Bittensor Price Forecast: TAO rallies amid Yuma Asset Management launch with flagship funds

- Bittensor surfaces above the 200-day EMA, recording over 7% gains so far on Friday.

- Yuma's CEO, Barry Silbert, announces two flagship funds on Bittensor’s subnet tokens.

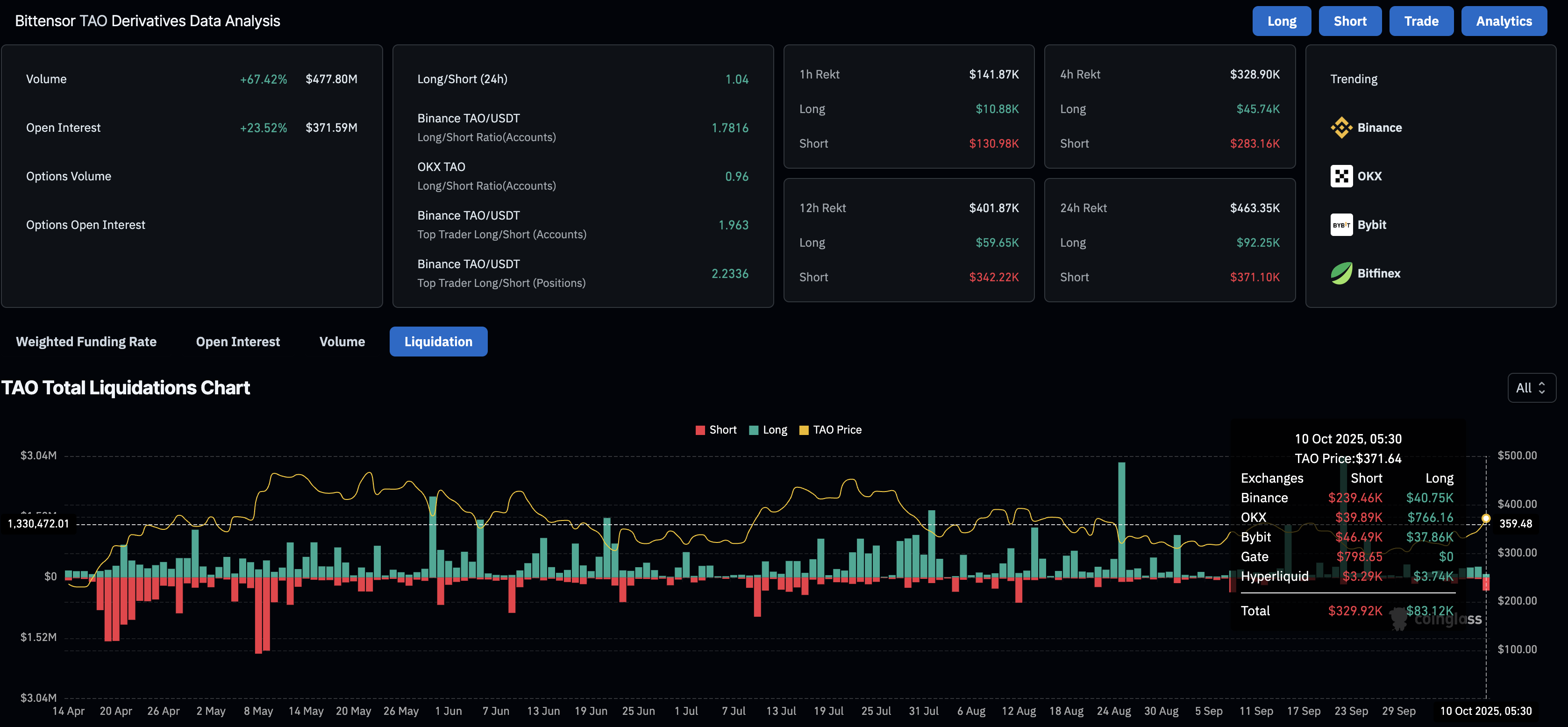

- Derivatives data signals an increase in retail interest.

Bittensor (TAO) price is up by 7% at the time of writing on Friday, extending its uptrend for the third consecutive day. The TAO rally is based on the recent announcement by Digital Coin Group’s CEO, Barry Silbert, of the launch of two flagship funds for Bittensor’s subnet token, which are part of its decentralized Artificial Intelligence (deAI) ecosystem.

Technically, the recovery run eyes further gains as bullish momentum increases alongside positive sentiments in the derivatives market.

Barry Silbert’s new subnet token funds fuel optimism surrounding Bittensor

Barry Silbert, the CEO of Digital Coin Group (DCG) and Yuma, announced the launch of Yuma Asset Management on Thursday, with a $10 million investment from DCG. The investment division will help institutional and accredited investors gain exposure to Bittensor’s deAI ecosystem of subnet tokens.

Subnets are mini-networks within the Bittensor ecosystem designed for specific use cases like translations, pattern or image recognition, fraud detection, etc., with their native alpha tokens paired against TAO. Stronger demand for a particular subnet would increase its emissions, generating rewards for miners, stakers, potential investors, and others that Yuma Asset Management is trying to onboard.

The two flagship funds are the Yuma Subnet Composite Fund, which will provide a market-cap-based exposure including all active subnets, and the Yuma Large Cap Subnet Fund, which will provide a more targeted exposure.

Bittensor breakout rally eyes further gains on rising retail demand

Bittensor’s recovery of over 7% at press time on Friday outgrows the short-term declining range on the daily chart. The third consecutive day of profit exceeded the 200-day Exponential Moving Average (EMA) at $358, which acted as a dynamic resistance in late August and September.

A decisive close above this dynamic average line would confirm the range breakout, which could target the $464 level, marked by the May 10 close. Beyond this, the $500 psychological level and the January 5 close at $562 could act as overhead resistances.

Adding to the upside potential, the retail interest surrounding Bittensor has increased. CoinGlass data shows that the TAO futures Open Interest (OI) is up 23.52% in the last 24 hours, reaching $371.59 million. This double-digit rise refers to an increase in the value of outstanding futures contracts, indicating a boost in traders’ conviction that TAO will secure further gains.

Additionally, the short liquidations of $329,920 so far on Friday outpace the long liquidations of $83,120, suggesting a buy-side dominance as sellers are squeezed out.

TAO derivatives data. Source: CoinGlass

The technical indicators on the daily chart indicate a bullish bias as the Relative Strength Index (RSI) advances to 66, reflecting heightened buying pressure. Additionally, the Moving Average Convergence Divergence (MACD) extends the uptrend into positive territory amid successive rises of green histogram bars, indicating a steady rise in bullish momentum.

TAO/USDT daily price chart.

Looking down, if TAO fails to hold above the 200-day EMA, the 50-day EMA at $336 and the $300 psychological mark could act as support levels.