Bitcoin Weekly Forecast: BTC 16-day consolidation ends — fakeout or real breakdown?

- Bitcoin price closes below its lower consolidation limit at $116,000, ending a 16-day consolidation phase this week.

- The US Federal Reserve holds interest rates steady in the 4.25%–4.50% range for the fifth consecutive time.

- The White House released its crypto report this week, pushing for regulatory clarity.

Bitcoin (BTC) price closes below its lower consolidation limit at $116,000, ending a 16-day consolidation phase this week. BTC declined 3.4% so far this week, and the breakdown comes amid a steady macroeconomic backdrop, with the US Federal Reserve (Fed) holding interest rates unchanged, signaling risk-off sentiment. Market participants are also digesting positive developments for the digital asset space, such as the release of the crypto policy report from the White House.

As traders weigh the significance of the breach, the market now faces a critical juncture — whether this is a temporary fakeout or the beginning of a deeper correction.

Fed keeps interest rates unchanged

Bitcoin price consolidation came to an end on Thursday, slipping below its lower limit at $116,000. The 16-day-long consolidation phase came to an end a day after the Fed interest rate decision on Wednesday.

The Fed kept the interest rates unchanged at the 4.25%-4.50% range for the fifth consecutive time, despite intense pressure from US President Donald Trump and his allies to lower borrowing costs.

Fed Chair Jerome Powell said during the post-meeting press conference that the central bank had made no decisions about whether to cut rates in September, highlighting his hawkish stance, which does not bode well with riskier assets like Bitcoin. Moreover, the odds of a cut in September fell from nearly 60% before the meeting to roughly 43% after the press conference, according to the CME Fedwatch Tool.

The decision, however, met opposition from Fed Governors Michelle Bowman and Christopher Waller. This was the first time since 1993 that two governors had dissented on a rate decision.

Traders now look to the Nonfarm Payrolls (NFP) data for July this Friday for a fresh impetus for Bitcoin.

Trump's tariff deals raise uncertainty in crypto markets

Trade-war-related headlines in recent days have been mixed. The week started with optimism amid the announcement of a deal between the US and the European Union (EU), which followed a similar announcement between the US and Japan. The White House also reported continued talks with China.

Mid-week, however, and as the August 1 deadline loomed, deals with other major trading counterparts such as Canada, Australia or India were, and still are, in the air. Furthermore, Trump announced a whopping 50% tariff on Brazilian imports and a universal 50% tariff on imports of semi-finished copper products and copper-intensive derivative products, effective August 1.

