Solana Price Forecast: SOL targets $225 amid Coinbase-Squads USDC push

- Coinbase partners with Squads protocol to boost USDC adoption across the Solana ecosystem.

- The move follows Dogwifhat's launch of a Solana validator in partnership with DeFi Development Corp.

- SOL could extend its rise to $225 after the MACD crossed above its moving average line.

Solana (SOL) rallied 5% on Wednesday following Coinbase's partnership with Squads Protocol to improve stablecoin adoption across the cryptocurrency's blockchain.

Solana rallies amid Coinbase partnership with Squads

Coinbase said it has partnered with crypto infrastructure provider Squads to accelerate USDC adoption on Solana through its Multisig platform, according to a statement on Wednesday.

"Squads is driving on-chain stablecoin adoption across the Solana ecosystem. We're excited to support them as they deeply integrate USDC across their product suite to unlock further value for their customers," said Shan Aggarwal, Chief Business Officer at Coinbase.

Squad claims the partnership builds on an existing base of over $1 billion in USDC secured across its products. It also stated its Multisig secured over $10 billion in value, processing more than $5 billion in stablecoin transactions.

"We are thrilled to collaborate with Coinbase to accelerate the growth of USDC on the Squads platform and further its impact across the broader Solana ecosystem," Squads wrote.

Solana is currently the fourth-largest blockchain by stablecoin supply, hosting $11.17 billion of the sector's market cap, with USDC accounting for 75% of that figure, according to DefiLlama.

Meanwhile, Dogwifhat (WIF) launched its Solana validator on Wednesday, in partnership with SOL treasury firm DeFi Development Corp (DFDV). DeFi Dev Corp and the Dogwifhat community will share staking income, MEV, and other validator rewards, after covering operational expenses. DFDV claims to hold more than 1.3 million SOL tokens valued at approximately $250 million.

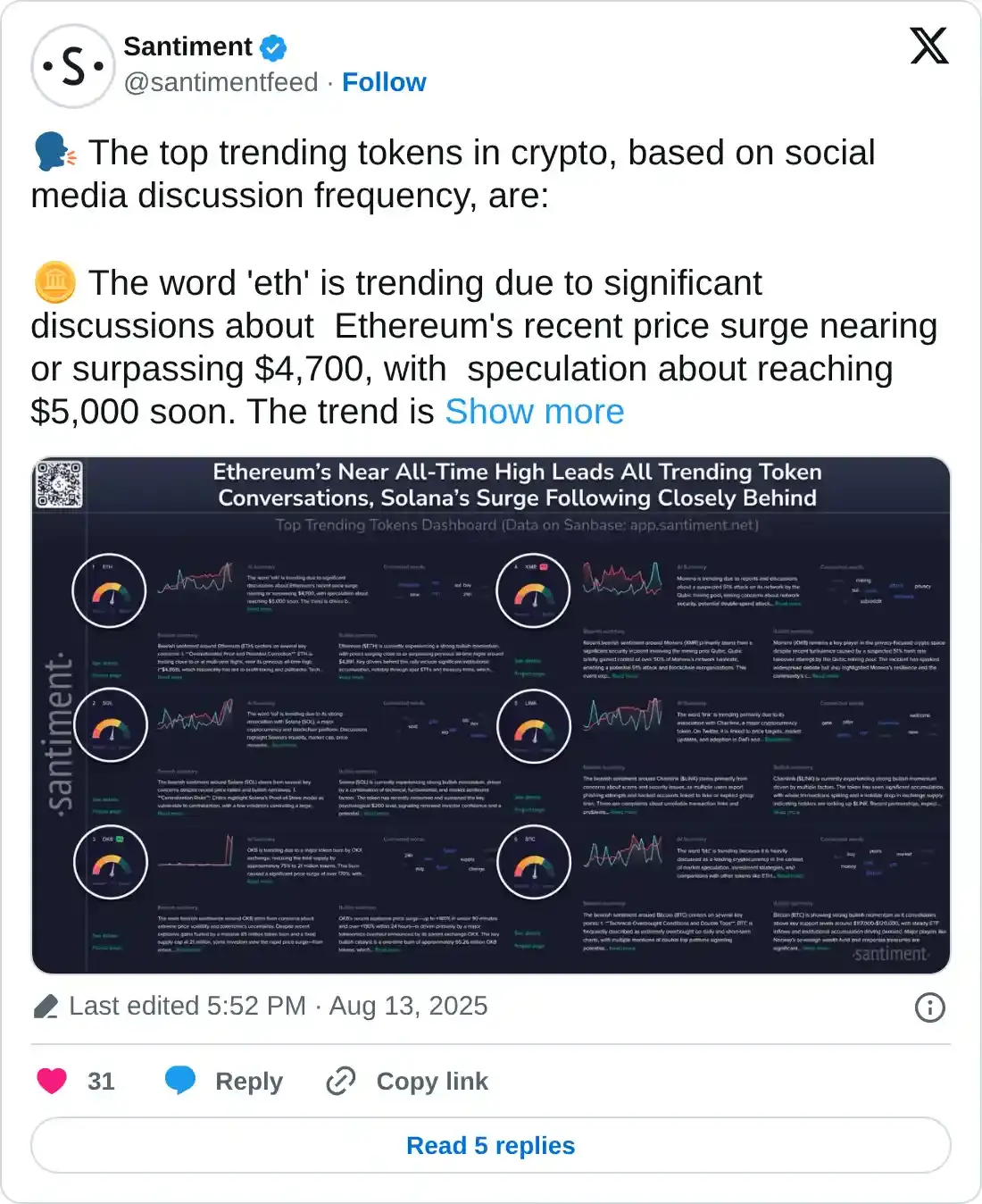

Additionally, SOL's rally has sparked increased online interest, with the ticker trending alongside discussions on Solana's liquidity, market cap, price movements, and trading activity, on-chain analytics platform Santiment wrote in an X post on Wednesday. Market participants are also comparing Solana to other cryptocurrencies like Bitcoin and Ethereum.

SOL eyes $225 following buy signal in the MACD

SOL rose more than 5% over the past 24 hours and crossed the $200 psychological level near a descending trendline resistance. If the altcoin holds the descending trendline as support and clears the hurdle at $210, it could rally to test the resistance at $225.

SOL/USDT daily chart

The Relative Strength Index (RSI) is approaching its overbought region while the Stochastic Oscillator is already in overheated conditions, signaling increased bullish momentum but with potential for a short-term pullback. Meanwhile, the Moving Average Convergence Divergence (MACD) crossed above its moving average line, which is a bullish signal.

A daily candlestick close below $180 will invalidate the thesis and potentially send SOL to $163.