Crypto Today: Bitcoin, XRP bulls push for record high breakout, Ethereum consolidates gains

- Bitcoin extends gains above $120,000 as bulls target record high milestone.

- Ethereum consolidates gains after breaking four-year resistance at $4,000.

- XRP eyes its all-time high backed by bullish technical indicators, including an uptrending RSI.

Bitcoin (BTC) edges higher, trading at around $121,259 on Monday, reflecting bullish sentiment in the wider cryptocurrency market. The recovery seen last week mirrored the increase in speculative demand, following the sell-off to support at around $112,000 on August 2.

Altcoins, including Ethereum (ETH) and Ripple (XRP), are following in Bitcoin’s footsteps, rallying in tandem. Ethereum breached its multi-year hurdle at $4,000 for the first time since November 2021 before extending the up leg above $4,300. XRP is maintaining its bullish outlook, aiming for its record high of $3.66, which was reached on July 18, backed by fresh institutional interest after Ripple and the United States (US) Securities and Exchange Commission (SEC) filed a joint motion to drop appeals.

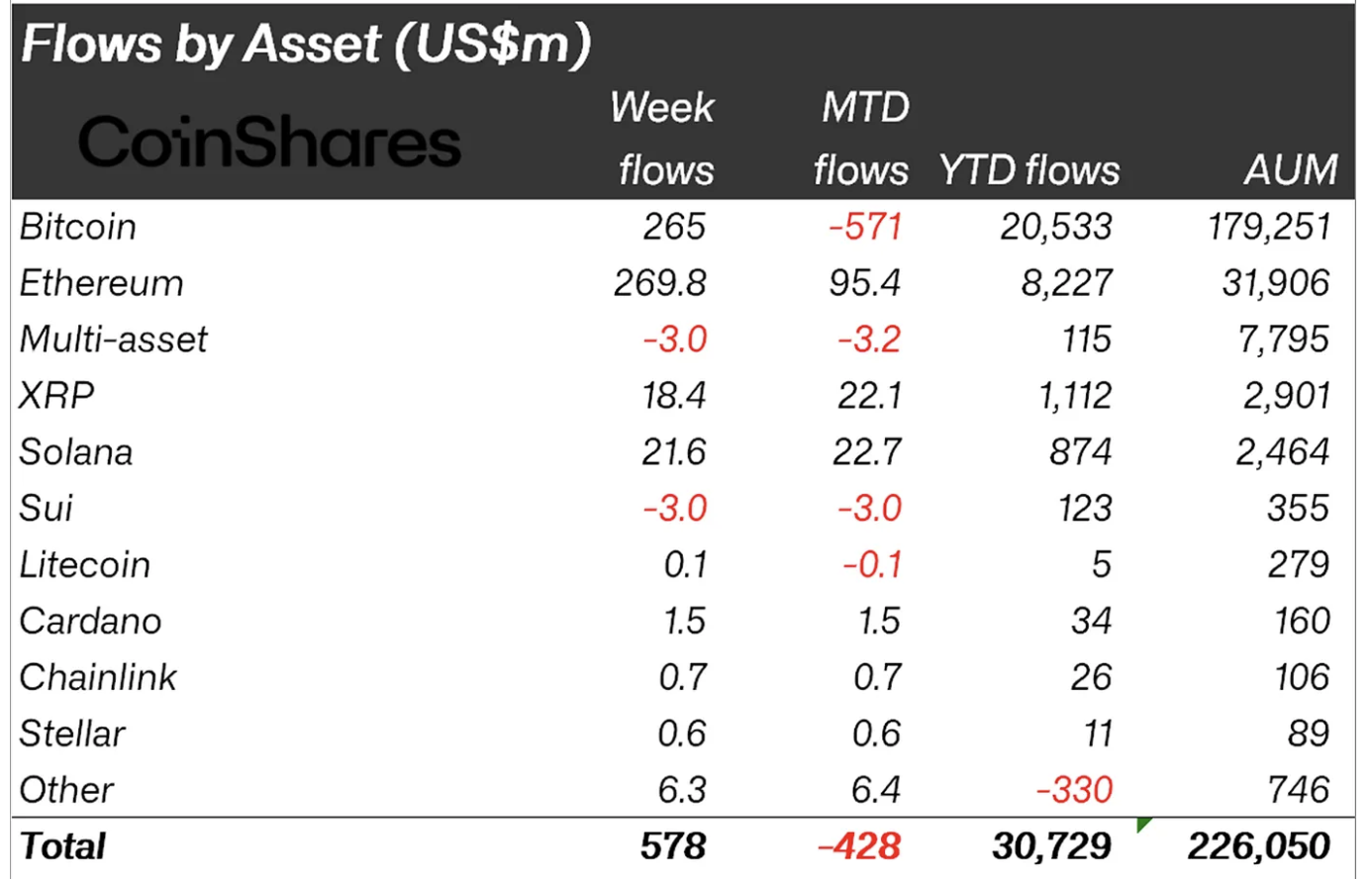

Data spotlight: Crypto asset flows rebound

Digital investment products saw a surge in inflows, which reached $578 million last week, according to a CoinShares report. Ethereum’s Exchange Traded Products (ETPs) led with over $268 million in inflows, which accelerated the year-to-date inflows to $8.2 billion and the total assets under management (AUM) to $31.9 billion, representing an 82% growth in 2025.

Bitcoin investment products regained momentum with $265 million in inflows last week. Altcoins, including Solana (SOL) and XRP, recorded $21.6 million and $18.4 million, respectively.

Crypto investment products flows stats | Source: CoinShares

The inclusion of cryptocurrencies in the US 401(k) retirement accounts boosted interest in digital products, pushing the prices of Bitcoin, Ethereum and XRP higher.

“In the latter half of the week, however, we saw $1.57 billion of inflows, likely spurred by the government’s announcement permitting digital assets in 401(k) retirement plans,” the CoinShares report highlights.

US-based speculative demand dominated the inflows with approximately $608 million, followed by Canada with $16.5 million. Interest in crypto-related investment products remained largely suppressed in Europe, with Germany, Sweden, and Switzerland collectively seeing outflows totalling $54.3 million.

