Ethereum Price Forecast: ETH dips below $3,700 as Trump’s new tariffs raise market concerns

- Ethereum price slips below key support, hinting at a pullback toward the $3,500 psychological level.

- Trump’s new reciprocal tariffs and the Fed’s hawkish stance have triggered risk-off sentiment.

- Despite rising risk aversion, whale wallets and institutional investors are steadily accumulating ETH.

Ethereum (ETH) price trades in red below $3,700 at the time of writing on Friday, closing below its key support level the previous week. ETH declined nearly 7% so far this week, which comes amid US President Donald Trump’s new reciprocal tariffs and the Federal Reserve’s (Fed) hawkish stance, triggering risk-off sentiment. Despite this rising risk aversion, whale wallets and institutional investors are steadily accumulating ETH, signaling long-term confidence in holders.

Risk-off sentiment prevails due to Trump’s new reciprocal tariffs and the Fed’s hawkish stance

Ethereum price slips below $3,700 at the time of writing on Friday, falling nearly 7% so far this week. This price decline was fueled by the Fed’s interest rate decision on Wednesday.

The US Fed kept the interest rate unchanged at the range of 4.25%-4.50% for the fifth consecutive time, despite intense pressure from US President Donald Trump and his allies to lower borrowing costs.

Risk aversion increases as Fed Chair Jerome Powell said during the post-meeting press conference that the central bank had made no decisions about whether to cut rates in September, highlighting Powell’s hawkish stance. Moreover, the odds of a rate cut in September fell from nearly 60% before the meeting to roughly 43% after the press conference, according to the CME Fedwatch Tool.

Apart from the Fed’s hawkish stance, the trade-war-related headlines in recent days have been mixed. The week started with optimism amid the announcement of a deal between the US and the European Union (EU), which followed a similar announcement between the US and Japan. The White House also reported continued talks with China.

Mid-week, however, and as the August 1 deadline loomed, deals with other major trading counterparts such as Canada, Australia or India were, and still are, in the air. Furthermore, Trump announced a whopping 50% tariff on Brazilian imports and a universal 50% tariff on imports of semi-finished copper products and copper-intensive derivative products, effective August 1.

