Bitcoin Weekly Forecast: BTC hits new all-time high and enters price discovery mode

- Bitcoin price prints a fresh all-time high near $118,900 on Friday, with bulls eyeing $120,000 as the next key milestone.

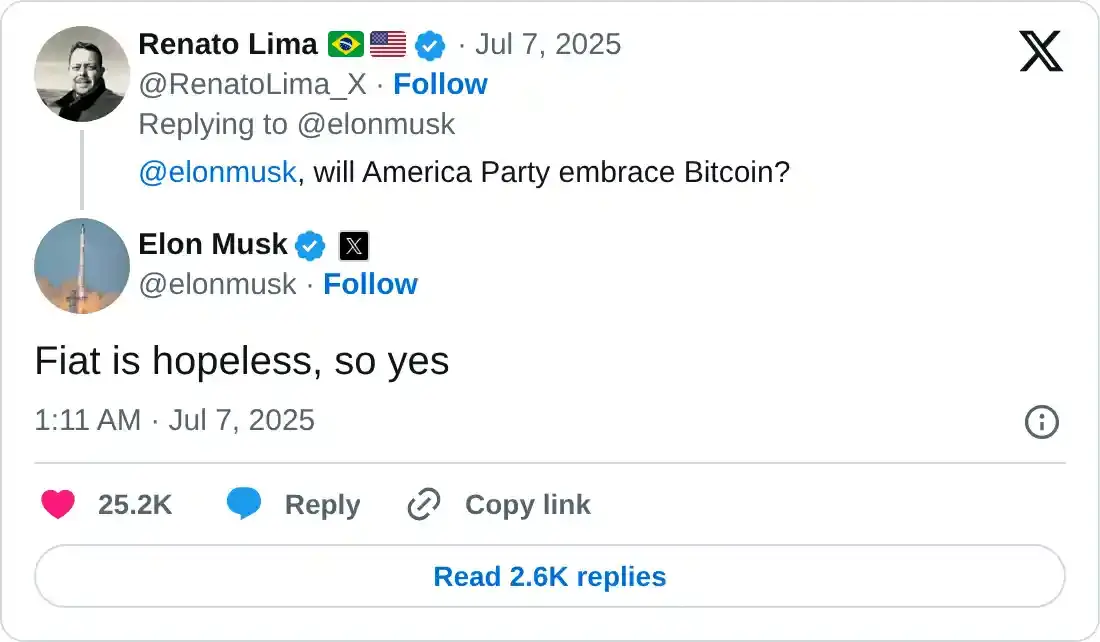

- Corporate and institutional demand remains robust, with spot Bitcoin ETFs recording a total of $1.69 billion this week as of Thursday.

- Renewed risk-on sentiment after Fed minutes strengthens, on-chain data shows low selling activity.

Bitcoin (BTC) price prints a new all-time high near $118,900 on Friday, entering uncharted territory as bullish momentum accelerates. The surge in BTC was supported by rising corporate and institutional demand, with spot Bitcoin Exchange Traded Funds (ETFs) recording a total of $1.69 billion this week as of Thursday.

Adding to this optimism, Federal Reserve (Fed) officials are considering cutting interest rates later this year, with some of them seeing the first rate cut as soon as July, as reported in the Fed's June meeting Minutes released on Wednesday, which has triggered risk-on sentiment across the crypto market. Meanwhile, on-chain data shows minimal selling pressure from traders, suggesting that BTC could be on track to test the $120,000 milestone soon.

Fed’s Minutes act as a catalyst for Bitcoin

Bitcoin recorded its highest weekly close in the first week of July, closing at 109,203 last Sunday. At the start of this week, BTC traded sideways, around $108,000, until Tuesday. The lack of any relevant market-moving news caused a consolidation in BTC during the first half of this week.

This ongoing consolidation phase came to an end during the American trading session on Wednesday, with BTC hitting a new all-time high (ATH) of $111,999. This renewed optimism was fueled by the Fed’s Minutes of the June meeting. The Federal Open Market Committee (FOMC) meeting minutes included a few officials who expressed the view that interest rates might decrease as early as July. At the same time, the majority of policymakers continued to have concerns regarding the inflationary pressures anticipated from US President Donald Trump's implementation of import taxes aimed at altering global trade.

The stance in the meeting minutes triggered a risk-on sentiment in the markets, which supports the price rally in cryptos, with the largest cryptocurrency by market capitalization reaching a new all-time high.

