Crypto optimism continues as markets believe worst of trade crisis is over

- Top 10 cryptocurrencies post nearly double-digit gain in the last seven days as trade-related uncertainty clears.

- Bitcoin holds steady above $103,500 and Ethereum hovers above $2,500 early on Wednesday.

- Meme coins, utility tokens, and altcoin prices rally on optimism in the global market as the Trump administration closes trade deals.

The cryptocurrency market capitalization holds above $3.45 trillion while the top three cryptos (Bitcoin (BTC), Ethereum (ETH) and XRP are in the green on Wednesday. Sentiment among market participants has improved as the uncertainty surrounding the trade war crisis settles following the Trump's administration trade deal with the UK and its temporary agreement to lower reciprocal tariffs with China.

The Crypto Fear & Greed Index shows the sentiment has improved steadily over the past week. The indicator reads 73 at the time of writing, up from 67 last week.

Crypto Fear & Greed Index | Source: Alternative.me

Crypto token categories like meme coins, utility tokens and altcoins also extend gains, riding on market optimism.

Crypto traders rejoice, gear for further gains

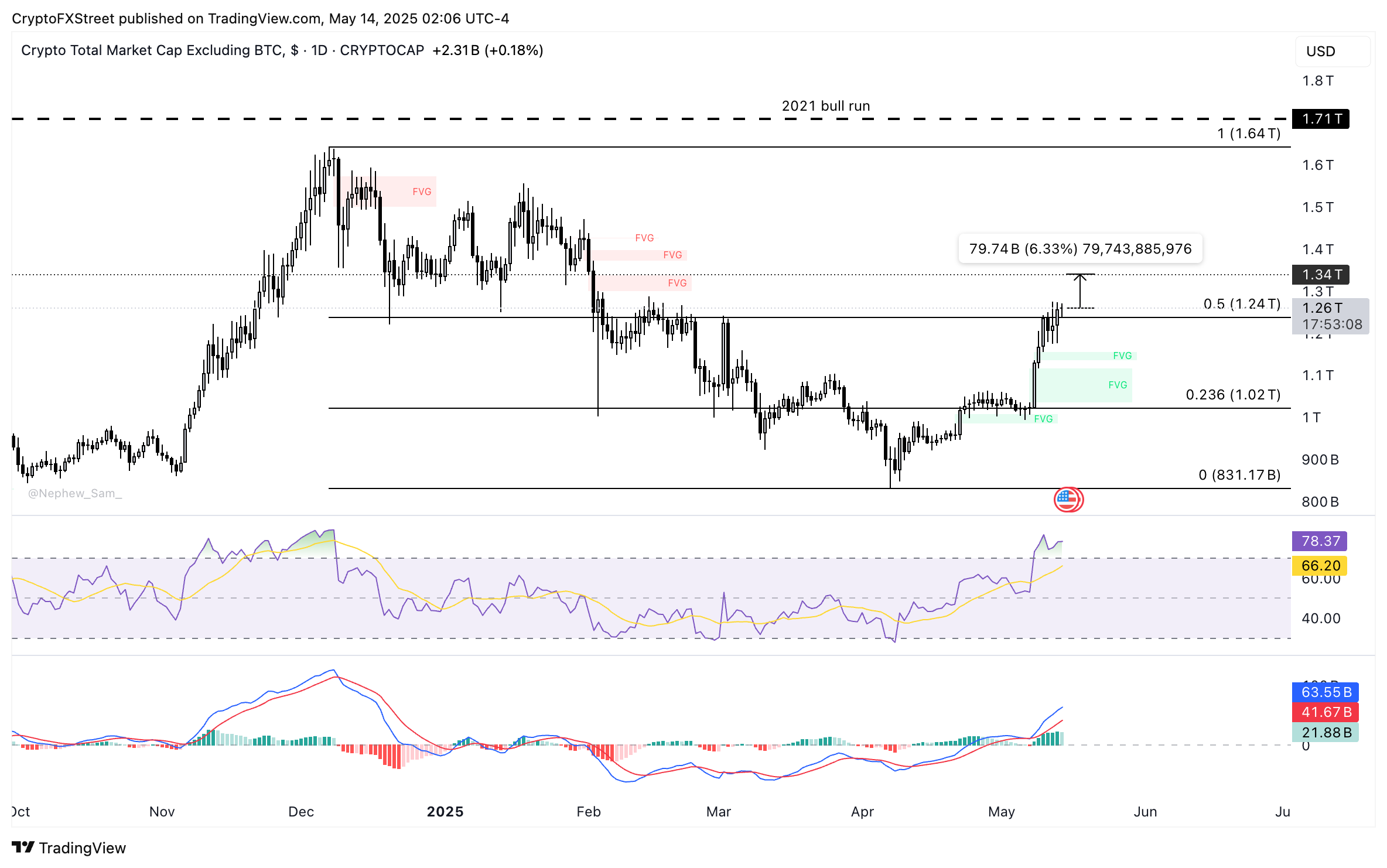

Data from CoinGecko shows that top 10 cryptocurrencies by market capitalization registered nearly double-digit gains in the last seven days. The total market capitalization of cryptocurrencies barring Bitcoin is back to a level previously recorded in February, just 6.33% away from $1.34 trillion, a key level marked by the upper boundary of a Fair Value Gap (FVG) on the daily price chart.

Crypto total market cap excluding BTC

Expert commentary

Ruslan Lienkha, Chief of Markets at YouHodler, told FXStreet that the agreement between the US and China to reduce tariffs is viewed as a positive development for the crypto market. Lienkha believes this could ease inflationary pressures and support global trade flows.

Lienkha said:

“Reduced tariffs can improve liquidity conditions and boost investor confidence, factors that are typically supportive of risk assets, including cryptocurrencies. Reduced trade tensions and improved macro stability should create a more constructive environment for risk assets. While both equities and crypto may benefit, crypto could experience relatively higher upside given its sensitivity to shifts in liquidity and investor sentiment.”

Still, the recent tariff adjustments still leave duties higher than the values noted prior to the initial trade policy shift, the analyst said, so the long-term deflationary impact may therefore be limited and gradual.

Commenting on Bitcoin’s price performance, Lienkha told FXStreet:

“A stable or rising equity market creates favorable conditions for Bitcoin to challenge new all-time highs. Conversely, if equity markets come under pressure, that negative sentiment is typically mirrored in Bitcoin’s price performance.”