Ethereum Price Forecast: The Ether Machine secures $650 million investment as ETH declines below key support

- The Ether Machine announced that it has secured a 150,000 ETH investment worth about $654 million.

- The announcement follows SharpLink Gaming's statement that it purchased 39,008 ETH last week.

- ETH has declined below a key ascending trendline support for the first time since June 22.

Ethereum (ETH) declined below a key ascending trendline support on Tuesday following The Ether Machine's announcement that it has secured a $654 million investment for its treasury.

Ethereum treasury firm gets 150,000 ETH boost

Digital asset treasury (DAT) company The Ether Machine announced on Tuesday that it secured a 150,000 ETH investment, worth about $654 million, in August for its digital asset treasury.

The investment, set to close in the fourth quarter, was made by Ethereum enthusiast Jeffrey Berns, who will join The Ether Machine's board of directors.

In addition to a previously announced committed financing of $800 million and a 169,984 ETH investment from its co-founder and Chairman, Andrew Keys, the company has now secured 495,362 ETH in committed capital, a statement on Tuesday reveals. It also noted that it has $367.1 million in cash to purchase additional ETH, "assuming no Dynamix Corporation public shareholders exercise their redemption rights and prior to the payment of transaction expenses."

"With the landmark commitment from Ethereum originalist Jeff Berns, one of the largest individual investments ever in a crypto treasury company, we now have nearly 500,000 ETH — about $2.5 billion," said co-founder and Chairman Andrew Keys in an X post. "That scale gives us unmatched strength and credibility in this market."

The Ether Machine plans to go public on the Nasdaq under the ticker ETHM upon the completion of a business combination between Dynamix Corporation and The Ether Reserve.

The firm's new investment follows steady ETH purchases by publicly traded companies over the past week.

SharpLink Gaming (SBET) said it purchased 39,008 ETH last week, bringing its total holdings to 837,230 ETH, according to a Tuesday statement. The Minnesota-based firm noted that it currently has about $71.6 million of cash and equivalents at its disposal for further ETH purchases after raising $46.6 million through its At-The-Market (ATM) facility.

Another DAT firm, ETHZilla, announced on Tuesday that it will pursue yield generation opportunities by deploying $100 million worth of ETH into the liquid staking protocol, EtherFi. The company stated that it holds 102,246 ETH and $221 million in cash equivalents.

The recent ETH acquisitions have pushed the total holdings of Ethereum treasury companies to 3.6 million ETH, valued at about $15.41 billion at the time of publication, according to data from the Strategic ETH Reserve.

Ethereum Price Forecast: ETH risks invalidating a bullish flag

Ethereum saw $146.6 million in futures liquidations over the past 24 hours, per Coinglass data. The total amount of long and short liquidations is $98.3 million and $48.3 million.

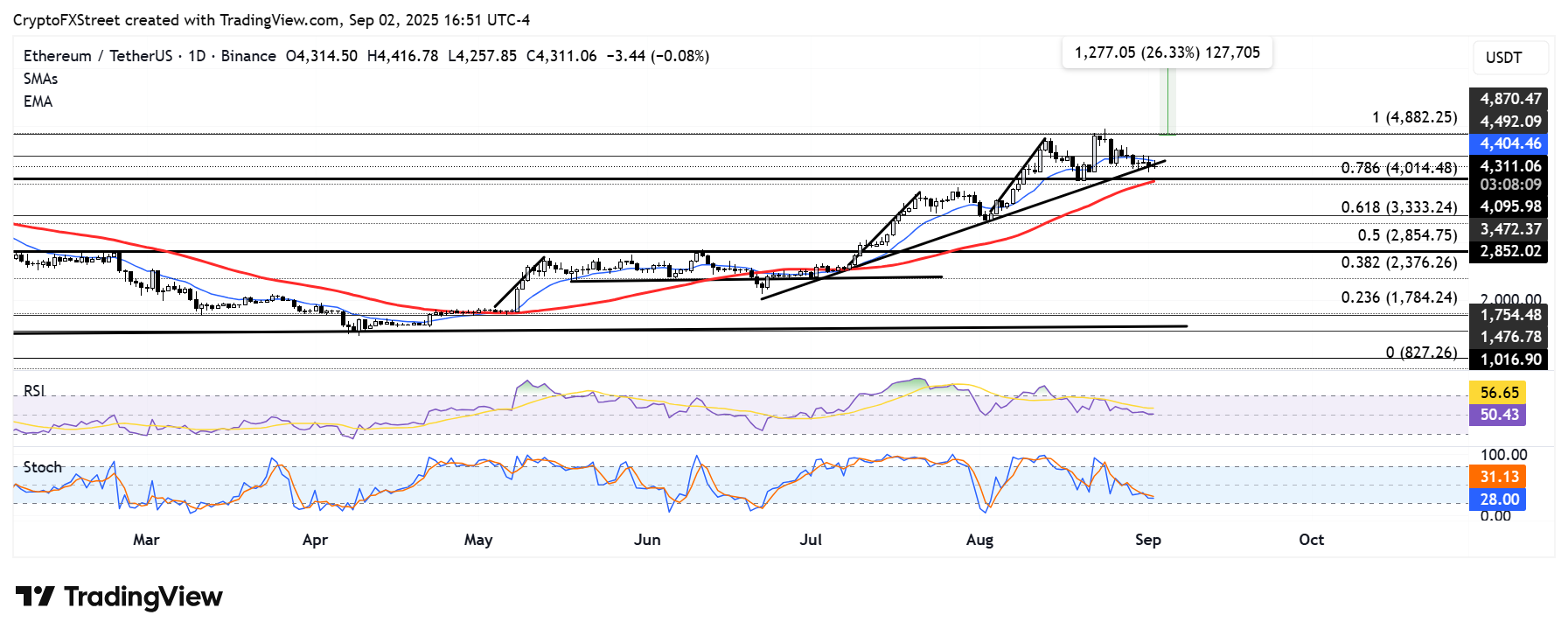

ETH is struggling to hold a key ascending trendline support after declining below it for the first time since June 22. As bulls and bears battle at the trendline, investors are watching the key support range between $4,000 and $4,100, which is strengthened by the 50-day Exponential Moving Average (EMA).

ETH/USDT daily chart

A firm decline below the $4,000 trendline will invalidate a multi-month bullish flag pattern, potentially sending ETH toward the $3,470 support level.

On the upside, ETH has to firmly recover the $4,500 level to begin another uptrend.

The Relative Strength Index (RSI) is testing its neutral level while the Stochastic Oscillator (Stoch) is on the verge of crossing into its oversold region.