Ripple Price Forecast: XRP rebounds on rising retail demand, falling exchange inflows

- XRP rebounds above key $2.40 support in tandem with other crypto majors on Thursday.

- XRP inflows into the Binance exchange decline significantly amid potential bear exhaustion.

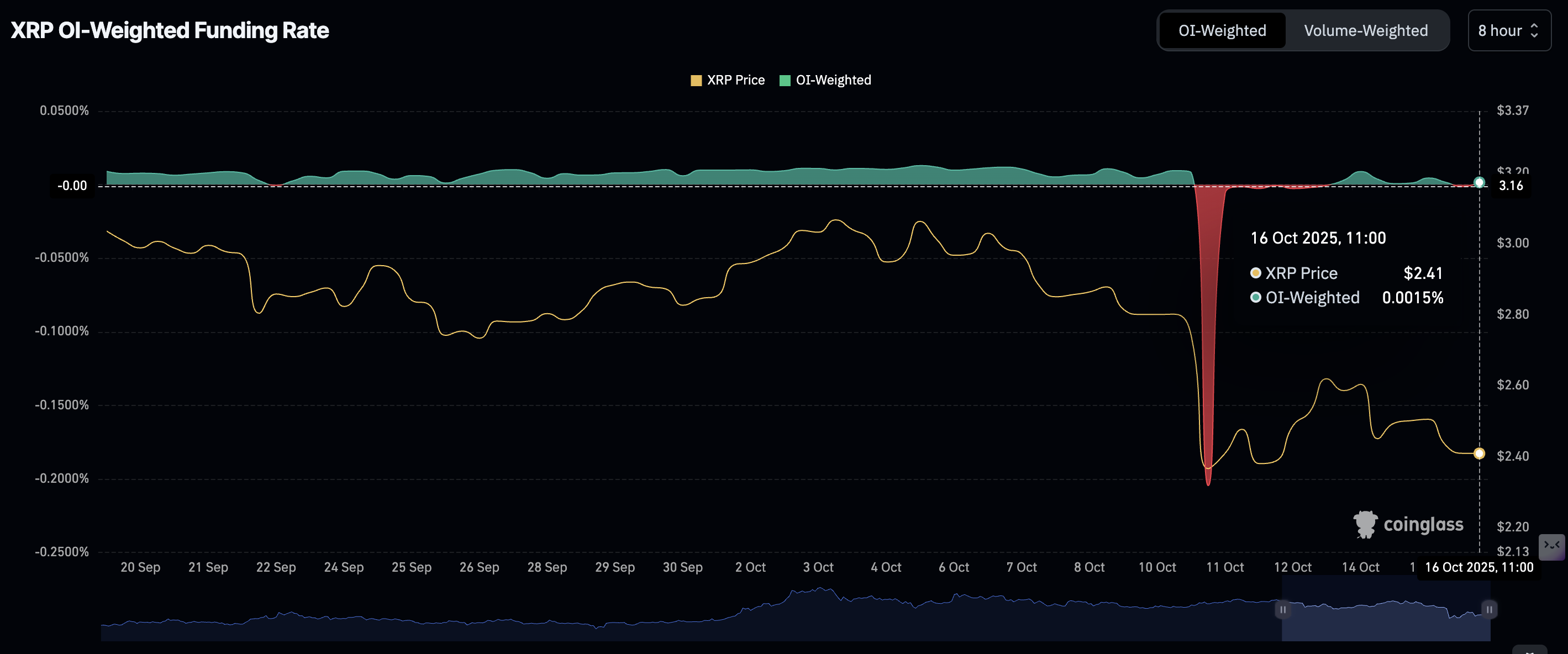

- Traders start piling into long positions as the XRP futures Open Interest weighted funding rate steadies.

Ripple (XRP) rises above $2.40 at the time of writing on Thursday, following two consecutive days of declines. The token briefly corrected, with the intraday candle wick reaching $2.35 earlier in the day, as a bearish wave spread across the cryptocurrency market.

If retail interest steadies in upcoming sessions, the uptrend could extend toward short-term resistance at $2.62 and later the psychological $3.00 level.

XRP shows signs of stability as selling pressure eases

XRP inflows into the Binance exchange increased in October, peaking at approximately 362 million tokens last Saturday. The surge coincided with the largest deleveraging event in the history of the industry and the subsequent flash crash in the XRP price to $1.25.

Traders often transfer assets to exchanges with the intention of trading or selling. Hence, the surge in inflows likely contributed to selling pressure. However, with inflows reducing this week, as shown in the chart below, a potential shift in sentiment could pave the way for a sustained recovery in the XRP price.

-1760625147622-1760625147623.png)

XRP Ledger Exchange Inflows - Binance | Source: CryptoQuant

Meanwhile, the XRP derivatives market has stabilized, with the futures Open Interest (OI) weighted funding rate flipping positive. According to CoinGlass data, the OI funding rate averages 0.0015% on Thursday, following a historical dip to -0.2045% on Saturday.

If an uptrend develops above the mean line in the coming days, as traders increase their exposure to XRP longs, it will suggest improved sentiment and boost the short-term bullish outlook.

XRP OI-Weighted Funding Rate | Source: CoinGlass

Technical outlook: Can XRP bolster its recovery?

XRP is trading above a short-term support established at $2.40, as cryptocurrencies post marginal gains on Thursday. This subtle uptick reflects the increase in retail demand along with the drop in exchange inflows.

If bulls tighten their grip, traders could anticipate a breakout above the 200-day Exponential Moving Average (EMA) at $2.62 on the daily chart and increase the odds of the price of XRP rising toward the $3.00 level.

XRP/USDT daily chart

Still, with the Moving Average Convergence Divergence (MACD) indicator maintaining a sell signal on the same daily chart, triggered on Thursday, downside risks remain.

The downward-trending Relative Strength Index (RSI) at 33 suggests the bearish momentum is increasing. Hence, the short-term support at $2.40 must hold to prevent the down leg from stretching to sweep more liquidity at $2.22, a level tested in early June.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.