Solana Price Forecast: SOL gains 6% as Solmate outlines plans for its treasury

- Solmate plans to launch the "first performant Solana validator" in the Middle East.

- The company also highlighted plans to pursue an "aggressive M&A strategy," prompting a 36% rise in its stock.

- SOL gained 6% on Thursday but could face resistance at the key 100-day EMA.

Solana (SOL) is up 6% on Thursday following a similar spark in the stock of treasury company Solmate after it outlined plans to streamline its company operations.

Solmate expresses validator center and M&A strategy plans

Solana treasury company Solmate Infrastructure (SLMT) issued an update on Wednesday regarding its validator operations, data center selection, a planned M&A strategy, and an amended rights agreement for its oversubscribed offering.

The company, formerly known as Brera Holdings, said it has chosen a data center in the UAE, and will begin testing what could be "the first performant Solana validator in the Middle East."

After purchasing over $50 million in discounted SOL tokens from the Solana Foundation last week, Solmate plans to use them to test its validator operations.

The Nasdaq-listed company said its "infrastructure-first efforts differentiate it from digital asset treasuries (DATs) that rely on financial engineering to drive growth."

Solmate also outlined an "aggressive M&A strategy" focused on companies that complement its treasury model.

"We are targeting businesses for which our SOL treasury will be fuel for their engine of growth — just like it is for ours — and will use that growth to accrete more SOL-per-share for Solmate investors," said Marco Santori, Solmate CEO and former chief legal officer at crypto exchange Kraken, in the update.

The company raised $300 million last month in a private investment in public equity (PIPE) deal involving Cathie Wood's ARK Invest, Pulsar Group, RockawayX and the Solana Foundation. It has negotiated an amendment with participants in the PIPE offering, with a registration statement expected to be filed by November 22.

Solmate, which holds 1.21 million SOL, ranks as the sixth-largest public Solana digital asset treasury, behind Forward Industries, Solana Company, DeFi Development Corp, Sharps Technology, and Upexi, according to the Strategic SOL Reserve website.

The company's stock, SLMT, closed on Thursday at $11.41, up over 36%.

SOL faces the 100-day EMA hurdle after a 6% rise

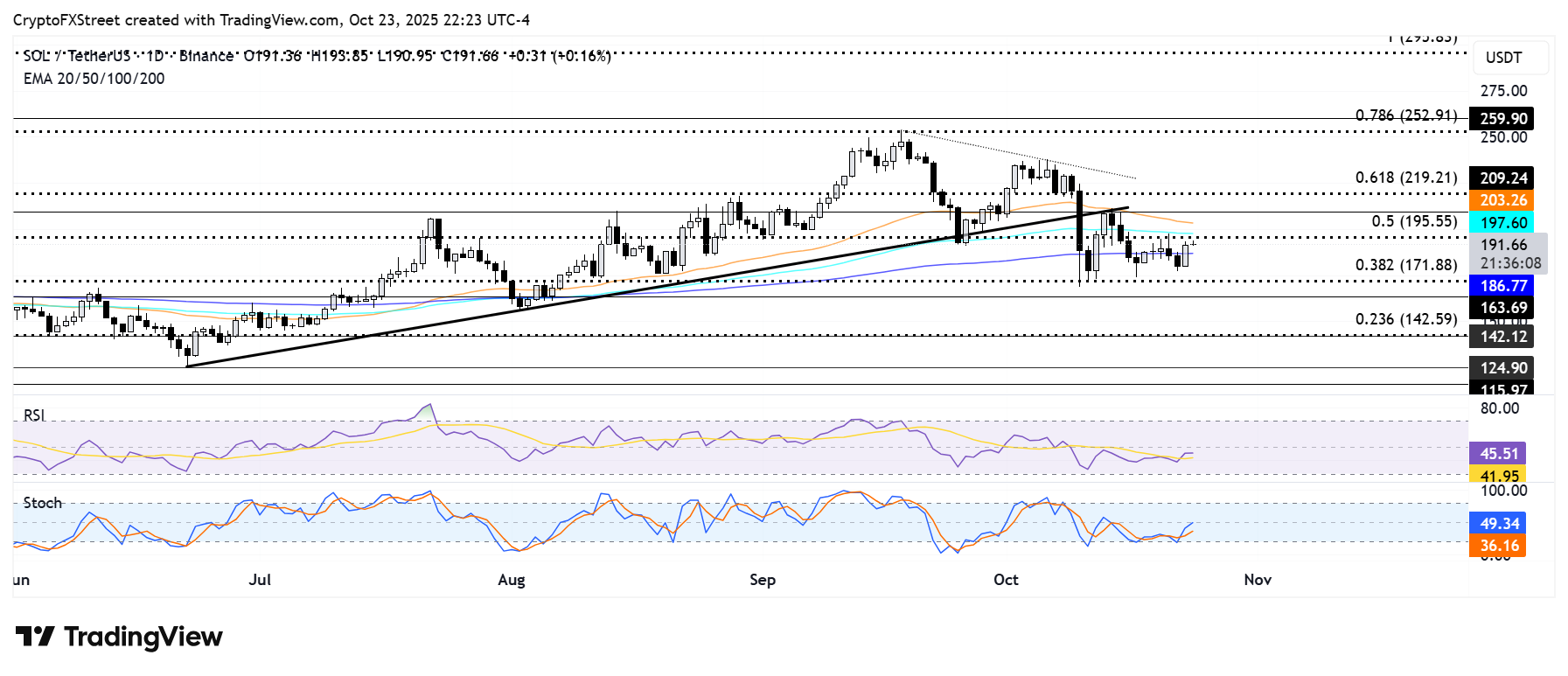

Solana surged 6% over the past 24 hours, outperforming the top ten cryptos, as it looks to retest the 50% Fibonacci Retracement level at $195.5.

SOL/USDT daily chart

The level is strengthened by the 100-day Exponential Moving Average (EMA), which restricted SOL's upward move on Tuesday. A firm move above the 100-day and 50-day EMAs could send SOL to tackle the $209 key level.

On the downside, SOL could find support near the 38.2% Fibonacci Retracement level at $171.8 if it fails to rise above $195.5.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are testing their neutral levels, indicating a weakening bearish momentum.