Ethereum Price Forecast: ETH record gains as SharpLink push treasury holdings above 205,000 ETH

Ethereum price today: $2,600

- SharpLink stock soars 20% after announcing a 7,689 ETH acquisition, boosting its total holdings above 205,000 ETH.

- Another ETH treasury firm, BTCS, also plans to raise $100 million through a combination of DeFi and TradFi strategies.

- ETH could rally to test the $2,850 resistance as it eyes a breakout above a key symmetrical triangle.

Ethereum (ETH) recorded a 2.7% gain on Tuesday after SharpLink Gaming (SBET) announced it had acquired 7,689 ETH, pushing its treasury holdings above 205,000 ETH.

Ethereum treasury picks up pace as SharpLink expands holdings above 205,000 ETH

Nasdaq-listed SharpLink Gaming stated that it bought 7,689 ETH at an average price of $2,501 per ETH last week. The company said it made the purchase after raising $64 million from the sale of 5.49 million shares through its At-The-Market (ATM) facility during the period, of which $37.2 million will be used to purchase additional ETH.

SharpLink also stated it grew its staking rewards to 322 ETH, earning an additional 100 ETH last week. As a result, its total treasury holdings have grown to 205,634 ETH, which it claims have been completely deployed across staking and restaking protocols.

SharpLink's stock, SBET, surged over 28% as investors rushed to buy on the announcement of its ETH acquisition, closing the day at $16.29, according to Google Finance data.

The company began purchasing ETH in early June, following a $425 million private placement led by Consensys, whose CEO, Joseph Lubin, went on to become SharpLink's Chairman.

Another Nasdaq-listed ETH treasury firm, BTCS, also plans to raise $100 million in 2025 through a combination of ATM equity offerings, convertible debt issuance, borrowing from DeFi lending protocol Aave, and yield generation opportunities via staking and block building. The company stated in a press release on Tuesday that the complex strategy enables it to increase shareholders' ETH per share "while minimizing dilution."

The development follows increased interest in ETH treasuries among low-capped publicly traded companies, especially with the buzz around tokenization and the GENIUS stablecoin bill, which the House will vote on next week.

Bit Digital (BTBT) announced a treasury balance of 100,603 ETH on Monday, following the acquisition of additional ETH using proceeds from the sale of 280 BTC and a $172 million offering. BitMine (BMNR) is also raising $250 million to launch a similar ETH treasury design.

These companies are following the footsteps of business intelligence software firm Strategy (formerly MicroStrategy), which began accumulating Bitcoin in 2020. The company has since increased its crypto treasury to 597,325 BTC, roughly 2.8% of Bitcoin's total supply.

Ethereum Price Forecast: ETH holds $2,500 support, eyes breakout above key symmetrical triangle

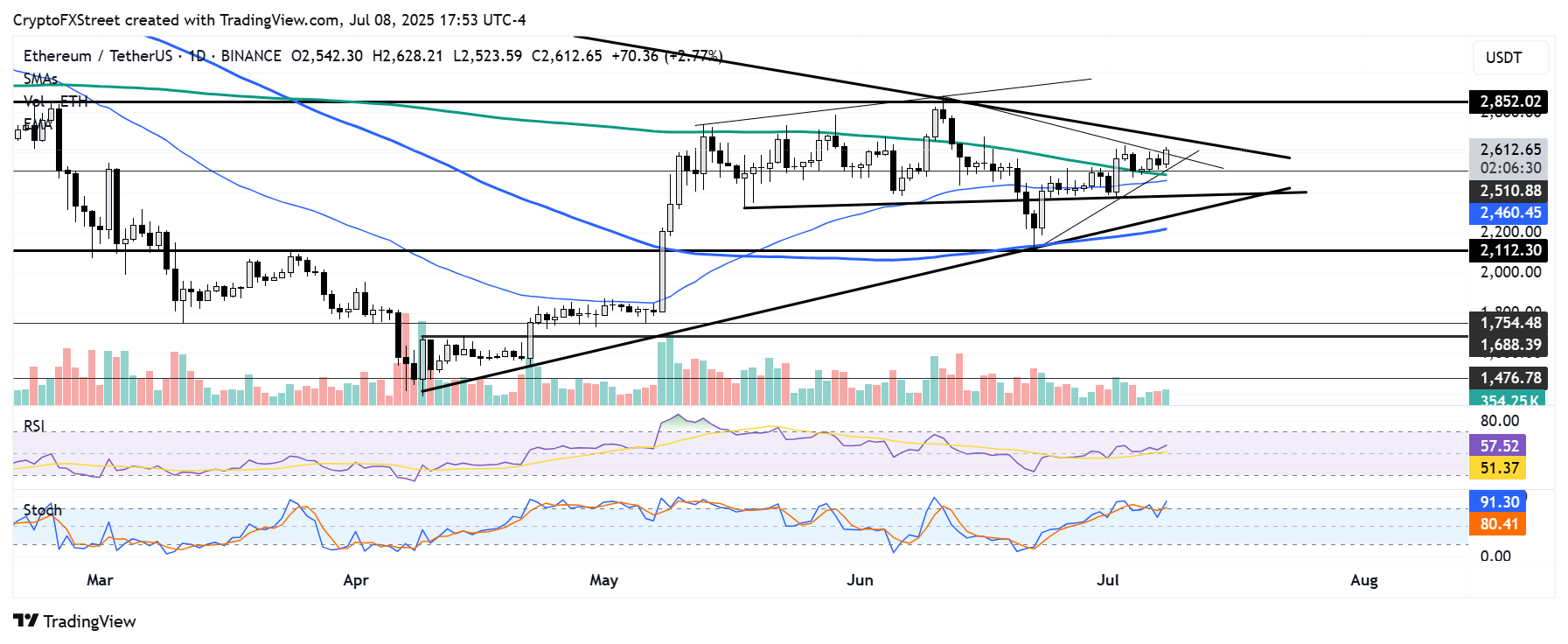

ETH is forming a strong support near $2,500 after bouncing near the $2,510 key price, strengthened by the 200-day Simple Moving Average (SMA) dynamic support. On-chain data also shows that $2,500 is one of the most significant accumulation zones for ETH in recent months, with investors scooping over 3.45 million ETH between $2,513 and $2,536, according to Glassnode data.

ETH/USDT daily chart

If ETH continues to hold the $2,500 support as it approaches the apex of a key symmetrical triangle, it could rally to test the resistance near $2,850, which has stood since February 4.

On the downside, ETH could test the lower boundary of the symmetrical triangle if it loses the $2,500 support.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are slightly tilted upward above their neutral levels, indicating a modestly dominant bullish momentum.