Ripple Price Forecast: XRP strengthens bullish outlook, bolstered by steady capital inflows

- XRP rises for a second straight day, extending gains above $2.28.

- XRP digital asset products saw $10.6 million in weekly inflows, pushing the total assets under management to $1.4 billion.

- Market sentiment around XRP remains positive with futures contracts' Open Interest increasing to its highest level since May 30.

Ripple (XRP) edges higher for two days in a row, reflecting positive market sentiment and steady institutional demand. A minor uptick on Monday sees the price of XRP hover near $2.28 at the time of writing. If risk-on sentiment remains high, the cross-border money remittance token will likely extend above $2.33, a level that capped price action in mid-May.

XRP offers bullish signs on steady capital inflows

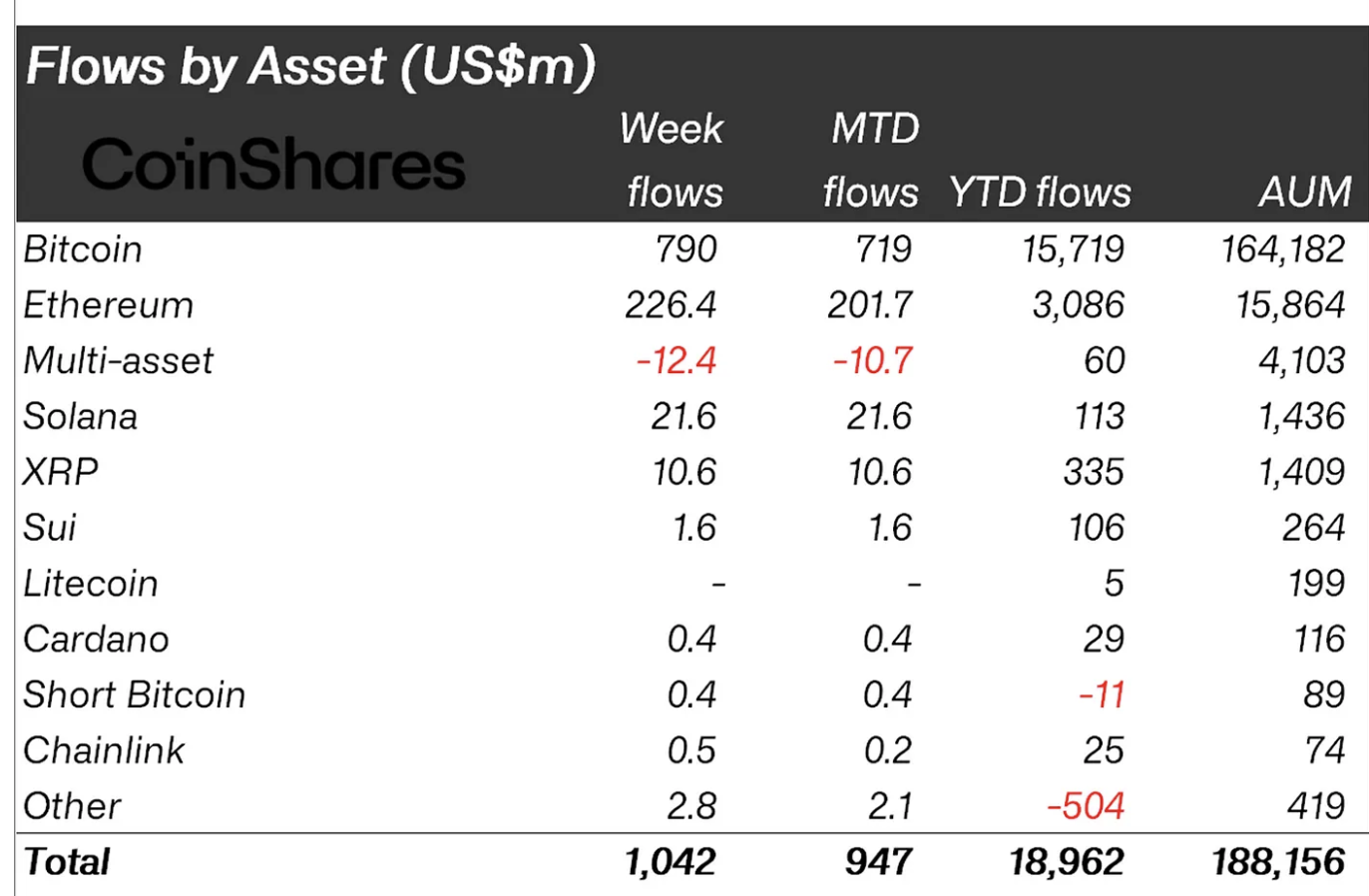

Digital asset products saw slightly over $1.03 billion in weekly inflows, according to the CoinShares report, which is released every Monday. Fund inflows into XRP-related financial products reached $10.6 million, accelerating year-to-date inflows to $335 million, as observed in the chart below. The cumulative total assets under management (AUM) average around $1.4 billion.