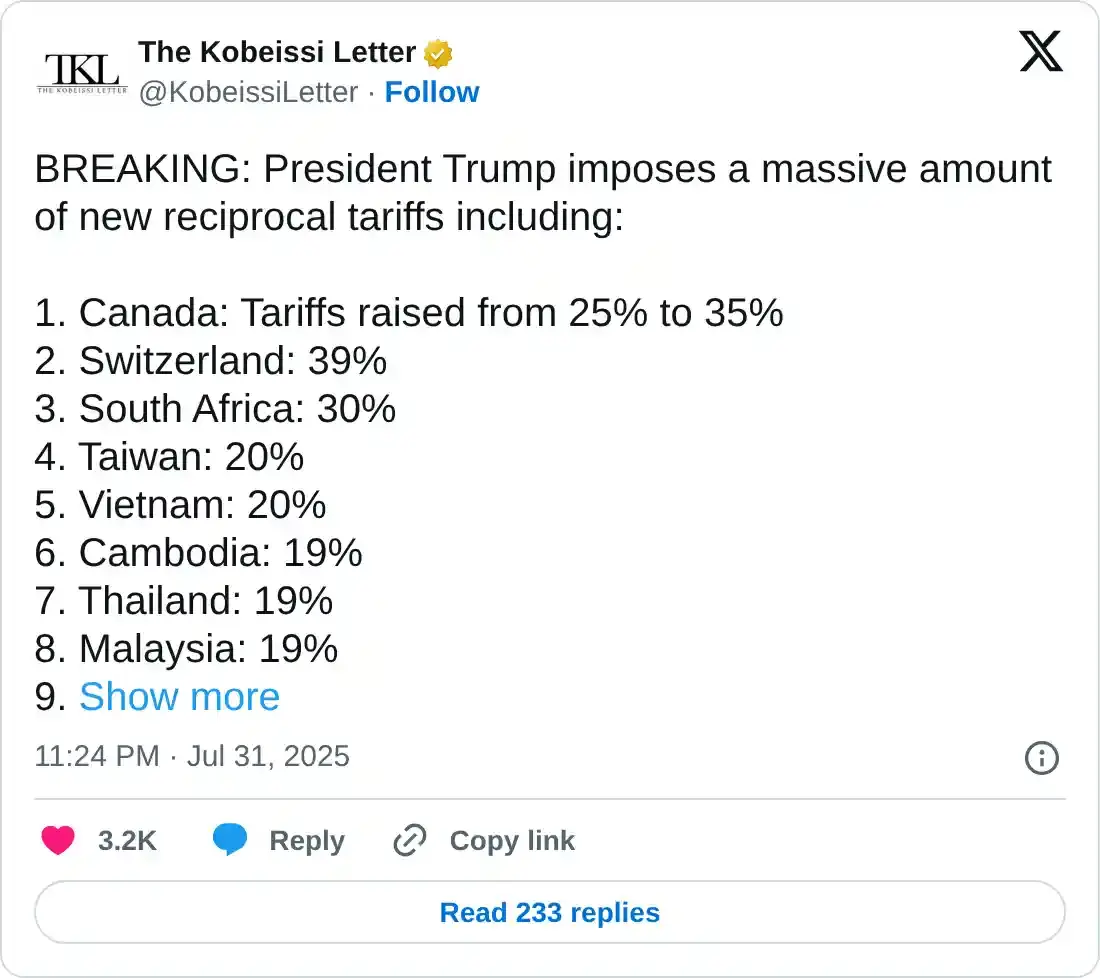

The Kobeissi Letter reported that Trump imposes a massive amount of new reciprocal tariffs, including Switzerland 39%, South Africa 30% and many Southeast Asian countries, as shown below. These tariffs are set to go live on Friday at midnight. Meanwhile, S&P 500 futures are down a mere 10 points, almost entirely due to Amazon’s weak earnings results.