Chart of the day: Bitcoin nears record high

Bitcoin price is searching for higher support after rallying to an intraday high of $122,335. The bulls appear to be in control, backed by key technical indicators, including a buy signal from the Moving Average Convergence Divergence (MACD).

Traders will likely consider increasing exposure as long as the blue MACD line remains above the red signal line as the indicator moves higher above the zero line.

The Relative Strength Index (RSI), which is approaching overbought territory, points to increasing speculative demand. Key areas of interest include the round-figure level at $120,000, which could serve as the initial support, and the $123,218 record high, reached on July 14.

BTC/USDT daily chart

Altcoins update: Ethereum, XRP show signs of consolidation

Ethereum price holds near its intraday high of $4,349 following the much-anticipated breakout above the four-year resistance at $4,000. The largest smart contracts token is trading at $4,252 at the time of writing, with the uptrend attributed to steady retail and institutional demand.

A buy signal from the MACD indicator affirms the bullish technical structure. The green histogram bars expanding above the zero line reinforce the upside bias, increasing the chance of Ethereum tagging its record high above $4,800.

Still, traders should consider tempering their bullish expectations, especially with the RSI stabilizing in overbought territory. High RSI readings are often a precursor to price corrections, suggesting overheated market conditions.

ETH/USDT daily chart

As for XRP, bulls remain in control with XRP up over 2% on Monday, trading at around $3.26 at the time of writing. The path of least resistance appears upward, backed by uptrending moving averages, including the 50-day Exponential Moving Average (EMA) at $2.88, the 100-day EMA at $2.66 and the 200-day EMA at $2.39.

XRP/USDT daily chart

The MACD indicator could confirm a buy signal on the daily chart if the blue line crosses and settles above the red signal line, calling upon investors to increase exposure.

If the RSI extends the uptrend toward overbought territory, it will suggest increasing buying pressure and increase the chances of XRP closing the gap to the all-time high of $3.66.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.