MYX Finance beats the market as Worldcoin, Virtuals Protocol record double-digit rise

- MYX Finance wins BNB Chain Annual Awards, fueling an uptrend to a record high.

- Worldcoin hits an eight-month high as Eightco announces $270 million WLD treasury.

- Virtuals Protocol recovers further off the lower descending channel boundary amid security maintenance.

MYX Finance (MYX), Worldcoin (WLD), and Virtuals Protocol (VIRTUALS) outperform the broader market with significant gains over the last 24 hours. MYX outperforms the broader market as it wins the BNB Chain Annual Awards, while Eightco underpins WLD’s ballistic recovery with a $250 million treasury.

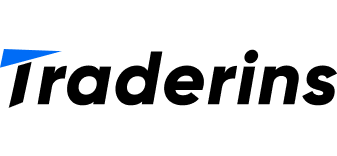

MYX Exchange goes ballistic with BNB Chain Awards victory

MYX Finance wins the Binance Annual Awards for the high volume decentralized exchange (DEX) category, named “Volume Powerhouse.” The runner-ups were Superp and PancakeSwap.

MYX token trades close to $13.50 at press time on Tuesday, retracing from the all-time high of $14.58 recorded earlier on the day. The immediate support for the DEX token lies at the 78.6% Fibonacci level at $11.31, which is retraced from Saturday’s open at $1.15 to Monday’s close at $14.08 as it takes a breather after a 303% rise on Monday.

The momentum indicators on the daily chart indicate a bullish bias as the Moving Average Convergence Divergence (MACD) and its signal line shoot up with high-rise green histogram bars.

Additionally, the Relative Strength Index (RSI) reads 92 on the same chart, indicating oversaturated buying pressure.

MYX/USDT daily price chart.

Looking up, a bullish continuation could target the 1.272 Fibonacci retracement at $17.60.

Worldcoin jumps as Eightco announces $270 million treasury plans

Worldcoin gains traction as Eightco Holdings Inc. (OCTO), a NASDAQ-listed company, announces the world’s first WLD treasury. Eightco plans to fund $250 million from private placement and an additional $20 million of strategic placement from BitMine (BMNR).

Worldcoin appreciates 10% at press time on Tuesday, extending the 52% gains from the previous day. The identity token marks the fifth consecutive day of recovery, hitting an eight-month high at $1.94 earlier on the day.

If the uptrend marks a decisive close above the $1.88 level, the bulls could target the $2.00 round figure.

Adding to the bullish bias, the MACD indicator displays a sharp increase in green bars and an uptick in the average lines, suggesting a boost in bullish momentum. Even so, the RSI reads 81 on the daily chart, indicating overbought conditions, as risk of a reversal looms.

WLD/USDT daily price chart.

On the downside, if WLD fails to uphold above the $1.64 level, it could extend the decline to the $1.50 psychological level.