Ethereum’s whale wallets and institutional demand remain robust

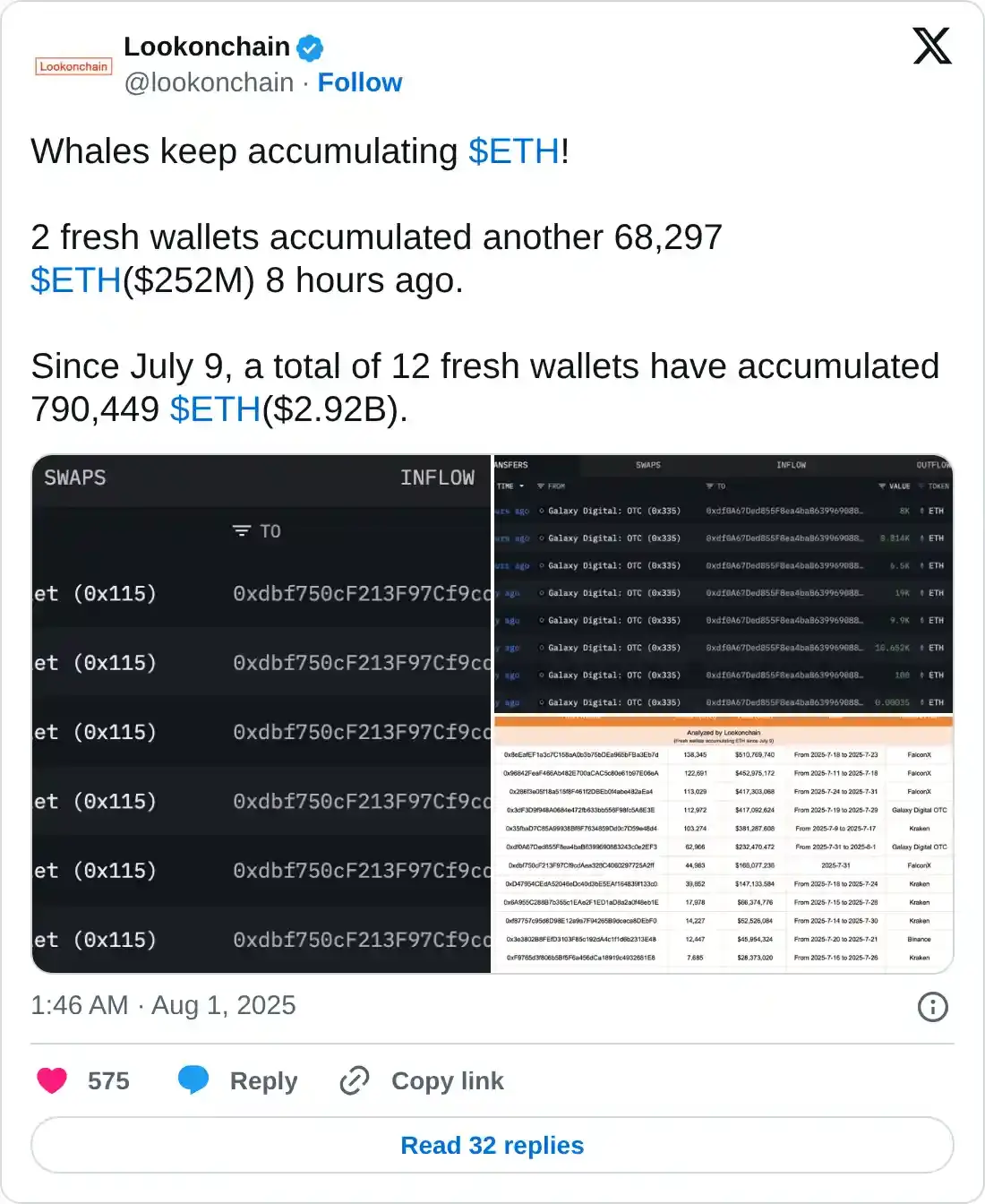

Despite a correction in Ethereum price, whale wallets and institutional demand have strengthened. Lookonchain data shows that whale wallets keep accumulating ETH tokens. Two fresh wallets have added another 68,297 ETH worth $252 million on Friday, as per the data. Since July 9, a total of 12 new wallets have accumulated 790,449 ETH worth $2.92 billion.

Institutional demand is also rising. According to the SoSoValue data, US spot Ethereum Exchange Traded Funds (ETFs) recorded an inflow of 306.58 million so far this week until Thursday, continuing its streak of positive flows since mid-May. In July, the monthly flows have reached $5.43 billion, the highest level since their launch.

Total Ethereum spot ETF net inflow weekly chart. Source: SoSoValue

Total Ethereum spot ETF net inflow monthly chart. Source: SoSoValue

What is there for Ethereum in August?

Ethereum reached a new year-to-date high of $3,941 on July 28, making a 48.80% return for the month. According to Ethereum’s historical data, ETH generally yielded a positive return for traders in August, with an average gain of 5.47%. If the regulation clarity, ETFs’ demand continues to strengthen and tariffs and geopolitical uncertainty ease, traders could see positive returns in August.

Ethereum historical monthly returns chart. Source: Coinglass

Ethereum Price Forecast: ETH closes below key support level

Ethereum price declined nearly 3% on Thursday, closing below its daily support level of $3,730. It trades below $3,700 at the time of writing on Friday.

If ETH continues its pullback, it could extend the decline to the next support at $3,500.

The Relative Strength Index (RSI) indicator on the daily chart slips below its overbought level and points downward, indicating fading bullish momentum. The Moving Average Convergence Divergence (MACD) also showed a bearish crossover on Wednesday, further supporting the bearish thesis and downward trend on the horizon.

ETH/USDT daily chart

On the other hand, if ETH recovers, it could extend the advance toward its key psychological level at $4,000.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.