Crypto Today: Bitcoin, Ethereum, XRP offer bullish signals as bets of September Fed rate cut rise

- Bitcoin trades near $120,000 as traders ramp up bets of an interest-rate cut by the Federal Reserve next month.

- Ethereum holds above $4,600 as institutional demand reinforces the token’s bullish case.

- XRP holds recent gains, with bulls aiming for its record high of $3.66.

Cryptocurrency prices are showing bullish signs on Wednesday, backed by strong market sentiment after the US Consumer Price Index (CPI) data showed that inflation increased, but below market expectations. Bitcoin (BTC) is back to trading marginally above $120,000 after a knee-jerk recovery from its previous day low of $118,928.

The bullish outlook spreads across the altcoin market with Ethereum (ETH) breaking above $4,700 backed by rising spot Exchange Traded Funds (ETFs) inflows, which hit the $1 billion mark for the first time on Monday.

Ripple (XRP), on the other hand, is upholding its recovery above support at $3.00 as bulls aim for the record high of $3.66 reached on July 18. Interest in XRP remains high following the resolution of the longstanding United States (US) Securities and Exchange Commission (SEC) lawsuit.

Market overview: Traders increase bets of Fed rate cuts

The US inflation data came in softer than market expectations on Tuesday, significantly raising bets for the first interest rate cut of the year in September.

The Bureau of Labor Statistics (BLS) CPI data showed a moderate 0.2% increase in July and 2.7% on a 12-month basis compared to market expectations of 0.2% and 2.8%, respectively.

The core CPI, which excludes food and energy, increased 0.3% in July and 3.1% annually compared to the market forecast of 0.3% and 3%, respectively. Federal Reserve (Fed) officials focus on core inflation to gauge long-term trends.

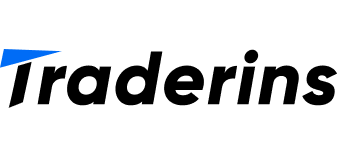

The CME FedWatch Tool shows that market participants are 96.2% in favour of the Fed cutting rates to the range of 4.0% to 4.25% in September. Only 3.8% of participants expect the central bank to hold interest rates steady in the range of 4.25% to 4.50%.

CME Fed Watch Tool | Source: CME Group

US President Donald Trump has consistently urged Fed Chair Jerome Powell to cut rates. However, the central bank has broadly called for patience and the need to monitor incoming data to gauge the impact of higher tariffs on the prices of goods and services before slashing borrowing costs.

