Ethereum Price Forecast: ETH breaches $3,100 as accumulation and whale buying persist

Ethereum price today: $3,090

- Ethereum accumulation addresses scooped up 3.24 million ETH in November.

- Whales have increased their balance by 480,000 ETH between last Sunday and Thursday.

- ETH faltered at the 50-day EMA and has breached the $3,100 support level.

Ethereum (ETH) saw a 3% decline on Friday, briefly falling below $3,100 despite a strong buying activity across whale and accumulation addresses.

Accumulation addresses and whales remained active buyers during ETH's 45% drawdown

Ethereum is seeing one of its strongest accumulation trends. In November alone, accumulation addresses scooped 3.24 million ETH, their highest monthly inflow in 2025, according to CryptoQuant data.

-1765565401878-1765565401879.png)

Accumulation addresses are wallets with no record of selling activity — mostly dominated by newly created accounts.

The trend has extended into December, with these addresses receiving inflows of over 1.6 million ETH so far this month.

The increased buying activity coincides with a steep drawdown in ETH, where it fell by nearly 45% from $4,755 on October 7 to a low of $2,623 on November 21. The move signals a strong buy-the-dip attitude among this cohort, especially as prices approached their average cost basis.

CryptoQuant data show that the average cost basis of accumulation addresses has served as a support level for ETH in 2025. Notably, ETH bounced at this level on November 21 and December 1.

-1765565475828-1765565475829.png)

The same price range aligns with the average cost of whales with a balance of 10,000-100,000 ETH. This cohort added 1.4 million ETH to their holdings in November.

-1765565527957-1765565527958.png)

After a brief distribution last week, they've stepped on the gas, accumulating 480,000 ETH between Sunday and Thursday.

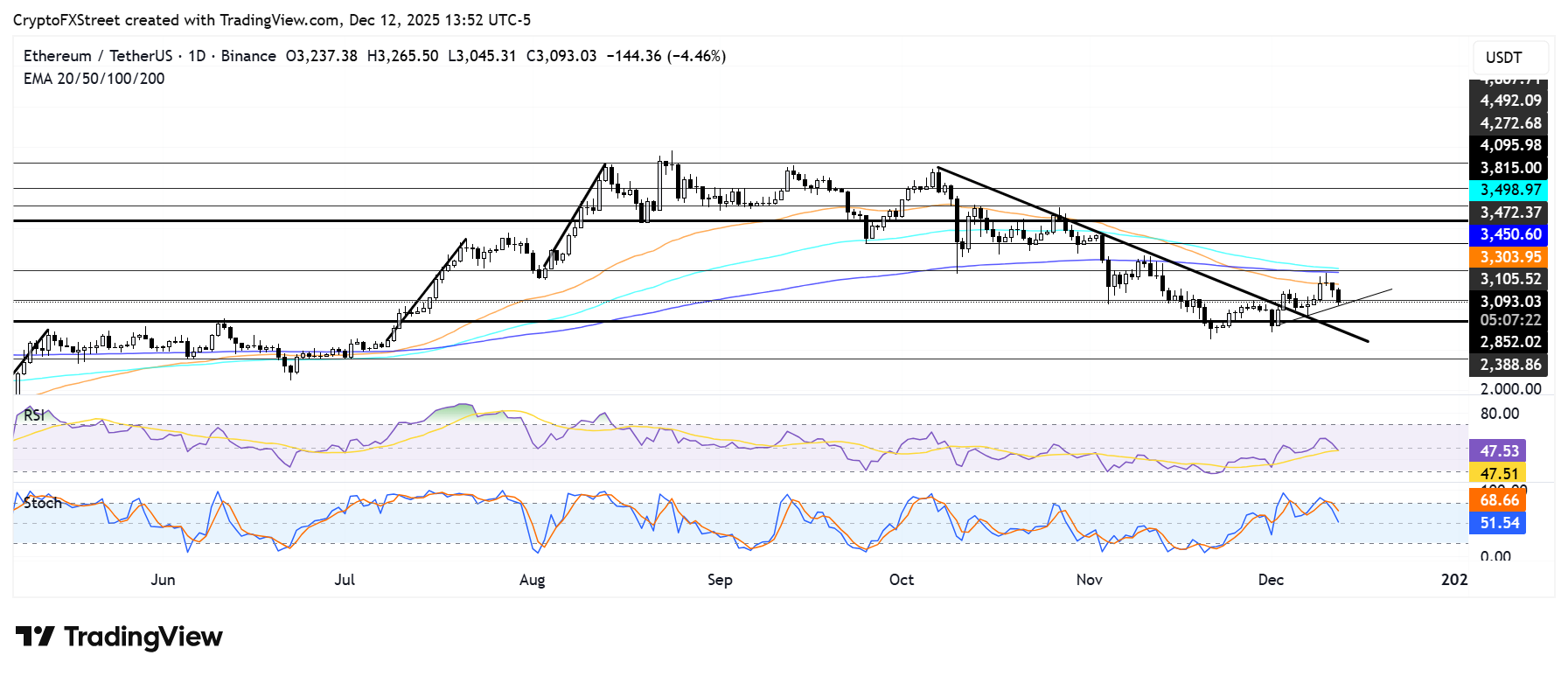

Ethereum Price Forecast: ETH falters at 50-day EMA, breaches $3,100

Ethereum saw $139.2 million in liquidations over the past 24 hours, led by $113.8 million in long liquidations, per Coinglass data.

ETH faltered at the 50-day Exponential Moving Average (EMA) and has breached support near $3,100. The top altcoin could fall toward $2,380 if the decline continues and ETH fails to find support at an ascending trendline extending from December 2 or the $2,850 key level.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are on a downtrend, testing their neutral levels. A firm decline below their neutral levels could accelerate the bearish momentum.