Top Crypto Gainers: Canton, MYX Finance, and Chiliz lead the New Year rally

- Canton is up almost 8% on the New Year, extending the 3% gains from Wednesday.

- MYX Finance approaches $4 following a 6.56% rise on the previous day.

- Chiliz trades in the green for the fourth straight day after a 6.50% rise on Wednesday.

Canton (CC), MYX Finance (MYX), and Chiliz (CHZ) are the top performers over the last 24 hours, marking a bullish start to the New Year. The recovery in CC, MYX, and CHZ is gaining momentum, increasing the possibility of further gains.

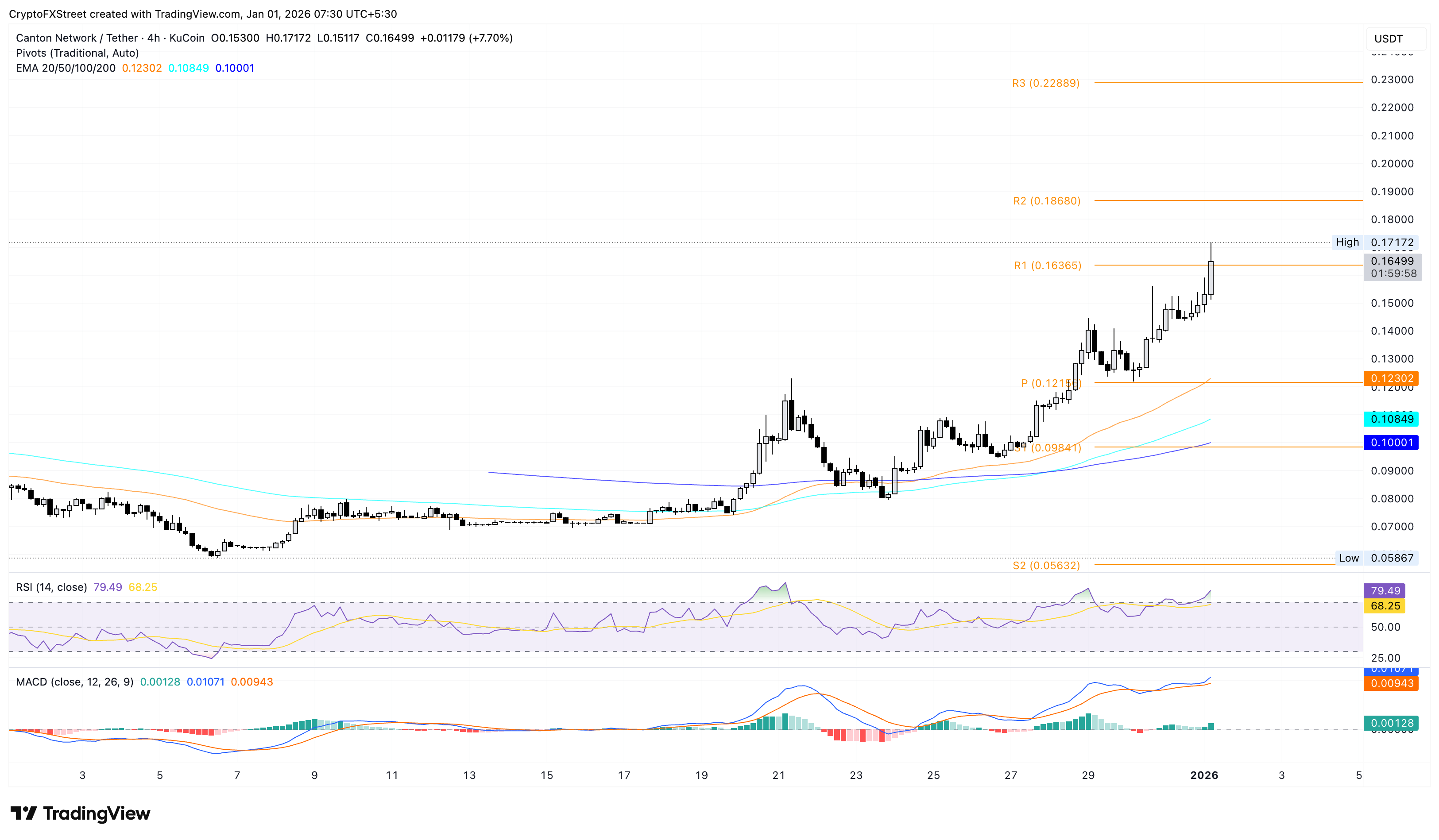

Canton extends the rally above $0.16

Canton is up nearly 8% at press time on Thursday, adding gains to the 3% rise from the previous day. The intraday recovery holds above the R1 Pivot Point at $0.1636 on the 4-hour chart, with bulls waiting for a decisive close.

If CC clears this level, the rally could extend to the R2 Pivot Point at $0.1868.

The technical indicators on the 4-hour chart corroborate the bullish thesis. The Relative Strength Index (RSI) is at 79, rising into the overbought zone as buying pressure strengthens. Additionally, the Moving Average Convergence Divergence (MACD) moves upward from the signal line, indicating a surge in bullish momentum.

On the flip side, a potential reversal below $0.1636 could test the $0.1500 psychological level, followed by the center Pivot Point at $0.1215.

MYX Finance gains traction, with bulls aiming for $4 breakout

MYX Finance hovers around $3.90 with bulls aiming for the $4 mark after the 6.56% rise on Wednesday. At the time of writing, MYX is up nearly 2% on Thursday, extending a steady upward trend for the ninth day.

If the MYX token secures a daily close above the R2 Pivot Point at $4.01 on the 4-hour chart, the uptrend could target the R3 Pivot Point at $4.37.

The RSI is at 67 on the 4-hour chart, fluctuating below the overbought zone, indicating a persistent buying pressure. At the same time, the MACD and signal line rise upward following a crossover on Wednesday, upholding the buy signal.

Looking down, the MYX token could find support at the R1 Pivot Point at $3.75 in case of a reversal.

Chiliz’s high-speed recovery aims to surpass $0.050

Chiliz trades above $0.04000 at press time on Thursday, extending the 6.50% rise from the previous day. The intraday recovery marks the fourth day of the uptrend, accounting for over 17% weekly gains so far.

If CHZ clears the previous swing high of July 21 at $0.04630, it could confirm a trend reversal to the upside. However, to reinstate a bullish trend, Chiliz should clear the $0.05000 psychological level, which is slightly above the R1 Pivot Point at $0.04948.

The RSI is at 73 on the daily chart, indicating an overbought condition and suggesting a rise in buying pressure. Additionally, the MACD and signal line continue to trend upward, while the successively rising green histogram bars indicate a surge in bullish momentum.

If Chiliz fails to hold above $0.04000, it could retest the centre Pivot Point at $0.03872.