Hyperliquid Price Forecast: HYPE shows strength despite broad market sell-off

- Hyperliquid price extends gains on Tuesday, continuing its rebound after defending a key support level last week.

- Whale accumulation, rising open interest, and positive funding rates collectively reinforce bullish sentiment.

- The technical indicators point to further upside, with momentum metrics signaling that bearish pressure is fading.

Hyperliquid (HYPE) price extends its gains, trading above $40 at the time of writing on Tuesday, defying broader market weakness as the token continues to build on last week’s rebound. On-chain and derivatives data support a bullish outlook with rising whale accumulation, increasing open interest, and positive funding rates. With momentum indicators signaling waning bearish pressure, the technical outlook is bullish, opening the door to further upside.

On-chain and derivatives data show bullish bias

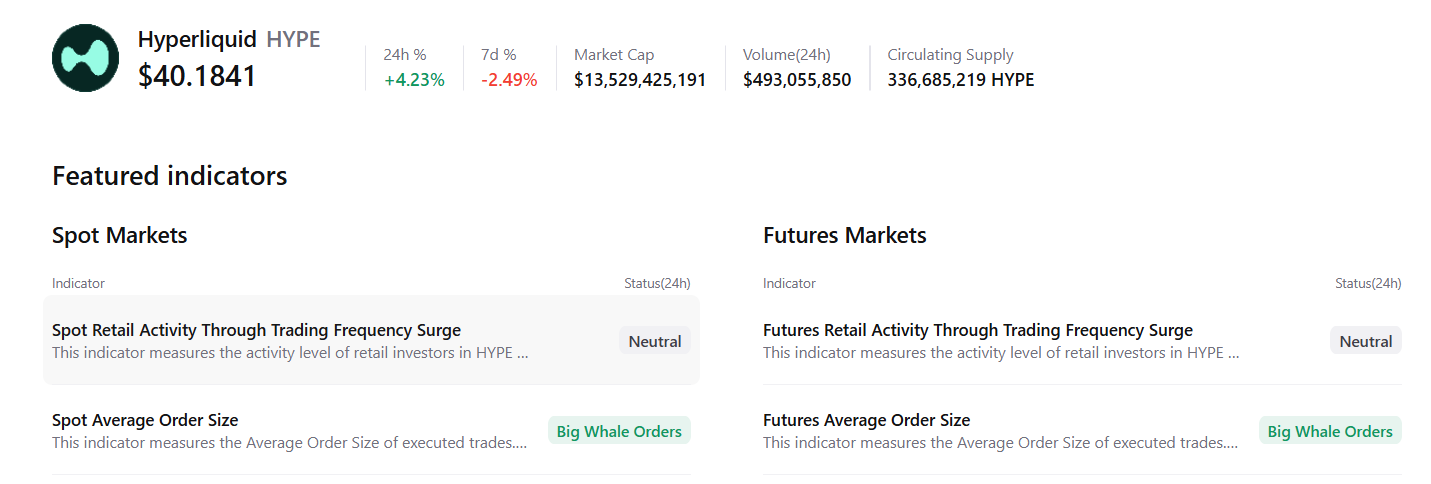

CryptoQuant summary data supports a positive outlook for HYPE as both spot and futures markets show large whale orders, signaling a potential rally ahead.

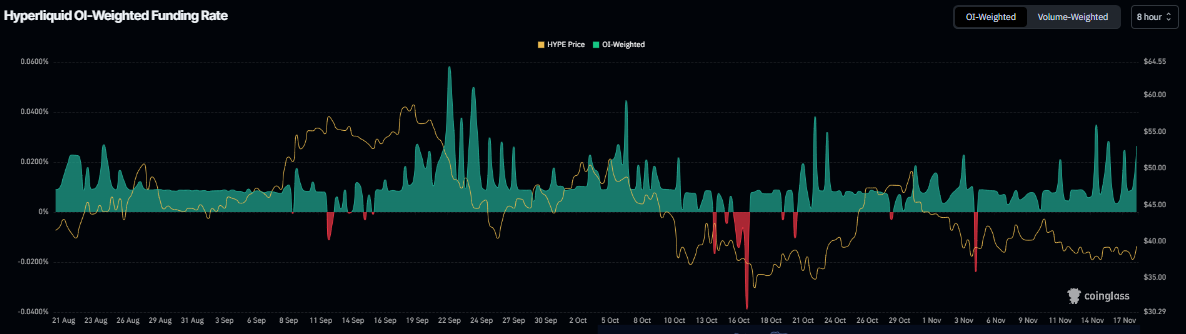

Apart from the large whale orders, the derivatives data also support a recovery rally for Hyperliquid. Coinglass’s OI-Weighted Funding Rate data shows that the number of traders betting that the price of HYPE will slide further is lower than those anticipating a price increase.

The metric has flipped to a positive rate, standing at 0.026% on Tuesday, indicating that longs are paying shorts. Historically, as shown in the chart below, when the funding rates have flipped from negative to positive, Hyperliquid’s price has rallied sharply.

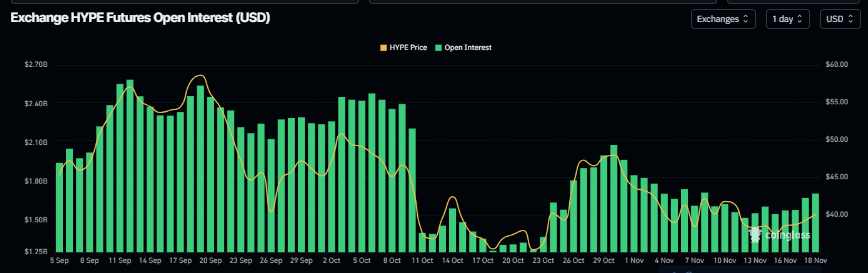

CoinGlass’ data shows that HYPE futures OI at exchanges rose to $1.71 billion on Tuesday, up from $1.52 billion on November 12, and has been rising steadily since then. Rising OI represents new or additional money entering the market and new buying, which could fuel the current HYPE price rally.

Hyperliquid Price Forecast: HYPE bulls aiming for $44 mark

Hyperliquid's price rebounded after retesting the daily support at $36.51 on Friday, and it nearly rose by 5% over the next three days. At the time of writing on Tuesday, HYPE continues its gains, trading above $40.

If HYPE continues its upward trend, it could extend the rally toward the next daily resistance at $44.48.

The Relative Strength Index (RSI) reads 48, pointing upward toward the neutral level of 50, indicating fading bearish momentum. For the recovery rally to be sustained, the RSI must move above the neutral level. Additionally, the Moving Average Convergence Divergence (MACD) lines are converging, with decreasing red histogram bars below the neutral level, indicating early signs of fading bearish momentum.

On the other hand, if HYPE faces a correction, it could extend the decline toward the daily support at $36.51.