Bitcoin Weekly Forecast: Fresh all-time highs, more to come?

- Bitcoin price steadies around $121,300 on Friday after reaching a new all-time high of $126,199 earlier this week.

- Profit-taking activity remains modest, with selling pressure still at relatively low levels.

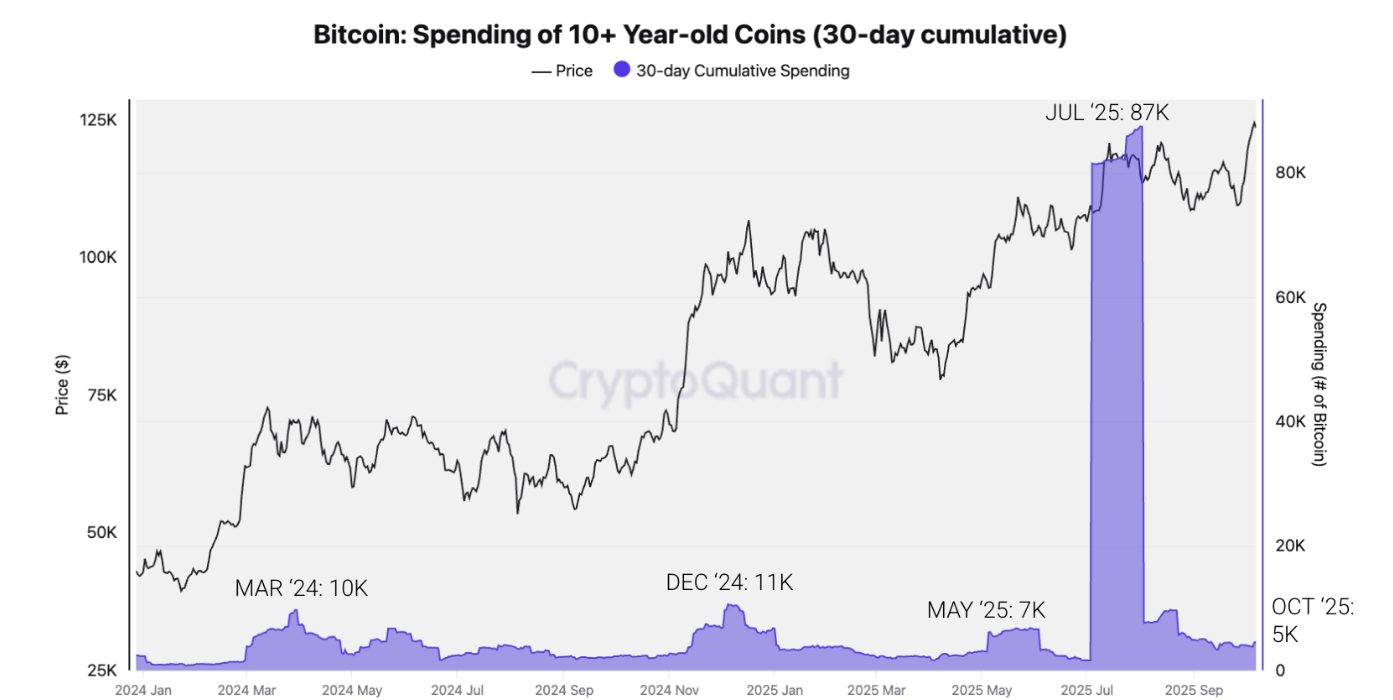

- Institutional demand continues to rise, with $2.72 billion in spot ETF inflows.

Bitcoin (BTC) steadies around $121,300 at the time of writing on Friday, after setting a new record high of $126,199 four days ago. While BTC experiences a minor correction so far this week, profit-taking remains modest and overall selling pressure continues to stay low. Meanwhile, the institutional demand keeps strengthening, with $2.72 billion in fresh inflows by Thursday, suggesting the rally may still have more room to run.