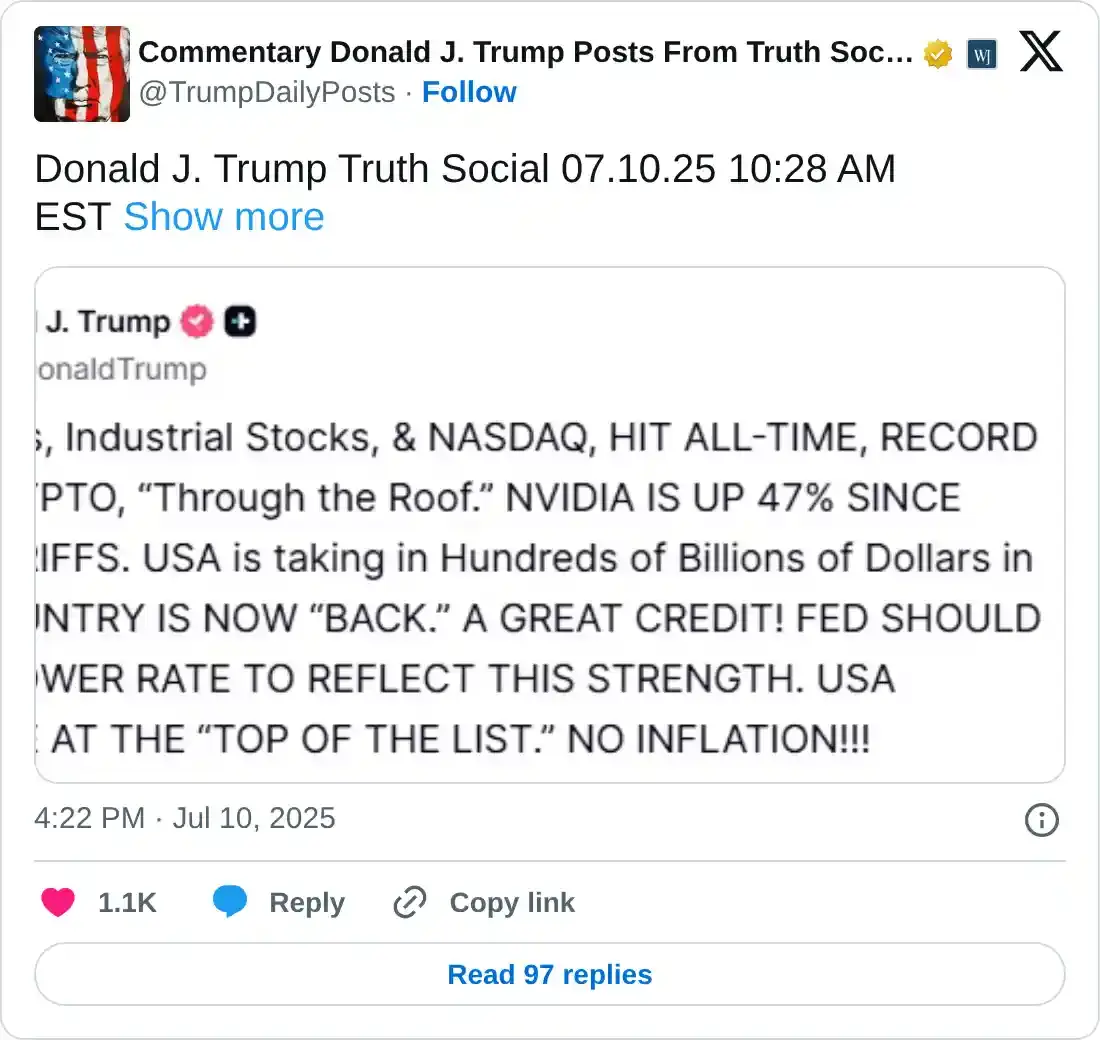

BTC moved to uncharted territory and continued to set record highs, reaching nearly $117,000 on Thursday. The rally was boosted as US President Donald Trump posted on Truth Social that stocks and crypto hit all-time highs and said, “FED SHOULD RAPIDLY LOWER RATE TO REFLECT THIS STRENGTH.”

On Friday, BTC continues to trade higher, hitting fresh all-time highs near $118,900, with bulls eyeing $120,000 as the next key milestone.

Corporate and institutional demand fuel BTC to record levels

Bitcoin price has been supported by rising corporate and institutional demand this week. On Monday, Japanese investment firm Metaplanet announced that it had purchased an additional 2,205 BTC, bringing the total holding to 15,555 BTC. On the same day, the Blockchain Group confirmed the acquisition of 116 BTC, bringing its total holdings to 1,904 BTC.

Additionally, Murano Global Investments PLC, a Nasdaq-listed real estate firm with a focus on hotels and resorts, announced that it would enhance its corporate strategy to establish a Bitcoin Treasury. The firm also entered into a Standby Equity Purchase Agreement (SEPA) with Yorkville, with a potential value of up to $500 million, to utilize proceeds from the sale of shares under the SEPA for general corporate purposes, primarily for investing in BTC.

