Bitcoin Price Forecast: BTC stabilizes as traders await US CPI data

- Bitcoin price hovers around $118,900 on Tuesday after failing to close above $120,000.

- US CPI data could trigger volatility for riskier assets such as BTC.

- Institutional demand remains robust as Metaplanet added 518 BTC and spot BTC ETFs recorded over $400 million in inflows.

Bitcoin (BTC) price is stabilizing around $118,900 at the time of writing on Tuesday, following a failure to close above its key $120,000 level the previous day, as market participants await the US Consumer Price Index (CPI) data, which is expected to provide fresh cues about the Federal Reserve’s (Fed) rate-cut path and could trigger volatility in Bitcoin price.

Bitcoin could face volatility after the US CPI data

Bitcoin traders await the key US CPI data release at 12:30 GMT. The inflation data could shape expectations for upcoming Fed rate cuts, potentially triggering volatility in the largest cryptocurrency by market capitalization.

Apart from this, the market showed cautious optimism after news that the US-China tariff truce will be extended until November 10, alongside China’s temporary easing of certain export controls on US firms for 90 days.

Furthermore, investors remain hopeful that the upcoming US-Russia summit on Friday in Alaska will increase the chances of ending the prolonged war in Ukraine. Such an outcome would trigger risk-on sentiment, favouring cryptocurrencies such as Bitcoin.

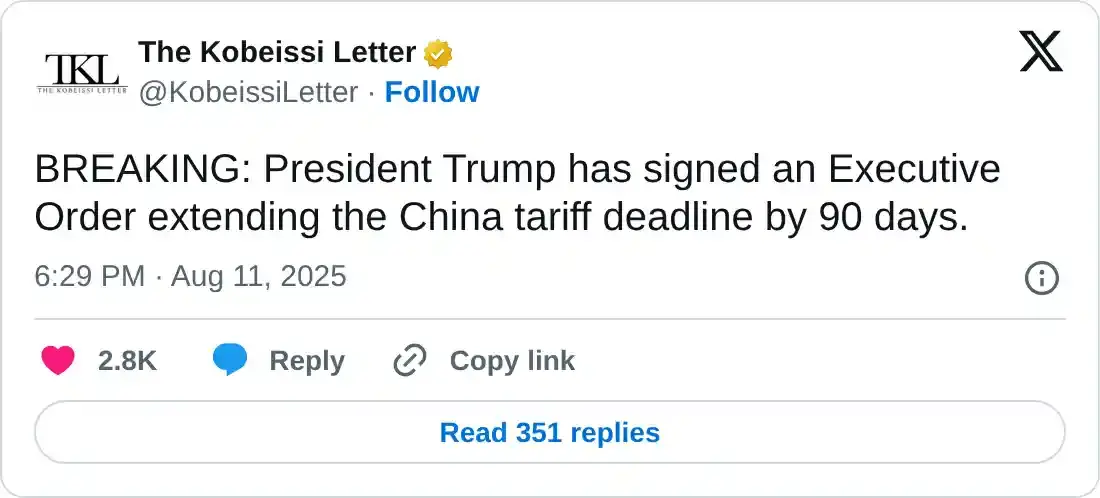

Metaplanet adds 518 BTC to its reserve

Japanese investment firm Metaplanet announced on Tuesday that it has purchased an additional 518 BTC, bringing its total holdings to 18,113 BTC.

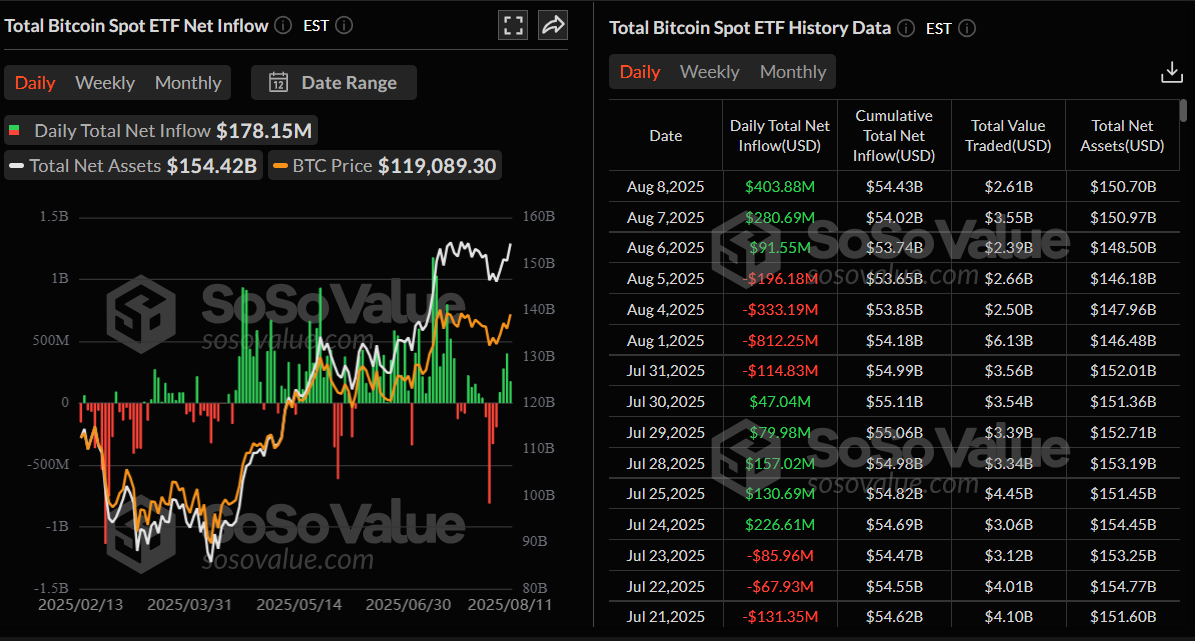

Institutional demand also remained robust. According to SoSoValue data, Bitcoin spot Exchange Traded Fund (ETF) recorded an inflow of $403.88 million on Monday, continuing its three-day streak of inflows since August 6. If these inflows intensify, BTC could increase beyond its all-time high of $123,218.

Total Bitcoin Spot ETF Net inflow chart. Source: SoSoValue

Bitcoin Price Forecast: BTC fails to close above $120,000 resistance

Bitcoin price reached a daily high of $122,335 during Monday's early session, inches away from its all-time high, but failed to sustain above $120,000 and ended the day with a slight decline at $118,686. At the time of writing on Tuesday, the price stabilized at around $118,900.

If BTC closes above the $120,000 pychologcal level on a daily basis, it could extend the rally toward its record high of $123,218. If a successful close above this level occurs, BTC would enter price discovery mode with bulls targeting the psychological level of $125,000.

The Relative Strength Index (RSI) on the daily chart reads 59, above its neutral level of 50, indicating bullish momentum. The Moving Average Convergence Divergence (MACD) showed a bullish crossover on Monday, giving a buy signal and suggesting an upward trend.

BTC/USDT daily chart

If BTC faces a correction from its $120,000 level, it could extend the decline to find support around the daily level at $116,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.