Bitcoin rally pauses as holders realize some profit

Bitcoin price started the week on a positive note, reaching a new all-time high of $126,199 on Monday. However, this upward momentum paused and BTC experienced a slight 2.5% pullback until Friday this week, as holders realized some gains.

This can be seen from the chart below, where Santiments’ Network Realized Profit/Loss (NPL) metric showed a spike on Monday, Tuesday and Wednesday for BTC, indicating that holders are, on average, selling their bags at a significant profit and increasing the selling pressure.

[14-1760092650801-1760092650813.38.57, 10 Oct, 2025].png)

BTC NPL chart. Source: Santiment

Despite some profit-taking, CryptoQuant reported that selling pressure remains low after Bitcoin’s new all-time high of $126,199. This indicates the rally may have further room to run, and a market top is not yet in sight.

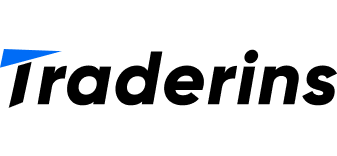

The chart below shows that the total net realized profits of Bitcoin holders over the last 30 days stand at 0.26 million BTC on Wednesday, equivalent to a $30 billion profit. This level is 50% below July’s previous peak of 0.52 million BTC or $63 billion profit, and far from the March and December 2024 levels of $78 and $99 billion profits, respectively.

“Low levels of profit-taking indicate that market participants are not selling heavily and that the price rally may continue ahead,” said CryptoQuant’s analyst.

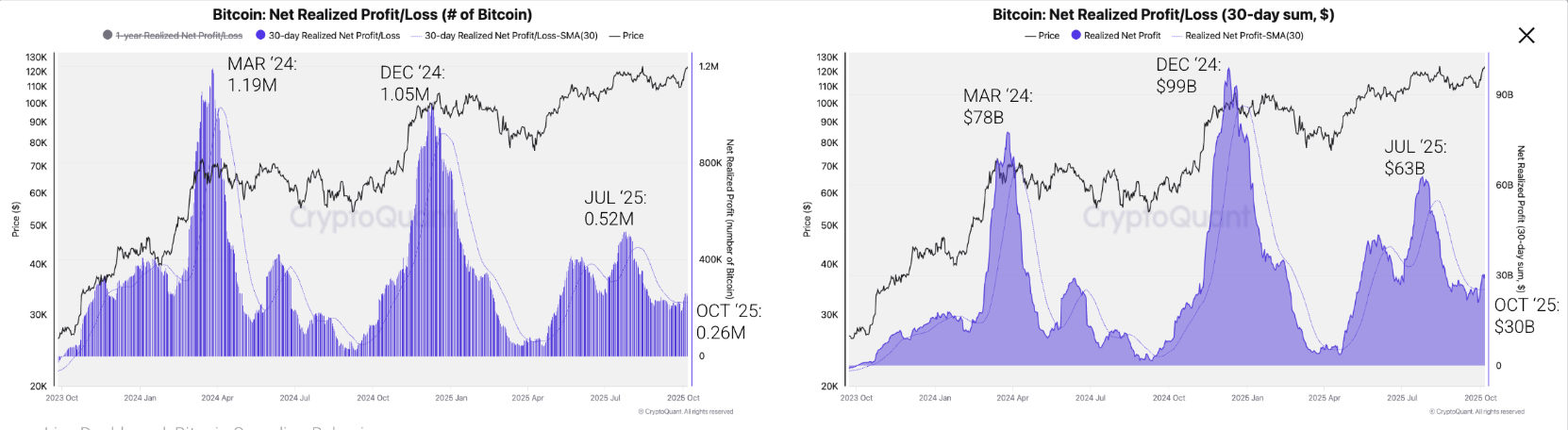

Moreover, selling activity from Bitcoin “OGs” also remains relatively low. Bitcoin's spending of 10+ year-old coins in the last 30 days stood at 5,000 on Wednesday – half of the expenditure seen in previous price peaks in March and December 2024, 29% below May’s 2025 top, and 94% lower than the July highs. High selling activity from Bitcoin OGs typically accompanies price tops.

