Ethereum Price Forecast: ETH holds near $3,500 as ETF inflows persist despite market jitters

- Ethereum price stabilizes around $3,500 after a nearly 10% decline in the previous week.

- Risk-off sentiment persists as Trump’s trade policy fuels market uncertainty.

- ETH spot ETFs recorded an inflow of $154.32 million last week, signaling continued investor interest despite the broader market pullback.

Ethereum (ETH) holds steady around $3,500 at the time of writing on Monday, after a nearly 10% fall in the previous week. The broader crypto market remains under pressure from rising macroeconomic uncertainty fueled by US President Donald Trump’s new tariffs on multiple countries and the Federal Reserve (Fed) hawkish stance.

Despite the market woes surrounding the crypto market late last week, inflows in spot ETH Exchange Traded Funds (ETFs) persisted, signaling resilience among institutional investors.

Risk-off sentiment triggers a correction in ETH

Ethereum price fell nearly 10% last week following the US Federal Reserve (Fed) interest rate decision, when rates were held steady at 4.25%–4.50%. The lack of clarity on a potential September rate cut reinforced a hawkish stance, triggering risk-off sentiment that weighed on crypto assets.

US President Donald Trump’s new tariffs on multiple countries last week also sparked market uncertainty, which in turn fueled a rise in risk aversion. This led to a sharp decline in the ETH price.

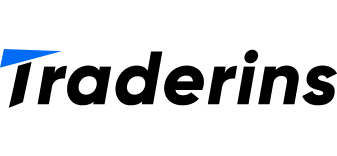

CryptoQuant’s report from last week highlights that profit-taking activity during the third wave, as shown in the graph below, was not limited to Bitcoin, as large holders of USDT, USDC, and WBTC on the Ethereum network also realized gains.

These collectively realized up to $40 million in daily profits in late July, a level on par with previous spikes observed during the March 2024 and January 2025 phases, signaling market tops.

Ethereum realized profit from USDT, USDC and WBTC whales chart. Source: CryptoQuant

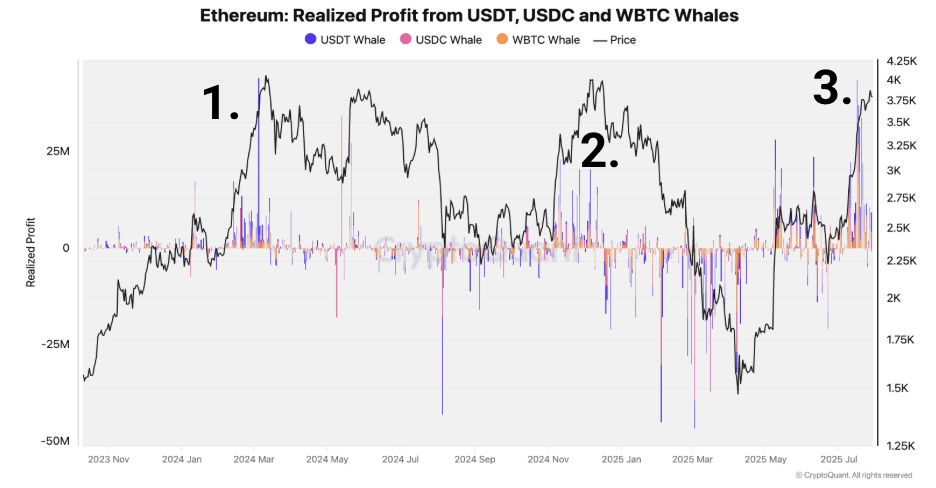

“The US investor demand has softened,” says the report.

Moreover, the Coinbase premium turned negative during late July (see graph below), a signal that US-based buyers are no longer paying a premium over global spot prices.

Ethereum Coinbase Premium Index chart. Source: CryptoQuant

Institutional demand weakens but holds up

Despite profit-taking activity and rising risk aversion, institutional demand persisted. According to the SoSoValue data, US spot Ethereum ETFs recorded an inflow of $154.32 million last week, continuing a 12-week streak of inflows since mid-May. Still, the amount of inflows fell sharply compared with the previous week's $1.85 billion. If inflows intensify, they could serve as a cushion against further price declines by reinforcing long-term investor confidence.

Total Ethereum Spot ETF Net inflow weekly chart. Source: SoSovalue

Ethereum Price Forecast: ETH recovers after retesting key support

Ethereum price closed below its daily support level of $3,730 on Thursday and declined more than 8% in the next two days, closing below support at $3,500.

On Sunday, ETH recovered slightly after finding support around its 78.6% Fibonacci retracement level at $3,392, drawn from the April low of $1,374 to the July high of $3,946. At the time of writing on Monday, it continues its recovery, trading above $3,500.

If ETH extends recent gains, it could aim for its previously broken support level at $3,730.

The RSI on the daily chart reads 56 after bouncing off the neutral level of 50 on Saturday and points upwards, indicating that bullish momentum is gaining traction.

ETH/USDT daily chart

On the other hand, if ETH faces a correction, it could decline toward its next key support at $3,170, the 50-day Exponential Moving Average (EMA).

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.