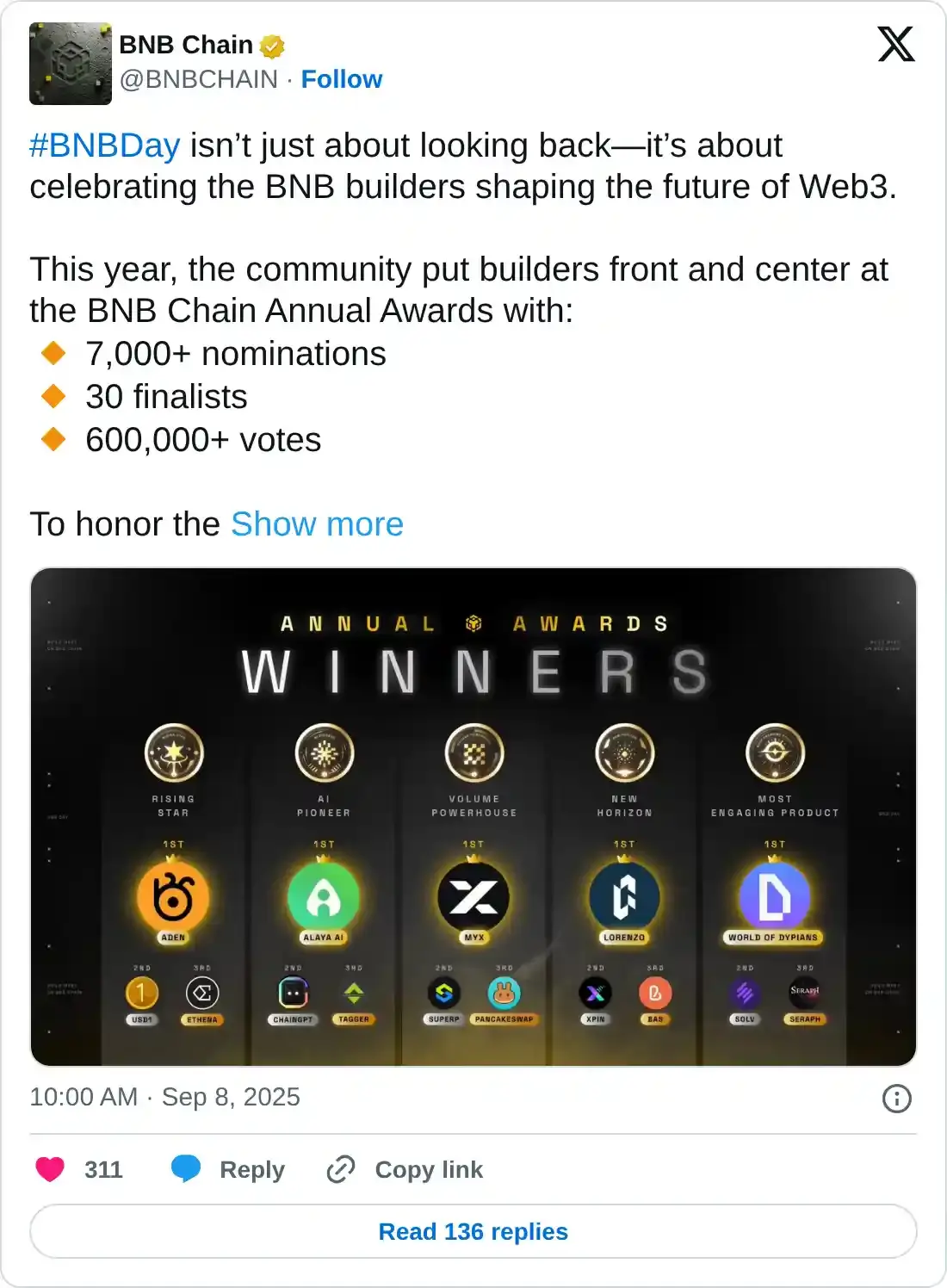

Virtuals Protocol upholds recovery amid security checks

Virtuals Protocol has announced that all websites will be under maintenance for a security check and potential upgrades on Tuesday. The checkup comes as a proactive move to overcome the recent reports of Node Package Manager (NPM) supply chain attacks. These attacks are a result of one or more compromised NPMs that exploit trusted developers of the larger chain.

VIRTUAL gains over 2% at press time on Tuesday, building on the 11% rise from Monday. The recovery run extends an upcycle within a falling channel pattern on the daily chart.

A decisive close above the 200-day Exponential Moving Average (EMA) at $1.37 could extend the rally to the upper resistance trendline near $1.50. In case of a channel breakout, the $1.95 level marked by the July 22 high could be a potential target.

The MACD and signal line approach the zero line after a recent crossover on Saturday, suggesting that the bullish momentum is increasing. Furthermore, the RSI at 56 rises above the halfway line, with further space to reach the overbought region, suggesting upside potential.

VIRTUAL/USDT daily price chart.

Looking down, a reversal below the 50-day EMA at $1.28 could test the $1.00 psychological support.