Apart from the corporate demand, Elon Musk announced on Monday that his new political group, called the America Party, will support Bitcoin. When asked on the social media platform X if the American Party will embrace Bitcoin, Musk replied, “Fiat is hopeless, so yes.”

Institutional demand also supported BTC. SoSoValue data show that spot Bitcoin ETFs have recorded a total of $1.69 billion in inflows until Thursday, marking the fifth consecutive weekly increase since mid-June. Moreover, on Thursday alone, it recorded the highest single-day inflow of $1.18 billion, similar to the levels seen during Donald Trump's victory in the US elections in November. If these inflows continue and intensify, BTC could extend the rally to test its next key milestone at $120,000.

Trump’s company files for “Crypto Blue Chip ETF” with the US SEC

US President Donald Trump’s Trump Media Group filed an S-1 registration statement with the US Securities and Exchange Commission (SEC) on Tuesday to launch a “Crypto Blue Chip ETF” for five assets, including Bitcoin, Ethereum (ETH), Solana (SOL), Cronos (CRO) and Ripple (XRP).

This ETF fund aims to allocate 70% of its assets to BTC, while 15%, 8%, 5%, and 2% are allocated to ETH, SOL, CRO, and XRP, respectively.

The approval of this fund would signal a bullish outlook for cryptocurrencies — especially for Bitcoin, given its maximum allocation — by boosting broader adoption and improving liquidity for the asset.

Few sellers and huge liquidations

CryptoQuant's weekly report, released on Thursday, highlighted that Bitcoin selling pressure remains low despite the price reaching a fresh all-time high this week.

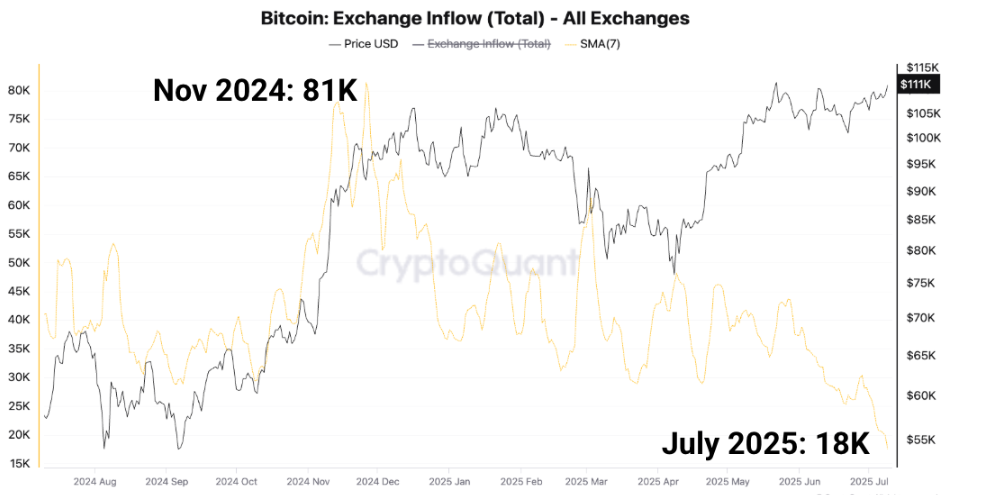

The chart below shows that the daily BTC exchange inflows have declined to 18,000 BTC, the lowest daily level since April 2015. A declining amount of Bitcoin flowing into exchanges indicates less selling pressure from new capital flows. Historical data show that inflows to exchanges spiked to 81,000 BTC on November 26, when the price first neared the $100K threshold.

