Ripple Price Forecast: XRP eyes record high breakout as stablecoin market cap surges

- XRP regains bullish momentum, targeting a breakout to $3.66 record high.

- The XRP Ledger stablecoin market cap has increased by 46% over the past week to $166 million.

- Crypto payment network Mesh adds support for Ripple's RLUSD

Ripple (XRP) extends gains for the second day in a row, trading at around $3.26 on Wednesday. XRP mirrors positive market sentiment across the cryptocurrency cycle market after the United States (US) July inflation came in below expectations, ramping up bets for the first interest rate cut this year in September.

If interest in XRP rises as reflected by the performance of the derivatives market this week, speculative demand could extend price recovery toward the record high of $3.66 reached on July 18.

CoinGlass data highlights a 9% increase in the derivatives market Open Interest (OI), averaging at $8 billion on Wednesday. Additionally, a 20% increase in the volume to $12.5 million suggests heightened trading activity.

XRP derivatives market data | Source| CoinGlass

XRP Ledger Stablecoin market surges, Mesh adds support for RLUSD

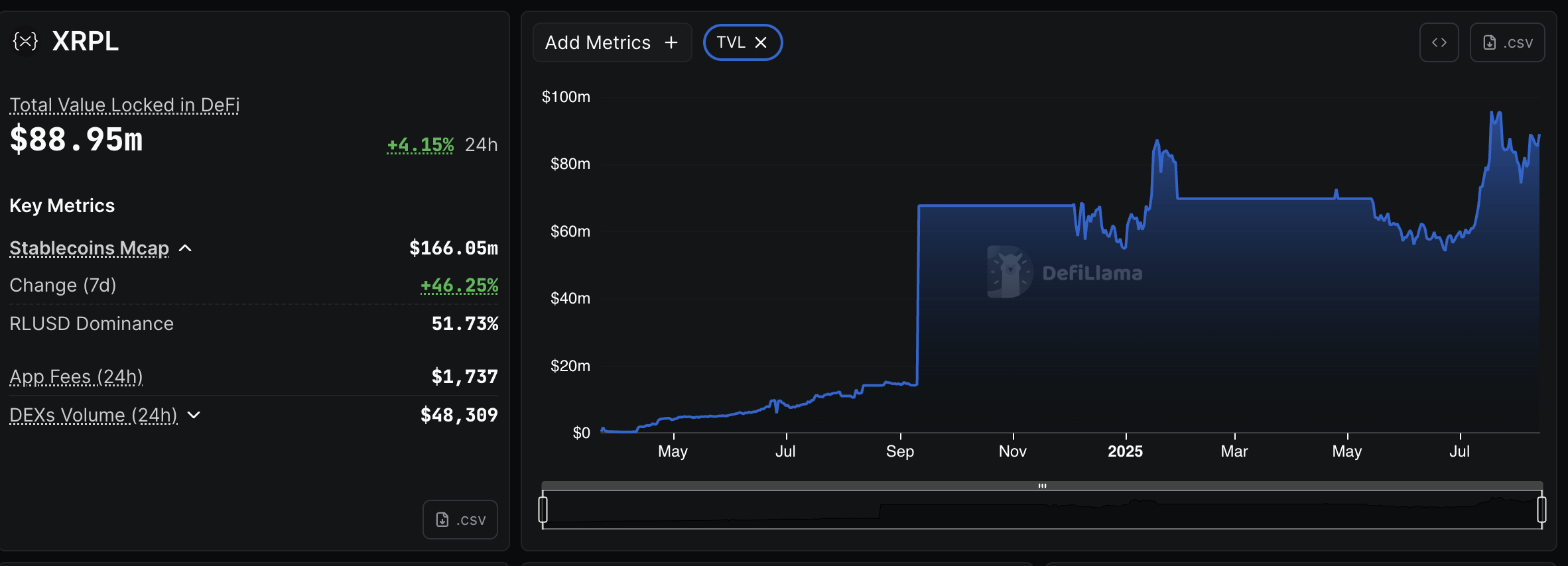

The stablecoin market capitalization on the XRP Ledger (XRPL) has surged over 46% in the past week, averaging $166 million, according to DefiLlama. Ripple USD (RLUSD) is the largest stablecoin on the protocol with 52% dominance.

The total value locked (TVL), which represents the sum of the value of all coins held in smart contracts linked to all the protocols on XRPL, is up 4% in the last 24 hours to $89 million. Should this trend continue, interest in XRP will rise, thus accelerating the tailwind on the token.

XRPL DeFi stats | Source: DefiLlama

Meanwhile, Mesh, a payment network supporting over 50 tokens has announced support for RLUSD. Merchants on the platform are now able to acceptation payment in the US Dollar (USD)-pegged stablecoin while users have the option of paying with RLUSD.

“With Mesh now supporting RLUSD, users can easily deposit, transfer, and pay using the stablecoin, and merchants can accept it at checkout. Since it’s fully backed 1:1 to the U.S. dollar, RLUSD can be relied on by both users and merchants alike for stable, non-volatile payments,” Mesh said in a blog post.

Technical outlook: XRP consolidates ahead of breakout

XRP is consolidating near its weekly high as bulls tighten their grip in the broader cryptocurrency market. Trading at $3.26 at the time of writing, XRP shows signs of stability ahead of an anticipated breakout above the short-term hurdle at $3.40, which was tested on Friday, and the record high of $3.66.

The Moving Average Convergence Divergence (MACD) confirms the XRP price's sideways movement, holding slightly above the zero line. Traders should watch for a potential buy signal that would manifest with the blue MACD line crossing above the red signal line.

XRP/USDT daily chart

The Relative Strength Index (RSI) upholds the XRP bullish bias, holding above the midline. Still, traders must be cautious because if the RSI declines below the midline, the path of least resistance will flip downward, increasing the chances of XRP sliding in search of liquidity toward the $3.00 level and the next support at $2.91 provided by the 50-day Exponential Moving Average (EMA).

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.