Solana extends gains on record high Open Interest, USDC adoption and Bullish IPO

- Solana reclaims the $200 psychological level, driving the SOL Open Interest to a record high of $12.55 billion.

- Around 750 million USDC have been minted on Solana as Squads partner with Coinbase to push its stablecoin adoption.

- Bullish launches its IPO and plans to migrate the infrastructure to Solana-native stablecoins.

Solana (SOL) crossed the $200 milestone on Wednesday, posting a third consecutive day of gains and reaching the highest level since February 4, supported by the broad recovery in the cryptocurrency market.

The uptrend in Solana is underpinned by rising USDC adoption on the network after the recent Squads and Coinbase partnership, alongside the announcement that Bullish, a crypto exchange, will shift its infrastructure to Solana after its recent Initial Public Offering (IPO) on the New York Stock Exchange (NYSE).

The technical outlook shows a bullish bias for Solana, as capital inflows in SOL derivatives drive the Open Interest into new record highs.

Solana TVL nears record high as Circle mints 750 million USDC

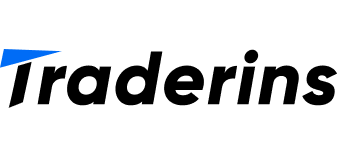

Solana, the sixth-largest cryptocurrency token by market capitalization, has seen an increase in its Total Value Locked (TVL) to $11.162 billion on Thursday from $10.920 billion the previous day.

Solana TVL. Source: DeFiLlama

A surge in TVL indicates increased adoption, driven by larger deposits of digital assets. The TVL inches closer to its all-time high of $11.988 billion.

Amid the rising TVL, around 750 million USDC, a stablecoin issued by Circle, has been minted over the last 24 hours. This increases the available liquidity on the network, which aligns with the partnership of Squads and Coinbase. The partnership aims to expand USDC adoption on Solana, with Squads making USDC the default stablecoin for its product offerings.

Peter Thiel-backed Bullish exchange plans migration to Solana

The Bullish crypto exchange shares surged 83% on its NYSE listing on Wednesday. In good news for SOL holders, the exchange has partnered with the Solana Foundation to utilize Solana stablecoins for its payment infrastructure. This will include services such as custody, payments, and settlements.

The institutional adoption of the Solana network, driven by its speed and low transaction costs, could further boost the risk-on sentiment among investors.

Solana eyes breakout rally to $295

Solana's recovery over the last three days could mark the beginning of a new bull cycle, as indicated by the Supertrend indicator. The SOL trading volume has increased by 10% over the last 24 hours, reaching $12.24 billion as the uptrend gains traction.

The Relative Strength Index (RSI) at 69 on the daily chart indicates an upside, suggesting buy-side dominance. Additionally, the Moving Average Convergence Divergence (MACD) indicates increasing bullish momentum, as evidenced by successively rising green histograms.