Digital assets fund inflows | Source: CoinShares

The United States (US) accounted for the lion’s share of the total weekly capital inflows at $1 billion, with $790 million going into Bitcoin ETFs, BTC treasuries and other related financial products.

“Price gains over the week pushed total assets under management to a new all-time high of US$188 billion. Trading volumes reached US$16.3 billion, in line with the weekly average so far this year,” the CoinShares report states.

Interest in XRP spans various sectors of the market, including futures contracts’ Open Interest (OI), which has increased by approximately 25% to $4.69 billion since dropping to $3.54 billion on June 23. This is the highest level since May 30.

XRP futures Open Interest | Source: CoinGlass

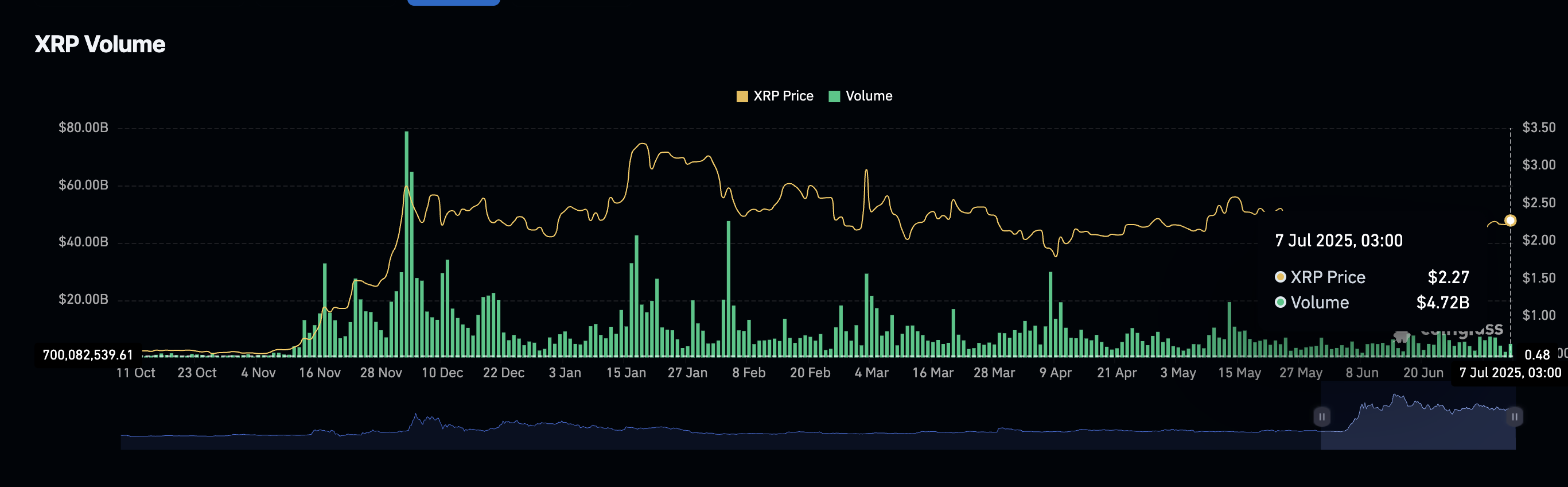

A significant increase in the futures contracts trading volume to $4.72 billion indicates swelling market activity. This, coupled with the rise in Open Interest, indicates that traders have a bullish bias and are willing to bet on future price increases.

XRP futures volume | Source: CoinGlass

Liquidations totaling $2.52 billion have been recorded over the past 24 hours, with short positions accounting for $1.52 million compared to approximately $997,000 wiped out in shorts.

Technical outlook: XRP flaunts bullish structure

XRP bulls are printing the second consecutive green candle on the daily chart, backed by steady interest in the token. Key technical indicators underpin the recovery and target a breakout above resistance tested at $2.33 in mid-June and $2.47 on May 23.

A buy signal from the Moving Average Convergence Divergence (MACD) indicator encourages traders to seek exposure. This signal manifests when the blue MACD line crosses above the red signal line. The green histogram bars above the zero line bolster bullish momentum.

At the same time, an upward-trending Relative Strength Index (RSI) at 57 shows that the uptrend has strength and could continue this week.

In case of a breakout above the short-term supply zone at $2.33, the bullish scope could expand beyond the hurdle at $2.47 to XRP’s peak in May at around $2.65.

XRP/USDT daily chart

Still, a trend reversal cannot be ruled out, especially given that market sentiment remains shaky due to US tariffs. President Donald Trump’s 90-day tariff pause ends on July 9, hinting at uncertainty in global markets.

With that in mind, traders should prepare for the possibility of a pullback toward the lowest support in June at $1.90. However, the 100-day Exponential Moving Average (EMA) currently at $2.22, the 50-day EMA at $2.21 and the 200-day EMA at $2.11 could absorb potential sell-side pressure, thus preventing a price drop below the $2.00 round-figure level.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.