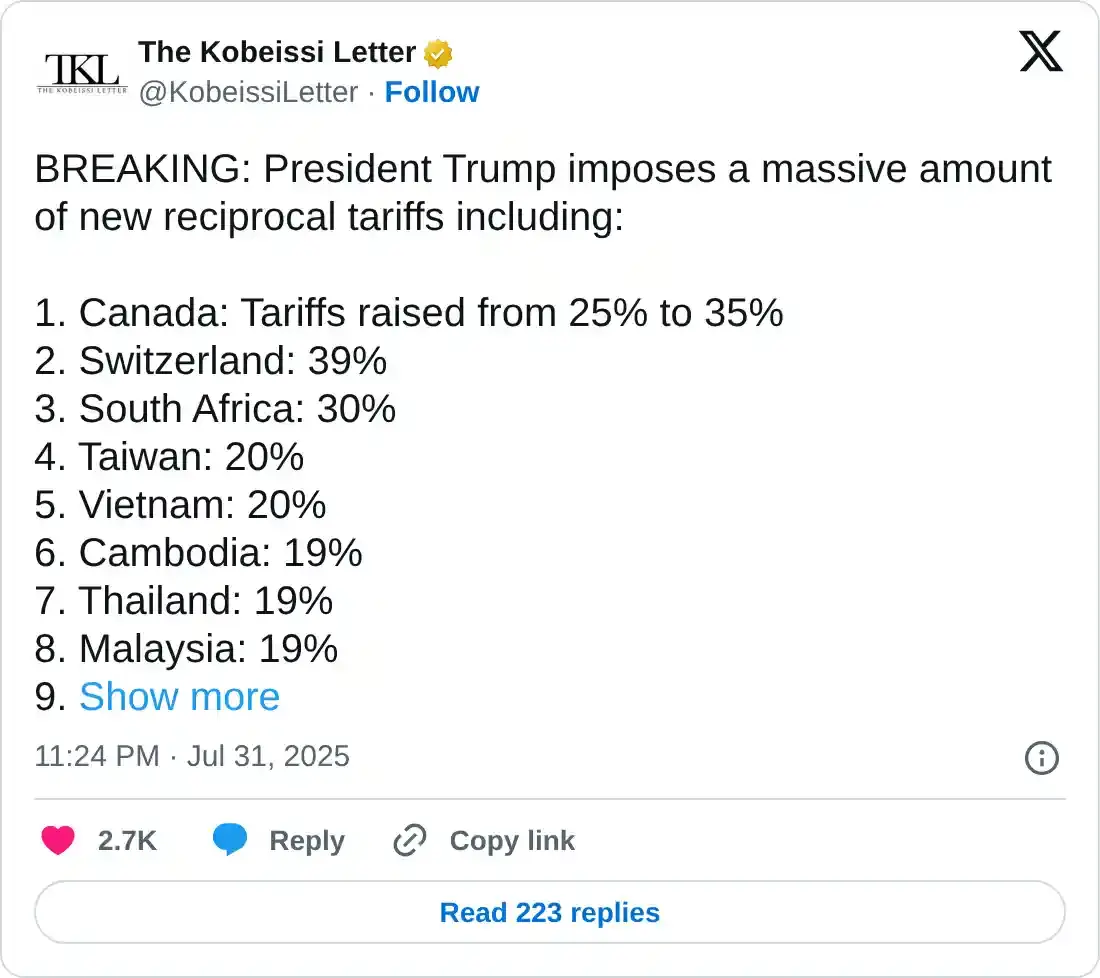

The Kobeissi Letter reported that Trump imposes a massive amount of new reciprocal tariffs, including Switzerland 39%, South Africa 30% and many Southeast Asian countries, as shown below. These tariffs are set to go live on Friday at midnight. Meanwhile, S&P 500 futures are down a mere 10 points, almost entirely due to Amazon's weak earnings results.

“In April, this headline would have sent the S&P 500 -3% lower. The trade war has lost its shock effect on markets,” reported Kobeissi.

White House releases its first virtual asset policy

The White House released its first virtual asset policy on Wednesday, as required by US President Donald Trump’s Executive Order (EO) 14178. The report, spanning over 160 pages, contains dozens of recommendations related to crypto policy and pushes for regulatory clarity in the US.

The report had a muted impact on Bitcoin's price, as BTC stabilized at around $111,700 on that day. Market participants likely ignored the text as the subject of the Bitcoin Strategic Reserve, which is key, was not clearly addressed.

However, key areas of interest include recommendations for the US SEC to establish clear guidelines for the development of tokenized stocks and treasuries. It also presses regulators to clarify “permissible bank activities” regarding stablecoins and the use of blockchains, promote transparency on how institutions can obtain bank charters and ensure that bank capital rules better reflect the risks particular to digital assets.

JPMorgan and Coinbase join hands to link bank accounts to crypto wallets

Bloomberg reported on Thursday that US bank JPMorgan Chase & Co. and American cryptocurrency exchange Coinbase Global Inc. had signed an agreement to link customers’ bank accounts to their cryptocurrency wallets directly.

“The connections between Chase bank accounts and Coinbase crypto wallets are expected to go live next year,” reported Bloomberg.

The partnership indicates a bullish long-term impact on the cryptocurrency market, including Bitcoin, as it enhances wider adoption, growing cooperation between traditional banks and crypto platforms.

US SEC gives green light to in-kind creations and redemptions for Bitcoin and Ethereum ETPs

The US SEC announced in its press release on Tuesday that it has voted to approve orders to permit in-kind creations and redemptions by authorized participants for crypto ETP shares.

This order is a departure from the previous cash-only mechanism used for spot BTC and ETH ETPs, which were limited to creations and redemptions on an in-cash basis. This development marks a regulatory shift from the previous cash-only mechanism used for spot Bitcoin and Ethereum ETPs, now aligning crypto products with traditional commodity-based ETPs like Gold and Oil.

What is there for Bitcoin in August?

Bitcoin reached a new all-time high of $123,218 on July 14, making an 8.13% return for the month. According to Bitcoin’s historical data, BTC generally yielded a positive return for traders in August, with an average gain of 1.60%. If the regulation clarity, ETFs’ demand continues to strengthen, and tariffs and geopolitical uncertainty ease, traders could see positive returns in August.

Bitcoin historical monthly returns chart. Source: Coinglass

Fakeout or confirmation?

Bitcoin price finally broke below its lower consolidation level at $116,000 on Thursday, ending a 16-day consolidation phase and signaling a potential shift in market momentum. At the time of writing on Friday, it hovers at around $115,600.

If BTC continues its pullback, it could extend the decline to retest the 50-day Exponential Moving Average (EMA) at $112,951.

The Relative Strength Index (RSI) on the daily chart is slipping below its neutral level of 50 and points downward, indicating that bearish momentum is gaining traction. The Moving Average Convergence Divergence (MACD) showed a bearish crossover on July 23, giving a sell signal. It also shows rising red histogram bars below its neutral line, suggesting further bearish momentum and a downward trend.

BTC/USDT daily chart

However, if BTC recovers, it could advance toward its upper boundary of the consolidation range at $120,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.