Ripple Price Forecast: XRP consolidates amid neutral retail activity, declining open interest

- XRP price holds above $3.00 as investors digest the impact of US PPI data on inflation and the Fed's interest rate decision.

- Declining futures Open Interest indicates waning bullish momentum and reduced investor interest.

- XRP's neutral retail activity signals upward potential without overheating.

Ripple (XRP) leans slightly bearish, holding above support at $3.00 on Friday. The cross-border remittance token abandoned the push toward its record high of $3.66 earlier in the week, peaking at $3.35 on Thursday before trimming gains amid fresh concerns about inflation rising in the United States (US).

Investors in risk assets like crypto are concerned that hotter-than-expected Producer Price Index (PPI) data could drive inflation higher – a move likely to cause the Federal Reserve (Fed) to hesitate about implementing the highly anticipated rate cut in September.

XRP faces declining open interest and neutral retail activity

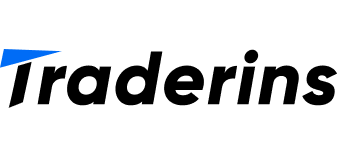

XRP's derivatives market showcases weakness, characterized by the futures Open Interest (OI) falling below $8 billion after peaking near $9 billion on Thursday. The current XRP OI level stands significantly below the $10.94 billion seen on July 22 after XRP hit a new all-time high on July 18.

A persistent decrease in OI indicates that XRP is dealing with low risk-on sentiment as fewer traders bet on the price rising in the short term. If this trend holds, recovery toward the $3.66 all-time high might be a pipe dream in the near term.

XRP futures Open Interest | Source: CoinGlass

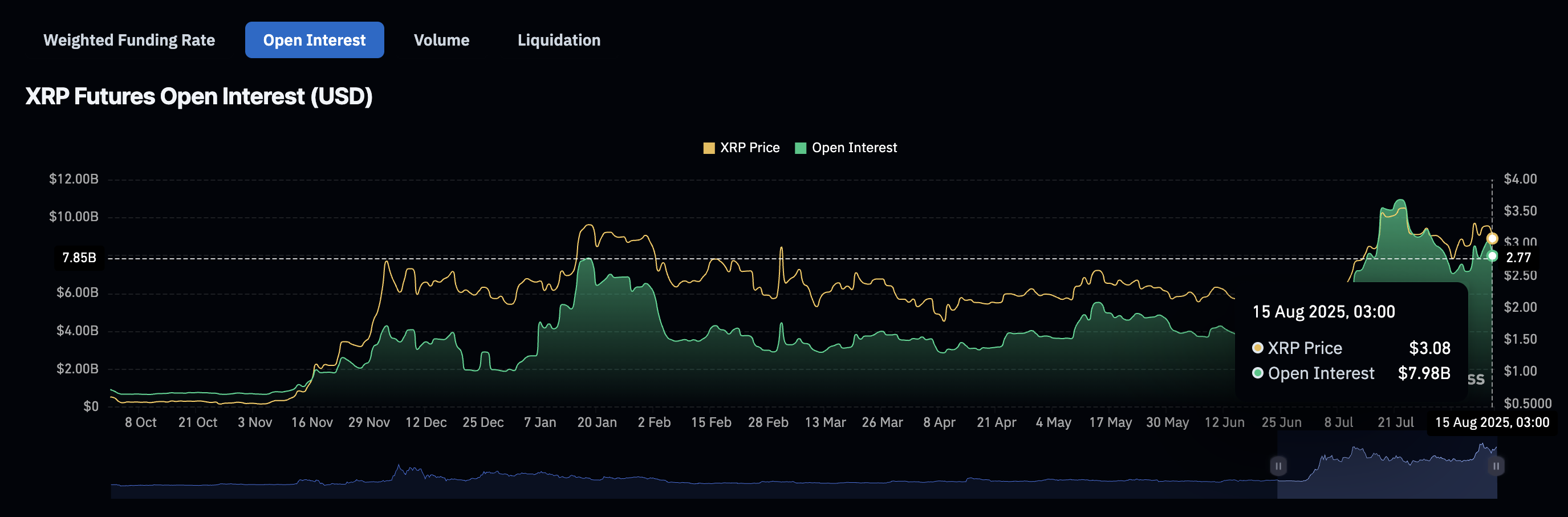

Still, the XRP Ledger's Futures Retail Activity Through Trading Frequency Surge metric by CryptoQuant suggests that there's still room for more upside movement in the short term.

Historically, red-coloured bubbles as seen on the chart below highlight periods when the futures retail market for XRP is overheating.

The last time this occurred was from early December to January, when XRP surged to a high of $3.40, marking a local peak. Currently, the metric is in the neutral zone, signaling that there's still potential for upward movement in XRP price without signs of overheating.

XRP Ledger's Futures Retail Activity Through Trading Frequency Surge | Source: CryptoQuant

Technical outlook: XRP risks extending correction below $3.00

XRP price is testing support at $3.00 amid bearish shockwaves in the broader cryptocurrency market. The Relative Strength Index (RSI), which is declining toward oversold territory on the 4-hour chart, indicates reduced buying pressure

A sell signal maintained by the Moving Average Convergence Divergence (MACD) indicator since Thursday backs the ongoing trend correction. XRP will likely prolong the reversal below the $3.00 demand area if the blue MACD line remains below the red signal line.

XRP/USDT 4-hour chart

The 200-period Exponential Moving Average (EMA) at $3.04 could absorb the selling pressure. Still, if the decline accelerates, traders will shift their attention to the next tentative support levels at $2.90, tested on August 6 and at $2.72, also tested on August 3.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.