Ethereum Price Forecast: Ether plunges 6% despite BitMine's 82,000 ETH acquisition

Ethereum price today: $3,650

- Ethereum treasury company BitMine acquired 82,353 ETH last week, growing its stash to 3.39 million ETH.

- The firm bought over 744,500 ETH throughout October despite prices declining by 7% in the month.

- ETH declines over 6% on Monday, testing the 200-day EMA just above the $3,470 support.

Ethereum (ETH) dives 6% on Monday, as BitMine's latest update that it bought 82,353 ETH failed to lift market sentiment.

BitMine boosts treasury stash to 3.39 million ETH

Ethereum treasury firm BitMine Immersion (BMNR) bought 82,353 ETH since its update last week, marking another round of sustained buying pressure.

With the latest acquisition, BitMine's holdings have climbed to 3.39 million ETH or 2.8% of ETH's circulating supply. The company added over 744,500 ETH throughout October despite prices declining by 7% in the month.

"Ethereum fundamentals continue to strengthen at an accelerating pace, with stablecoin supply on ETH rising >15% in the past 8 weeks and application [revenue] reaching an all-time high," said BitMine's chairman Thomas Lee in a Monday statement. "Most of the time, price leads fundamentals but at times fundamentals drive ahead, but price 'converges higher.'"

The Nevada-based firm reported total net assets of $13.7 billion, growing its cash balance to $389 million while maintaining a 192 Bitcoin (BTC) holding. However, its stake in the Worldcoin treasury, Eightco Holdings (ORBS), dropped from $88 million to $62 million.

BitMine, which plans to acquire 5% of ETH's circulation under a vision dubbed the 'Alchemy of 5%,' tops a host of public companies scrambling to accumulate ETH. Following BitMine is SharpLink Gaming (SBET), which holds 859,395 ETH, and The Ether Machine (ETHM) with 496,712 ETH, according to the StrategicETHReserve data.

Meanwhile, Ethereum exchange-traded funds (ETFs) saw $15.97 million in net inflows last week, led by Grayscale Ethereum Mini Trust (ETH), which brought in $56.05 million.

Ethereum Price Forecast: ETH plunges 7%, eyes $3,470 support

Ethereum saw $292.6 million in liquidations over the past 24 hours, led by $269.2 million in long liquidations, according to Coinglass data.

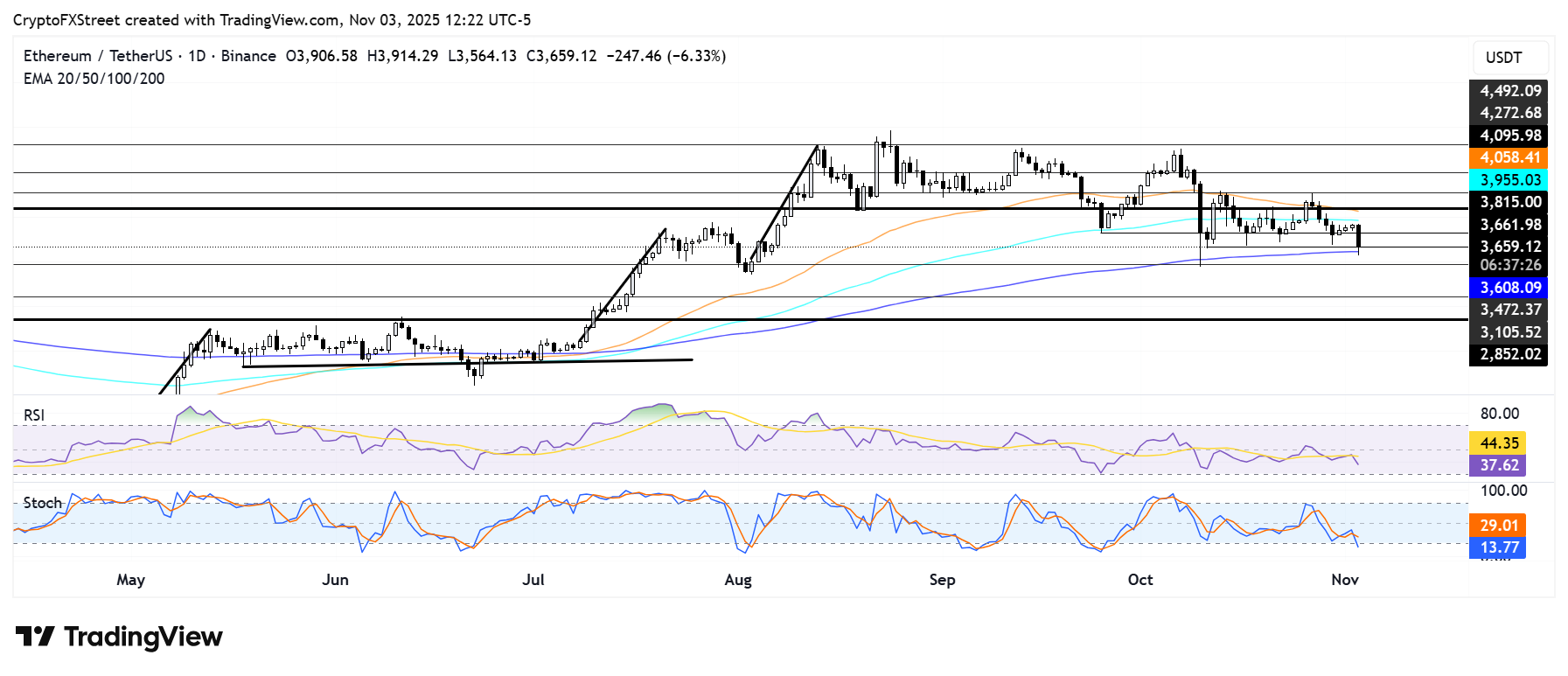

ETH has declined over 6% on Monday, breaching the $3,660 support and is testing the 200-day Exponential Moving Average (EMA). A failure to hold the 200-day EMA could push ETH to the support near $3,470. Further down is the $3,100 key level.

ETH/USDT daily chart

On the upside, ETH has to stage a recovery above $4,100 to resume a bullish trend.

The Relative Strength Index (RSI) saw a rejection at its neutral level and is trending toward oversold territory. Meanwhile, the Stochastic Oscillator (Stoch) has entered the oversold region, indicating a strong dominant bearish momentum. However, such conditions in the Stoch could also spark a short-term recovery.