BTC exchange inflow(Total) chart. Source: CryptoQuant

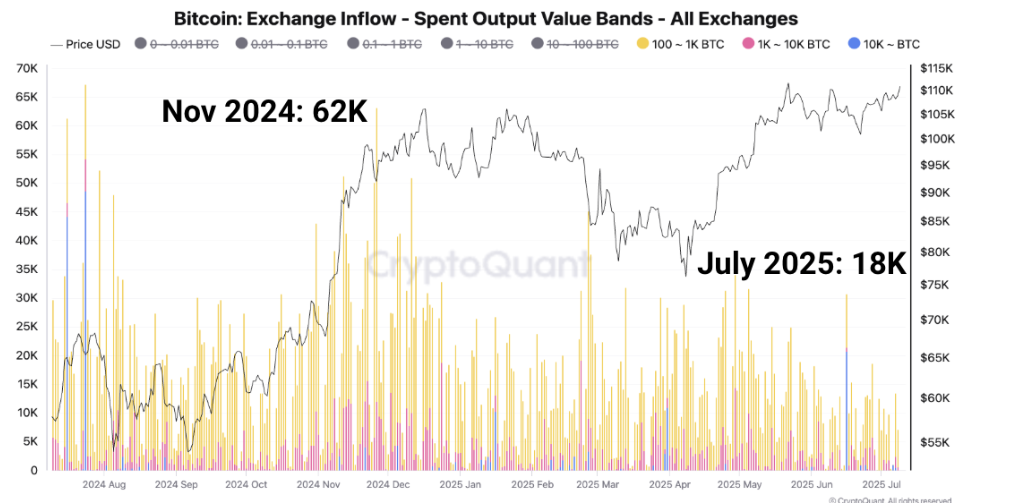

Additionally, large Bitcoin holders are also sending fewer coins to exchanges. The daily amount of Bitcoin sent to exchanges in batches of 100 or more BTC has declined to 7,000 BTC on Thursday from 62,000 BTC on November 26, indicating less selling pressure and supporting the bullish outlook in the token price.

Bitcoin Exchange inflow chart. Source: CryptoQuant

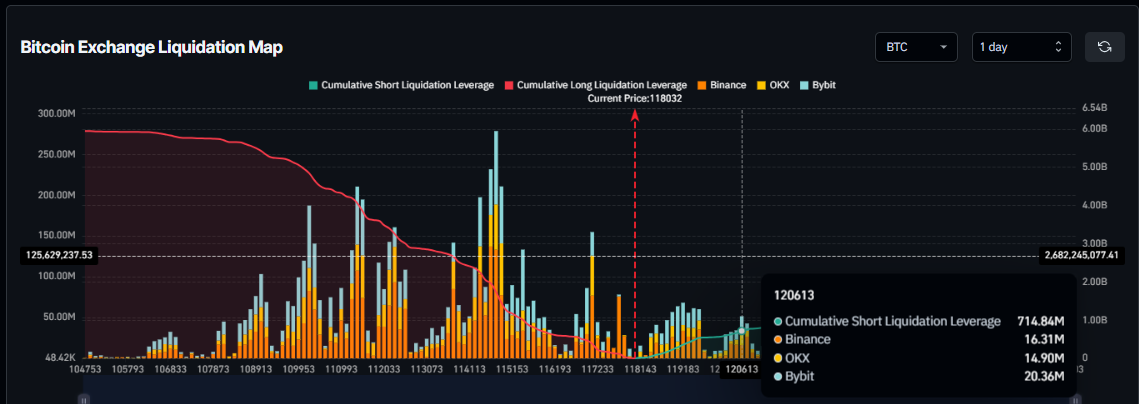

Following a massive $1 billion in liquidations on Thursday, the Bitcoin Exchange Liquidation Map indicates that nearly $700 million of Bitcoin shorts are poised to be liquidated if BTC surpasses $120,000, potentially triggering a short squeeze and further fueling the rally.

Bitcoin Exchange Liquidation Map chart. Source: Coinglass

Some signs of concern

Despite the Bitcoin price setting record levels, holders should watch for some signs of concern.

The tariff uncertainty has continued this week, with US President Trump sending out “tariff letters” with the following tariff rates to many Asian and African countries. Trump also threatened that any country aligning with the anti-American policies of BRICS would be charged an additional 10% tariff, and there would be no exceptions to this policy. These tariffs are scheduled to take effect on August 1.

Adding to this uncertainty, Donald Trump has said that the US will resume sending weapons to Ukraine after an announcement last week that Washington would halt some shipments of critical arms to Kyiv.

During a meeting with Israeli Prime Minister Benjamin Netanyahu on Tuesday, Trump said he was "not happy" with Russian President Vladimir Putin and that Ukraine was "getting hit very hard."

This announcement signals that the war in Ukraine is intensifying and not de-escalating. Any further escalation of these rising war tensions and geopolitical uncertainties could drive investors toward safe-haven assets, such as Gold (XAU), which brings a risk-off sentiment to the market, not boding well for the prices of risky assets like Bitcoin.

Bitcoin heads toward $120,000 milestone

Bitcoin price consolidation around the upper boundary of a previously broken consolidation zone at $108,355 came to an end on Wednesday. BTC surged to reach a new all-time high of $116,868 on Thursday. At the time of writing on Friday, it continues to set a record high at $118,869.

As BTC enters into a price discovery mode, and if the upward trend continues, it could extend the rally toward the key psychological level of $120,000.

The Relative Strength Index (RSI) on the daily chart reads 73, above its overbought level of 70, indicating strong bullish momentum. However, traders should be cautious as the chances of a pullback are high due to overbought conditions. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator showed a bullish crossover at the end of June. It also shows rising green histogram bars above its neutral zero line, suggesting bullish momentum is gaining traction and continuing the upward trend.

BTC/USDT daily chart

However, if BTC faces a correction, it could extend the decline to find support around the upper boundary of a previously broken consolidation zone at $108,355.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.