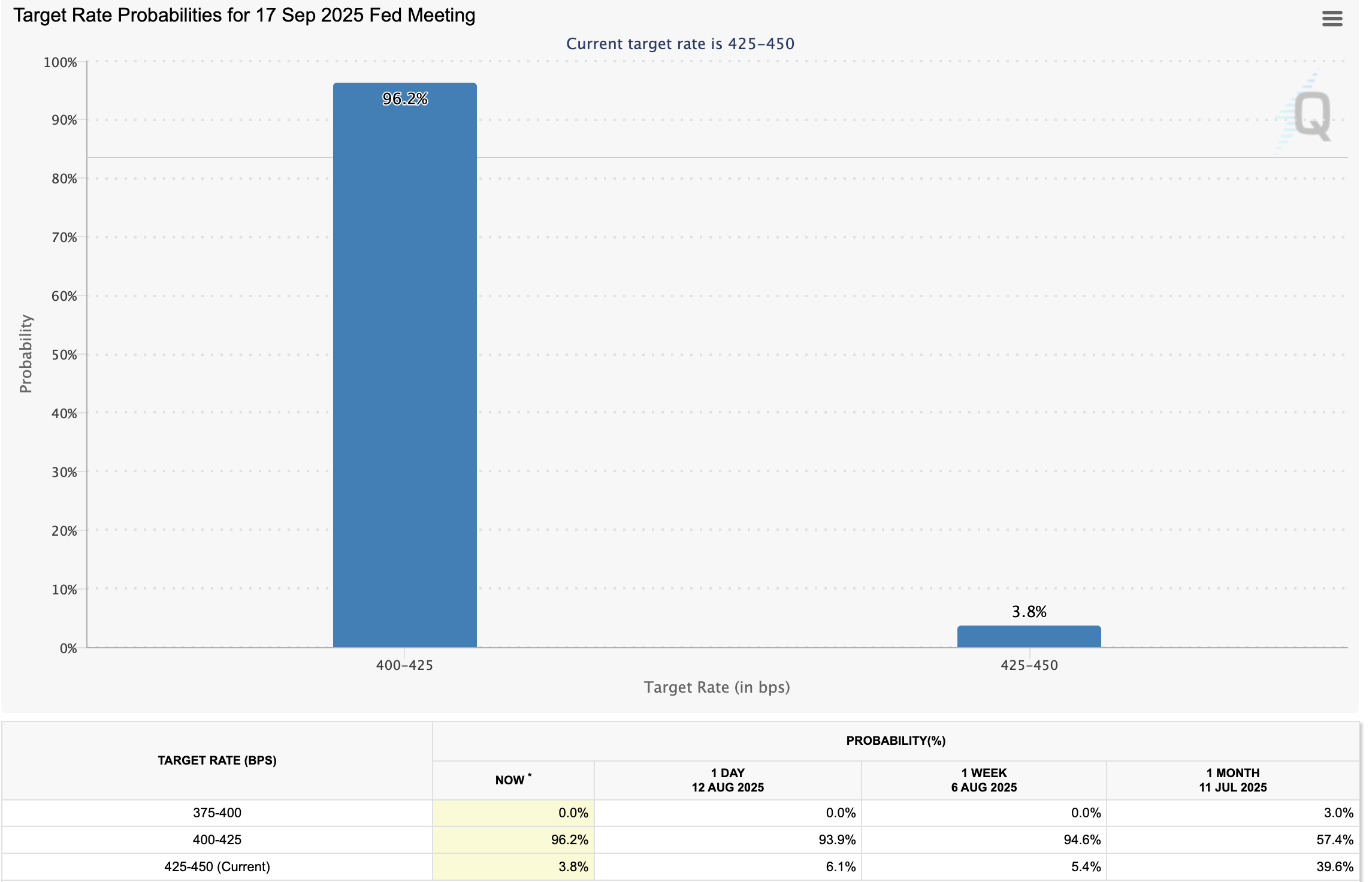

Traders on Polymarket have ramped up bets on interest rate cuts when Fed officials meet in September. Based on the chart below, 80% of traders on the platform believe that there is an 80% chance of the Fed cutting the rates by 25 basis points, a move that could improve risk-on sentiment for risk assets like equities, Bitcoin and altcoins.