Institutional demand remains strong

Bitcoin institutional demand remained strong as of this week. According to SoSoValue data (chart below), Bitcoin spot ETFs recorded a total of $2.72 billion in inflows as of Thursday. This marks the second consecutive week of positive flow, following the largest inflow in 2025 and the second-largest on record in the previous week, which pushed the BTC price to new highs.

On the corporate side, DDC Enterprise Limited (DDC), a publicly listed company pioneering Bitcoin treasury adoption, announced on Wednesday the completion of a $124 million equity financing round, led by PAG Pegasus Fund and Mulana Investment Management. The proceeds will be used to advance the company’s Bitcoin treasury strategy. To date, DDC has accumulated a total of 1,058 BTC.

Earlier on Tuesday, KindlyMD, Inc. (NAKA), a provider of integrated healthcare services and a Bitcoin treasury vehicle through its subsidiary Nakamoto Holdings, announced a strategic partnership with Antalpha (ANTA) and its intent to establish $250 million convertible debt facility.

The proceeds will also be used to expand Bitcoin holdings in the Nakamoto Bitcoin Treasury, fund general corporate purposes, and replace a prior $203 million Bitcoin-backed credit facility from Two Prime Lending Limited, which will remain available for future use.

Mixed sentiments among traders

Bitcoin price recovered slightly on Wednesday, closing above $123,300. This recovery followed the Minutes from the Federal Reserve’s September meeting, which indicated near unanimity among participants to lower interest rates over the remainder of the year, amid concerns about labor market risks. Policymakers, however, remained split on whether there should be one or two additional rate reductions before the year-end. This dovish stance triggered a slight risk-on sentiment, which helped BTC to recover. Adding to this, the Israel-Hamas ceasefire and hostage agreement announced this Thursday eases some of the geopolitical tensions, supporting Bitcoin's recovery.

However, Fed Chair Jerome Powell’s Thursday speech offered no new monetary policy cues. At the same time, the US government shutdown dragged into its second week after the Senate rejected motions to advance competing bills for the seventh time on Thursday and will not hold any further votes until at least next Tuesday, when the upper chamber is expected to return.

This development led the US Dollar to rise to its highest level since early August on Thursday, pressuring risk assets as its negative correlation with Bitcoin pushed BTC down to $119,651 on the day.

On Friday, Ukraine reported a large-scale Russian assault on Kyiv, involving ballistic missiles and drone strikes, which targeted critical infrastructure and caused widespread power outages. This keeps geopolitical risks in play and largely offsets the optimism led by the Israel-Hamas agreement on the first phase of the Gaza peace plan.

Luxembourg’s sovereign wealth fund becomes first in the Eurozone to invest in BTC

According to a post by Coin Bureau on Thursday, Luxembourg's Intergenerational Sovereign Fund becomes the first Eurozone state fund to invest in Bitcoin, allocating 1% of its holdings to Bitcoin ETFs.

This move is bullish for Bitcoin in the longer term as it increases its legitimacy among institutional investors, leads to wider adoption, and could pave the way for other European states to follow.

Correction or new record high?

Bitcoin price reached a new all-time high (ATH) of $126,199 on Monday, but failed to maintain the upward momentum and declined over 2% until Thursday, retesting the $120,000 support level. At the time of writing on Friday, it hovers at around $121,300.

If BTC continues its correction and closes below $120,000, it could extend the decline toward the next daily support level at $116,000.

The Relative Strength Index (RSI) on the daily chart reads 59 after falling from the overbought conditions on Monday, indicating a potential slowdown in bullish momentum and the likelihood of short-term consolidation.

BTC/USDT daily chart

However, if the $120,000 holds as support and BTC maintains its upward momentum, it could extend the rally toward the record high of $126,199.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.