of ecosystem or gameplay rewards. The bonded version remains non-transferable among players and incurs a variable fee, paid by sellers to the treasury, which helps keep value circulating within the ecosystem. Moving forward, the ecosystem and gameplay rewards will be distributed in bAXS tokens to address these in-game economic issues.

Retail demand is back

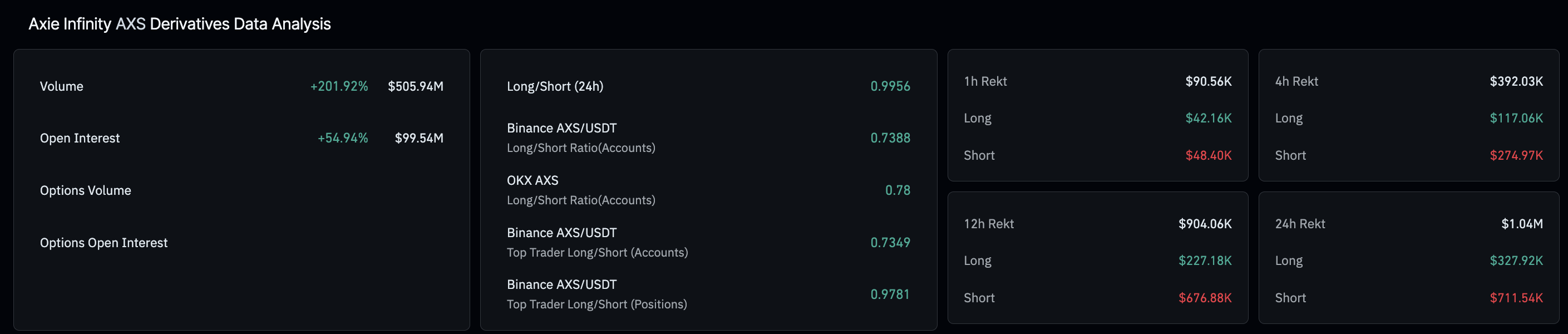

CoinGlass data show that AXS futures Open Interest (OI) has increased by roughly 55% over the last 24 hours, reaching $99.54 million, signaling increased capital inflows as traders anticipate further gains.

Amid inflows, short liquidations of $711,540 outpace long liquidations of $327,920, suggesting that more than double bearish positions were wiped out compared to bullish positions.

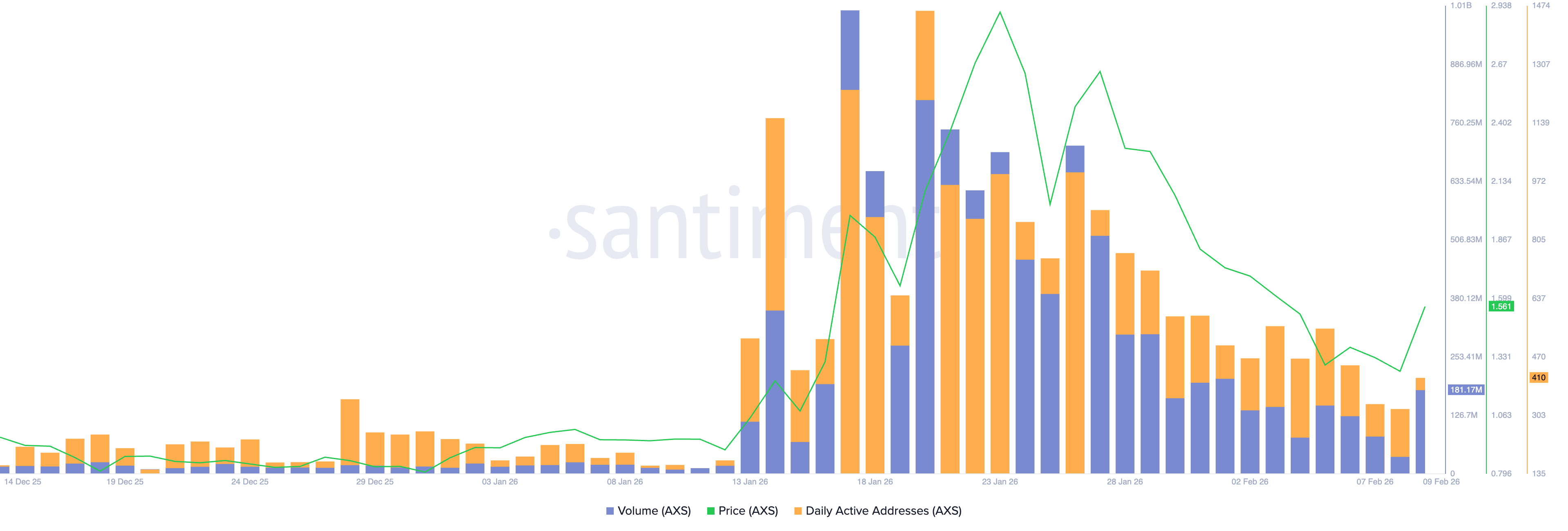

On-chain data indicate that a surge in user demand aligns with the rising retail interest. Santiment data show daily active addresses stood at 410 as of Monday midday in Asian trading hours, up from 321 on Sunday.

Additionally, trading volume reached over 181 million AXS on Monday, up from 36.67 million the previous day. Typically, a surge in trading volume that supports a recovery increases the likelihood of extended gains.

Technical outlook: Will AXS rally extend gains?

Axie Infinity holds above $1.50 at the time of writing on Monday, securing nearly 25% gains after a steady decline of over 50% since January 28. Still, the AXS token price remains beneath the 50-day and 200-day Exponential Moving Averages (EMAs), suggesting a prevailing bearish pressure.

If AXS clears the 50-day EMA at $1.55, it could extend the gains toward the 200-day EMA at $1.79.

The Moving Average Convergence Divergence (MACD) on the daily chart stalls after crossing below the zero line on Friday, while the negative histogram bars are contracting, which suggests a reduced bearish momentum. The Relative Strength Index (RSI) on the same timeframe stands at 47, edging higher toward the neutral zone as selling pressure wanes.

However, if the 50-day EMA keeps the rebound capped, AXS risks losing the 50% Fibonacci retracement at $1.42, measured from the May 14 high at $3.70 to the October 10 low at $0.550.