Polymarket rate cut bets | Source: Polymarket

Chart of the day: Bitcoin bulls aim for a new record high

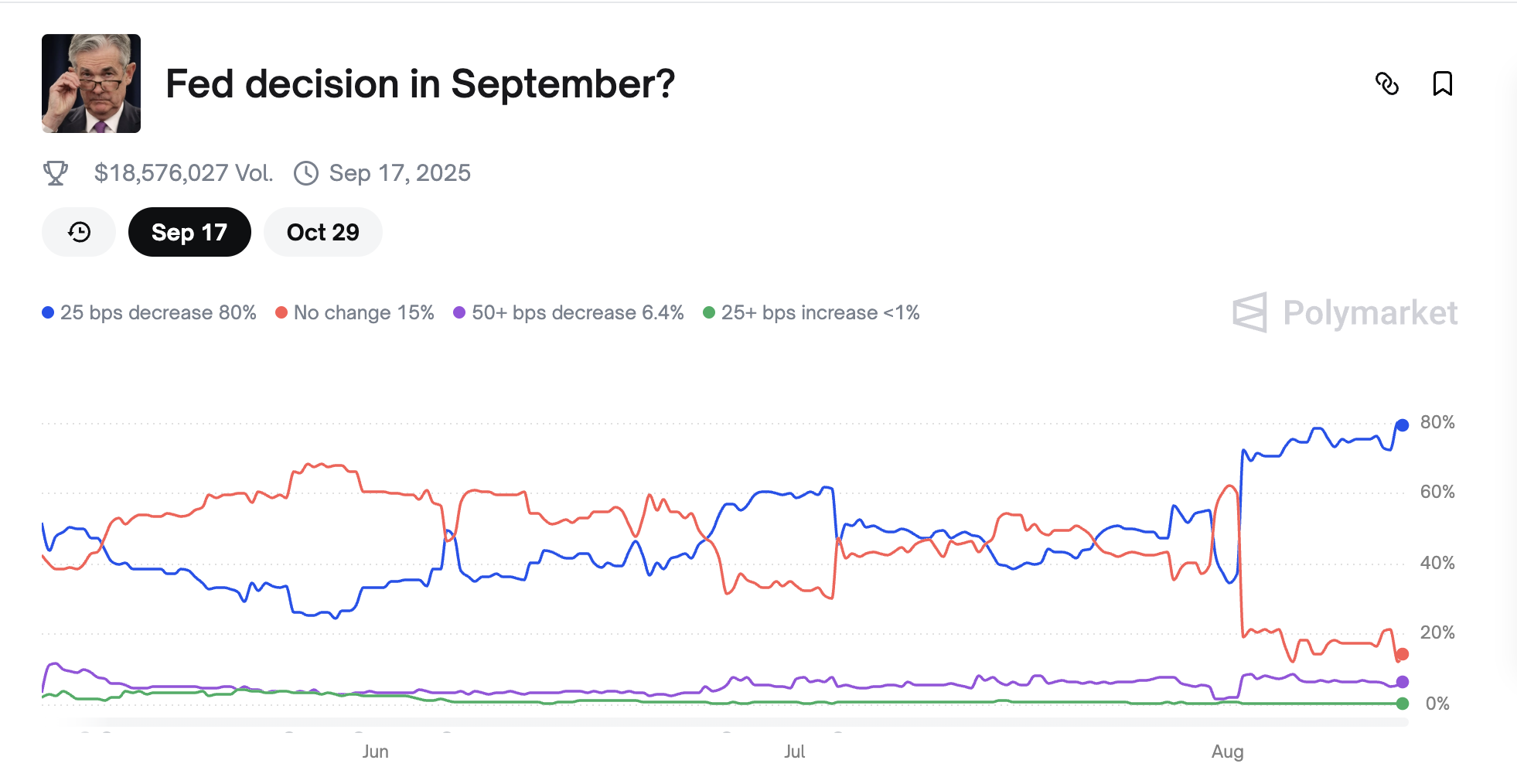

Bitcoin price is trading slightly above $120,000, underpinned by steady institutional capital inflows primarily from spot ETFs in the US. SoSoValue data shows that spot ETFs saw approximately $66 million in inflows on Tuesday, bringing the cumulative net inflow near $55 billion with net assets currently averaging at $155 billion.

Bitcoin spot ETFs | Source: SoSoValue

The largest cryptocurrency by market capitalisation offers bullish signals on the daily chart (see below). A buy signal from the Moving Average Convergence Divergence (MACD) indicator encourages traders to increase exposure, anticipating the price to uphold the uptrend toward BTC’s record high of $123,218 reached on July 14.

BTC/USDT daily chart

Traders will look for a daily close above $120,000 to ascertain the uptrend’s strength. Key levels of interest to traders are Bitcoin’s weekly peak of $122,335, the record high at $123,218 and, on the downside, the support range between $117,000 and $118,000.

Altcoins update: Ethereum, XRP target all-time highs

Ethereum price is trading slightly less than 4% from its record high of around $4,878 reached in November 2021. The path of least resistance is upward, underpinned by higher spot ETF inflows.

