Ripple Price Forecast: Could XRP accelerate rebound toward record highs amid key bullish catalysts?

- XRP price recovery continues above the $3.00 support-turned-resistance as investors broadly weigh risk-on sentiment.

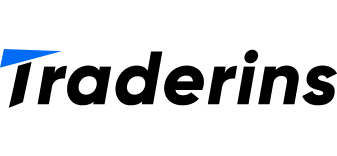

- XRP futures Open Interest stabilizes above $7 billion as weighted funding rate remains in bullish territory.

- XRP holds above key support levels, including the 50-day and the 100-day EMAs, while the RSI steps slightly above the midline.

Ripple (XRP) price regains strength for the second day in a row, trading slightly above $3.00 at the time of writing on Monday. The uptick in cryptocurrency prices across the market follows an extremely volatile week, marked by key macro events including the Federal Reserve (Fed) interest rate hold and the announcement of United States (US) President Donald Trump’s higher tariffs, most of which are expected to take effect on August 7.

XRP shows signs of extending the uptrend, but first traders will be looking for a daily close above $3.00 to affirm the bullish grip. Interest in the token could increase in the coming sessions, especially with the derivatives market Open Interest (OI) stabilizing after a significant drop.

XRP futures open interest and funding rate stabilize

The derivatives market saw a significant drop following the run-up to July peak levels. According to CoinGlass data, XRP futures OI, which peaked at $10.94 billion on July 18, declined to $7.05 billion amid last week’s sell-off before rising slightly and averaging around $7.23 billion on Monday.

Since OI is the notional value of outstanding futures or options contracts, a persistent decline indicates a lack of investor conviction in the price of XRP sustaining an uptrend.

If the green line on the chart below holds above the $7 billion and gradually rises in upcoming sessions, an increase in speculative demand could drive the next leg up to the record high of $3.66, reached on July 18.

XRP Futures Open Interest | Source:

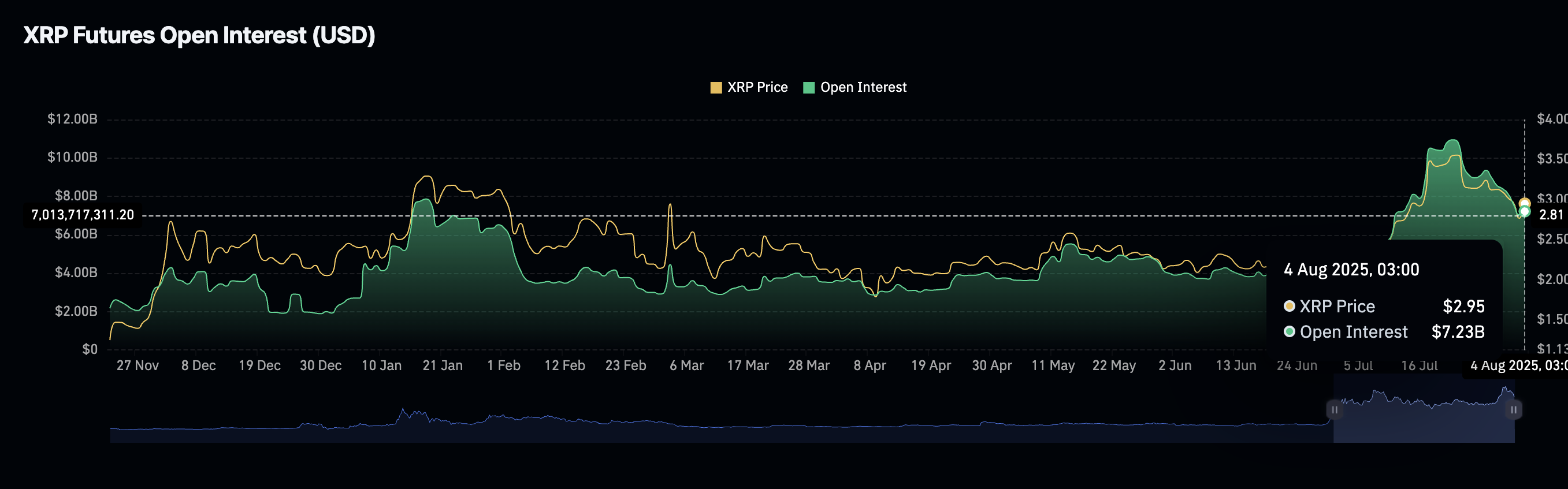

As for funding rates, the chart below highlights the decline that preceded last week’s sell-off. The XRP futures weighted funding rate experienced a steady decline from its July peak of 0.0524%, approaching the mean line before it lifted slightly to 0.0090% at the time of writing. Positive and rising funding rates indicate bullish sentiment as traders increase exposure to long positions.

XRP Futures Weighted Funding Rate | Source: CoinGlass

Technical outlook: XRP could extend recovery

XRP price holds above its short-term support at $3.00, representing an 11% increase from Saturday’s low of $2.73. The cross-border money remittance token also holds above key support levels provided by the 50-day Exponential Moving Average (EMA) at $2.79 and the 100-day EMA at $2.79, affirming XRP’s bullish outlook.

Bullish momentum is building as observed by the Relative Strength Index (RSI), which is rising above the midline and targeting overbought territory. If the RSI supports the uptrend, buying pressure will tick up amid a steady increase in risk-on sentiment.

XRP/USDT daily chart

Key areas of interest for traders range from the next resistance level at $3.33 and the record high of $3.66. If support at $3.00 is tested and broken, the 50-day EMA will come in handy to absorb the selling pressure, with other tentative support areas provided by the 100-day EMA at $2.58 and the 200-day EMA at $2.34.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.