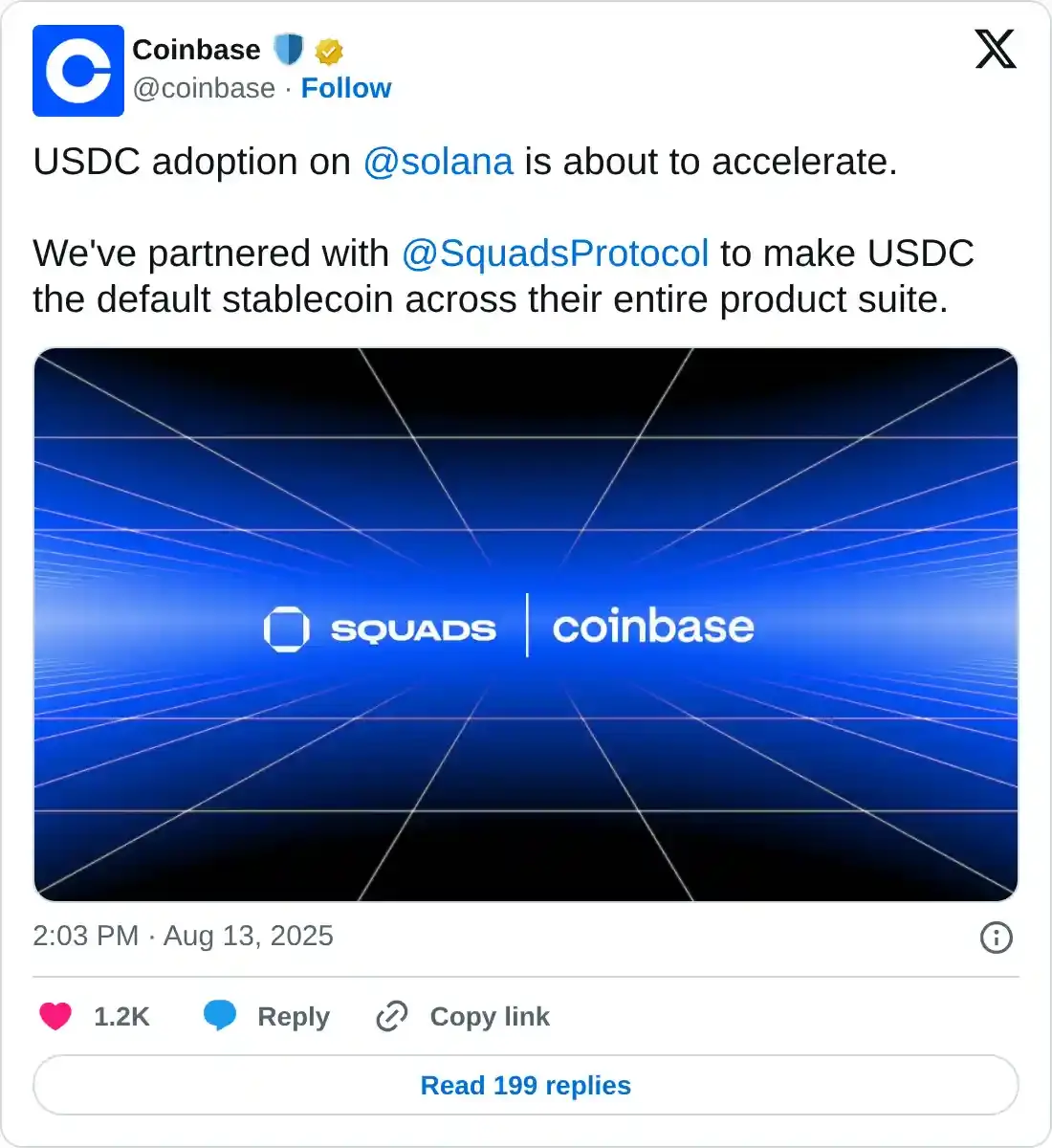

The bullish dominance alters the derivatives market dynamics, as the Open Interest (OI) reaches a new all-time high of $12.55 billion on Thursday after an 11.55% increase in the last 24 hours. An increase in OI refers to rising traders' confidence in the price trend.

Notably, the liquidation data points to a larger wipeout of bearish positions as $20.53 million in short liquidations outpace the $12.25 million in long liquidations in the same time frame.

Solana derivatives. Source: Coinglass

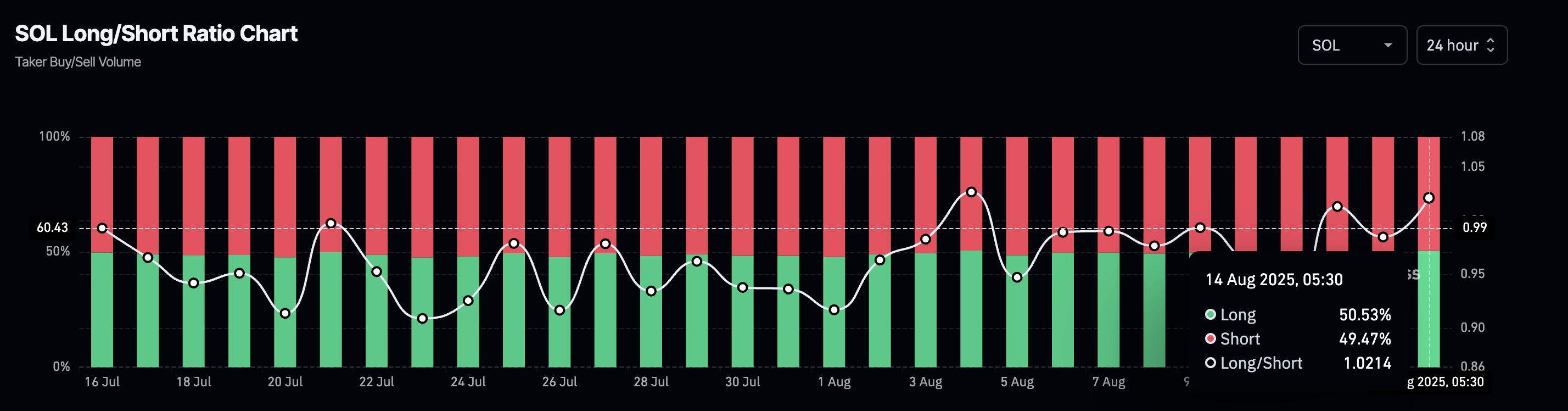

Still, the long-to-short ratio based on the Taker buy/sell ratio indicates a nearly neutral playing field. The long positions account for 50.53% in the last 24 hours, raising the long-to-short ratio to 1.0214, up from 0.9849 on Wednesday.

SOL Long/Short ratio. Source: Coinglass

An uptrend continuation in Solana could target the 61.8% Fibonacci level at $219, which is drawn from the $295 high on January 19 to the $95 low on April 7. A decisive push above this level could extend the uptrend to $252, aligning with the 78.6% Fibonacci level.

SOL/USDT daily price chart.

On the contrary, a bearish turnaround below the $200 could retest the 50% retracement level at $195.