Ethereum could resume fight for all-time high as whales continue accumulation

- Ethereum's recent price movement has shown that it's still significantly correlated with Bitcoin.

- Whales are accumulating Ethereum, with the aim to participate in the ETH restaking boom.

- The SEC's recent Wells notice to decentralized exchange Uniswap could affect Ethereum, considering it is home to a large portion of DeFi.

Ethereum (ETH) showed signs of recovering its bullish momentum on Thursday, briefly rising to $3,618 as whales entered a buying spree. Despite the movement from whales, the US Securities and Exchange Commission (SEC) Wells notice to Uniswap could affect Ethereum in the long run.

Read more: Ethereum extends correction as Van Eck CEO dampens chances of spot ETH ETF approval

Daily digest market movers: Whales accumulation, Bitcoin correlation, Wells notice

Ethereum joined a host of other altcoins in trading in the green on Thursday after two days of sustaining a bearish move. Here are your key market movers for the largest smart contract blockchain:

- After ETH's slight increase on Thursday, large ETH whale Ox347 deposited 9000 ETH tokens to Binance at $3,560 in a bid to book profits, according to onchain insights from Spot On Chain. Although this is the whale's largest ETH deposit to date, its address still holds 29,738 ETH worth a whopping $106 million with an estimated profit of $68.5 million.

- Despite the profit-taking from whale Ox347, onchain data from Lookonchain indicates that some other whales are taking opposite actions:

Whale 0x4359, who had earlier bought 10,309 ETH ($35.82 million) at the bottom of the price drop on Wednesday, withdrew another 3,092 ETH ($11.12 million) from Binance on Thursday. As a result, his total ETH withdrawals from Binance in the past three days have reached 24,044 ETH ($86.5 million).

Another whale, 0xACc7, withdrew 22,251 ETH ($80.06 million) from exchanges on Thursday, taking their total exchange withdrawals in the past three days to 33,925 ETH ($122.06 million).

Some crypto community members have speculated that the whales' recent move may be to participate in the restaking boom that's heating up in DeFi, especially with the Mainnet launch of EigenLayer. Data from Lookonchain confirms this as whales/institutions withdrew ETH from Binance and staked it into Pendle and Bedrock.

Whales/Institutions withdrew $ETH from #Binance and staked it into #Pendle and #Bedrock today.

— Lookonchain (@lookonchain) April 11, 2024

0x1958(related to #Fenbushi Capital) withdrew 7K $ETH($24.5M) from #Binance and staked it into #Pendle.https://t.co/jMvAKPRvyn

Whale"0xaF35" withdrew 6.7K $ETH($23.4M) from #Binance… pic.twitter.com/Ae4wOTqNdV

- While the recent price increase may have several factors layered in, it shows Ethereum still maintains a significant correlation with Bitcoin (BTC). Like several other large-cap altcoins, Ethereum's price movement has largely mimicked Bitcoin's since the beginning of the year. Hence, the Bitcoin halving – less than eight days away – could prove critical in determining ETH's price movement in the coming days.

- On Wednesday, the US Securities and Exchange Commission (SEC) issued a Wells notice to Ethereum's largest decentralized exchange, Uniswap. The Wells notice, a formal document indicating the SEC's intention to take legal action against an individual or firm, was issued based on claims that Uniswap operated as an unregistered securities broker and exchange.

If the SEC succeeds in taking legal action against Uniswap, it could significantly affect the broader DeFi landscape. This would have telling effects on Ethereum, the underlying home to roughly 80% of DeFi solutions. Earlier in March, the SEC had issued subpoenas to three firms that had dealings with the Ethereum Foundation. Many crypto community members have stated that the SEC aims to classify Ethereum as a security.

Also read: Ethereum could be set for growth as Vitalik Butein shares update on its future

Technical analysis: ETH may continue sideways movement

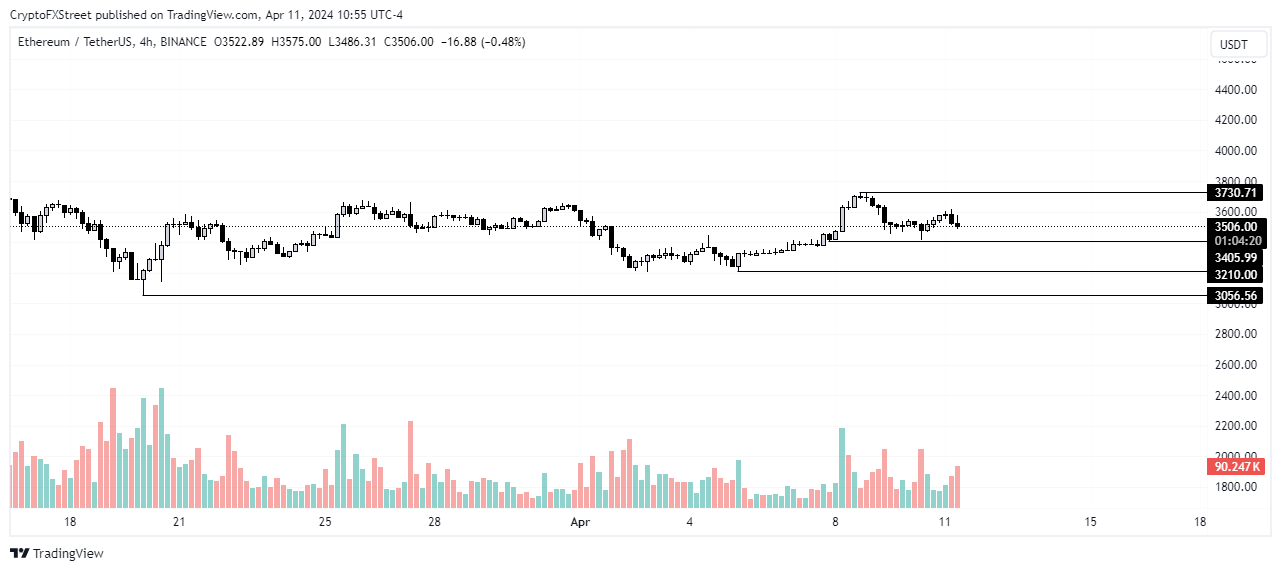

ETH's price has been following a sideways pattern after recovering from the one-week correction that followed the high of $4,094 on March 11. While traders expected a rally back to the $4,094 high when ETH tagged the key resistance of $3,730 on Monday, the price retraced. The continued sideways move indicates traders are exercising caution and are indecisive on whether to go long or short.

ETH/USDT 4-hour chart

Read more: Ethereum's price recovery looks imminent as ETF approval sees a glimmer hope

The constant switch between increased long and short liquidations in the past two weeks confirms this indecision. ETH may continue this sideways movement until key events like the Bitcoin halving and the SEC's spot ETH ETF approval decision take place. However, a bearish trend may begin if the price breaks key supports of $3,210 and $3,056 formed on April 5 and March 20, respectively.

Ethereum is trading at $3,500, up 0.8% at the time of writing.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.