On Monday, ETH spot ETFs operating in the US saw inflows of approximately $1 billion for the first time on record. The bullish streak continued with inflows on Tuesday, totaling $534 million.

Interest in Ethereum is on the rise, with publicly listed companies like Sharplink Gaming and Bitmine, among others, racing to increase exposure to the largest altcoin.

Ethereum spot ETF data | Source: SoSoValue

Ethereum’s technical outlook is bullish on Tuesday, underpinned by a buy signal from the MACD indicator. Investors will likely scoop up ETH if the blue MACD line holds above the red signal line.

Key areas of interest for traders in the short-term are the record high of around $4,878, the potential $5,000 milestone and the short-term round-figure support at $4,500.

ETH/USDT daily chart

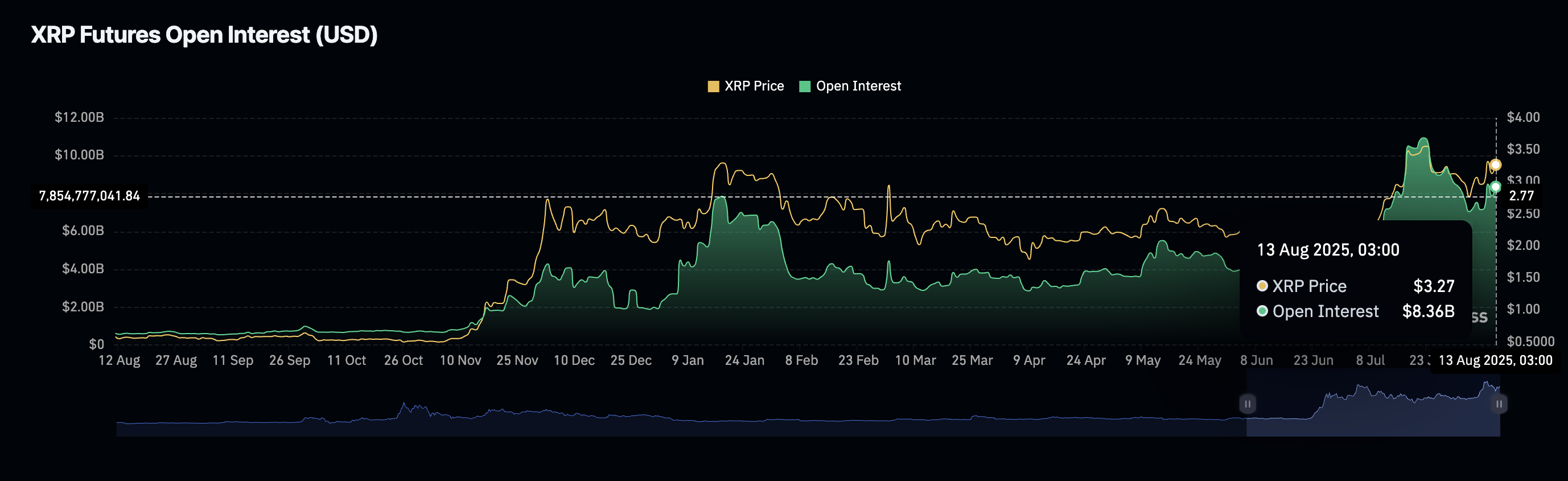

As for XRP, the path of least resistance appears upward, backed by steady trading volume and retail interest, evidenced by the futures Open Interest (OI) increase to $8.36 billion from $7.05 billion recorded on August 3, when the price plunged to $2.72.

XRP Futures Open Interest | Source: CoinGlass

The cross-border money remittance token is trading at $3.28 at the time of writing, up slightly on the day and eyeing the record high of $3.66. Traders should look out for a potential buy signal from the MACD indicator if the blue MACD line crosses and settles above the red signal line.

XRP/USDT daily chart

Still, resistance at $3.40 could delay the breakout, hence there’s a need to prepare for tentative support levels such as $3.00 and the 50-day Exponential Moving Average (EMA) demand zone at $2.91.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.